Fed Chair Sends S&P 500 Plummeting In 2022's Tenth Lévy Flight Event

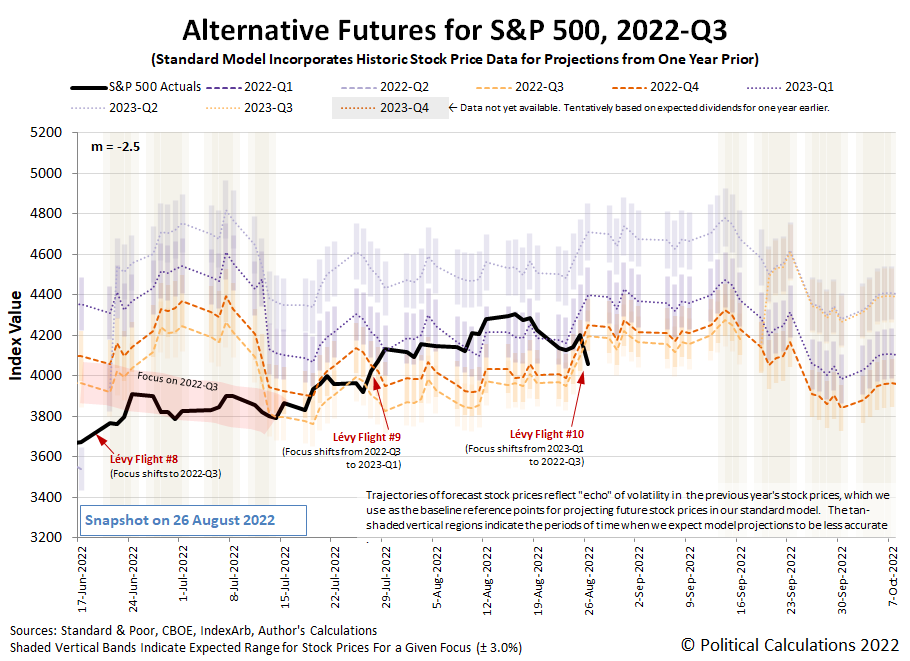

Fed Chair Jerome Powell spoke from the Federal Reserve's annual retreat at Jackson Hole on Friday, 26 August 2022. In doing that, he succeeded in sending the S&P 500 (Index: SPX) on its tenth confirmed Lévy flight event of 2022, sending the index down 3.37% to close the week at 4,057.66.

Since it's the tenth Lévy flight event of the year, investors are getting a lot of exposure to these high volatility episodes. For readers who are new to the concept, here's what it means:

- Lévy flights involve large changes in stock prices that occur more often than statistical analysis based on a normal distribution predicts.

- These events coincide with investors shifting their forward-looking focus from one point of time in the future to another.

- How much stock prices change during these events are tied to what the expectations are for dividend growth between these future points in time.

All of these are tied together in the dividend futures-based model we invented to forecast the future of the S&P 500. The alternative futures chart tracks the actual trajectory of the index against the levels it projects it would be for when investors focus their attention on specific future quarters.

Going into the last trading week, the chart shows investors had been focused on the future quarter of 2023-Q1 in setting current-day stock prices. Fed Chair Powell's Jackson Hole speech on Friday, 26 August 2022 however refocused their attention on 2022-Q3 by increasing the uncertainty they have for how much the Fed will change interest rates at its upcoming September meetings.

Our summary of the market-moving headlines of the trading week documented how that shift in the forward-looking focus developed during the trading week.

Monday, 22 August 2022

- Fed minions Jackson Hole conference becomes center of investor focus:

- Inflation hitting hard in Mexico, United Kingdom:

- Bigger trouble developing in the Eurozone:

- Bigger stimulus developing in China:

- BOJ minions see Japan's economy getting worse:

- Wall Street ends sharply lower on fears of aggressive Fed

Tuesday, 23 August 2022

- Signs and portents for the U.S. economy:

- Fed minions putting bigger rate hikes on the table:

- Bigger trouble developing in the Eurozone, United Kingdom:

- ECB minions rethinking plan to hike rates:

- Wall Street ends down as investors eye slowing economy

Wednesday, 24 August 2022

- Signs and portents for the U.S. economy:

- Fed minions get ready to party the only way central bankers can!

- Bigger trouble, stimulus developing in China:

- Wall Street ends higher, with all eyes on Jackson Hole

Thursday, 25 August 2022

- Signs and portents for the U.S. economy:

- Fed minions described as having been wearing kid gloves, trying to shift focus to 2022-Q3:

- Fed officials: no call yet on 50 vs 75 bps rate hike next month

- Fed's Powell leaves kid gloves behind as he saddles up for Jackson Hole

- Fed's Bostic says he's split between 50 bps and 75 bps Sept rise - WSJ

- Fed's George: Too soon to predict size of Sept hike

- Fed's Bullard: Inflation likely to be more persistent than expected

- Fed's Harker: Would like to get rates above 3.4% and 'sit for a while'

- Fed's George: Too soon to predict size of Sept hike

- Bigger trouble developing in Eurozone:

- BOJ minions determined to keep unending stimulus alive:

- ECB minions thinking they may need to think more about inflation:

- Wall Street ends sharply up, fueled by Nvidia and Amazon

Friday, 26 August 2022

- Signs and portents for the U.S. economy:

- Chief Fed minion Powell predicts pain in fight against inflation, other minions fall in line and promise shallow recession:

- Bigger stimulus developing in China:

- Bigger trouble developing in Japan:

- ECB minions thinking more about bigger rate hikes:

- Wall Street ends in a hole after Powell's Wyoming speech

After Fed Chair Jerome Powell got done speaking on Friday, 26 August 2022, the CME Group's FedWatch Tool's projections of the Fed's future interest rate hikes registered big changes in investor expectations, confirming the Lévy flight event resulting from investors resetting their time horizon. Instead of a half-point rate hike in September (2022-Q3), the probability of a three-quarter point hike rose over 50% as investors' expectations changed for this quarter. Looking further forward in time, that hike would be followed by a half-point rate hike in November (2022-Q4), after which, investors think the Fed will hold off on more rate hikes until February 2023 when they anticipate a quarter-point rate hike. That will put the Fed's target for the Federal Funds Rate in the 3.75-4.00% range, which is where investors are now expecting the Fed's series of rate hikes will top out.

Meanwhile, the Atlanta Fed's GDPNow tool's forecast for real GDP growth in 2022-Q3 held steady at 1.6%, so we can rule out changes in the outlook for the U.S. economy as a significant contributing factor to what happened with stock prices during the week. What happened was caused by investors drawing in their focus from 2023-Q1 to 2022-Q3 in reaction to Powell's Jackson Hole remarks.

More By This Author:

Why Hasn't The Price Of Gold Fallen More With The Fed's Rate Hikes?Price Surge Spikes New Home Market Cap As Sales Collapse

The S&P 500 Vs. Dividend Stock Funds

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more