February CPI, ORCL Is Growing Again, NVDA

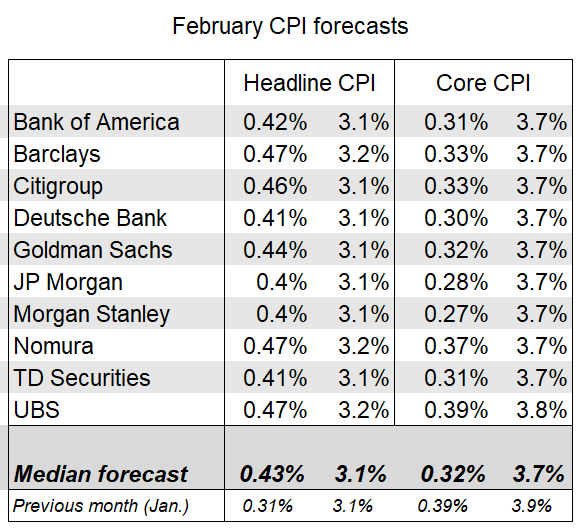

This morning at 8:30 am EST the BLS will report the February CPI. As you can see in the table above, estimates are for headline to be +0.4% and core +0.3% month over month. Anything notably higher than that is likely to result in a selloff and anything notably lower a rally.

(Click on image to enlarge)

Oracle (ORCL) reported earnings Monday after the close. For many years the stock was dead money because it had no growth. But with their move to the cloud, that has changed. Overall revenue increased 7% and cloud revenue increased 25% to $5.1 billion. This is a stock I like and have owned in the last few years but with it +13% in the premarket I wouldn’t chase it today.

(Click on image to enlarge)

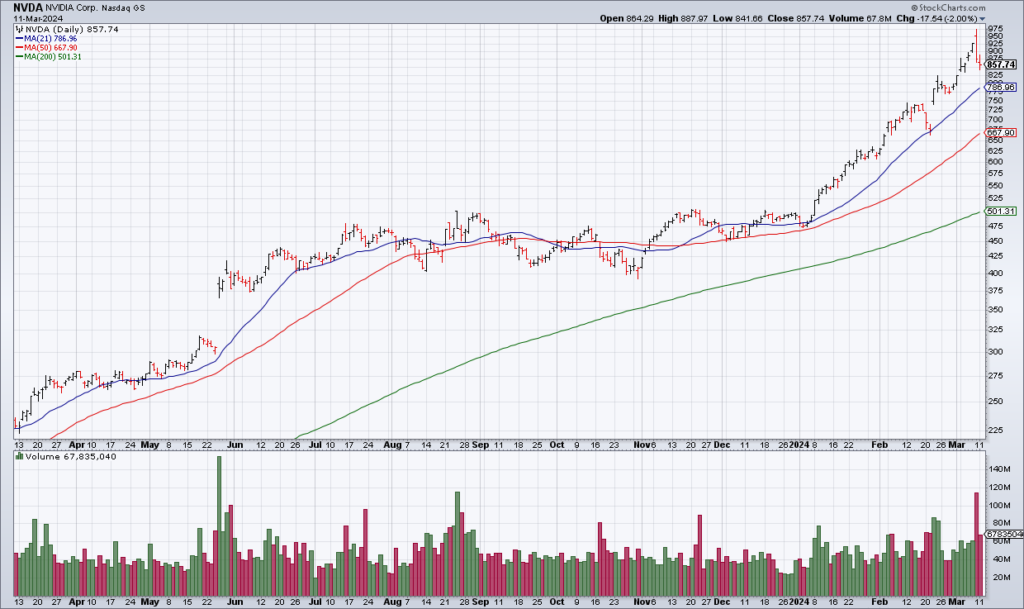

Last, continue to keep an eye on Nvidia (NVDA) after Friday’s nasty reversal. It lost another 2% Monday and if it continues to move lower will put pressure on the major indexes because of its size and how much of the S&P’s YTD gain has come from it.

More By This Author:

NVDA-Led Market Reversal Likely Marks At Least Short Term TopIn Search Of Goldilocks: February Jobs & CPI Reports

AVGO: Where’s The AI Boom?