Fear & Greed Index: Market Sentiment Is Excessive These Days - Take A Look

Investors are driven by two emotions: fear and greed. Too much fear can sink stocks well below where they should be and, when investors get greedy, they can bid up stock prices way too far. CNN has created a Fear & Greed Index that correlates well with stock market corrections and crashes so what emotion is driving the market now?

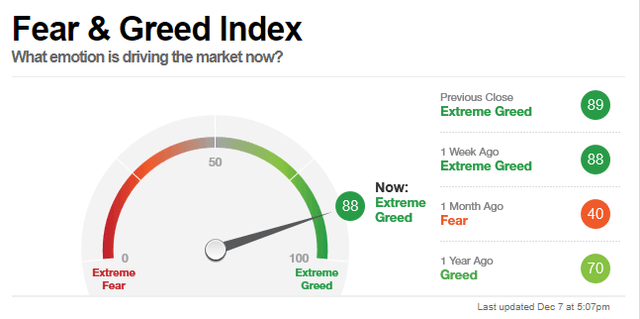

Well, according to the latest analyses, as the graphic shows below, there is excessive greed in the markets.

The Fear & Greed Index looks at how far each of 7 indicators have moved from their respective average relative to how far they normally move - the higher the reading, the greedier investors are with 50 being neutral - and then all the indicators are put together - equally weighted - into a final index reading.

The 7 indicators CNNMoney's Fear & Greed Index looks at are:

- Stock Price Momentum: The S&P 500 versus its 125-day moving average.

- The S&P 500 is currently 8.96% above its 125-day average which is further above the average than has been typical during the last two years. Rapid increases like this often indicate extreme greed.

- Last changed Dec 14th from a Greed rating.

- Stock Price Strength: The number of stocks hitting 52-week highs and lows on the New York Stock Exchange.

- The current number of stocks hitting 52-week highs exceeds the number hitting lows and is at the upper end of its range, indicating extreme greed.

- Last changed Nov. 23rd from a Greed rating.

- Stock Price Breadth: The volume of shares trading in stocks on the rise versus those declining.

- The McClellan Volume Summation Index measures advancing and declining volume on the NYSE. During the last month 6.37% more of each day's volume has traded in advancing issues than in declining issues, and this has kept the indicator at the upper end of its range - and where it has been for the last two years - indicating extreme fear.

- Last changed Nov. 19th from a Greed rating

- Put and Call Options: The put/call ratio, which compares the trading volume of bullish call options relative to the trading volume of bearish put options.

- During the last five trading days, volume in put options has lagged volume in call options by 57.65% as investors make bullish bets in their portfolios. This is a lower level of put buying than has been the norm during the last two years and is a neutral indication.

- Last changed Dec. 17th from a Fear rating.

- Junk Bond Demand: The spread between yields on investment grade bonds and junk bonds.

- Investors in low quality junk bonds are accepting 2.24 percentage points in additional yield over safer investment grade corporate bonds. While this spread is historically low, it is sharply higher than recent levels and suggests that investors are becoming more risk averse indicating extreme greed.

- Last changed Dec. 16th from a Greed rating.

- Market Volatility: The CBOE Volatility Index (VIX) measures volatility.

- The VIX is at 21.57, a neutral reading, indicating that market risks appear low.

- Last changed Nov. 3rd from an Extreme Fear rating.

- Safe Haven Demand: The difference in returns for stocks versus Treasuries.

- Stocks have outperformed bonds by 4.09 percentage points during the last 20 trading days which is in-line with what has been typical for the last two years. As such, it is neutral not indicate neither fear nor greed.

- Last changed Dec. 17th from a Greed rating.

Some History

- The Fear and Greed index sank to Extreme Fear (12) back in September, 2008, at the height of the financial crisis as the stock market tumbled. The stock market finally bottomed in March 2009 and the latest bull market began. By the first quarter of 2012 stocks had staged their best run in decades and the index showed Extreme Greed.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

The whole "Fear and Greed" concept seems to be rather accurate and certainly gives evidence of being very correct, THAT is rather disturbing, really.