FDX: A Beaten-Down Package Play For A Potential Year End Rally

Image Source: Pixabay

FedEx Corp. (FDX) needs no introduction. It’s the third-largest package courier in the world with a 17% global market share, behind only DHL (39%) and UPS (24%). Because it’s growing and pays a decent dividend (2.6% yield at recent prices), add FDX.

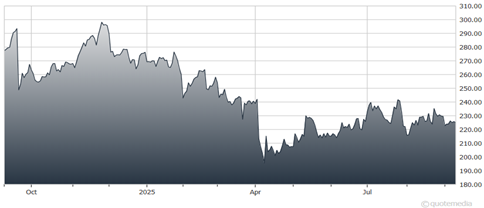

Like every package delivery company, FedEx’s sales and earnings peaked during Covid, when people around the world did virtually all of their shopping online and packages were zooming around the world like never before. While there hasn’t been a big drop off from the two Covid-enhanced years, sales have yet to eclipse their fiscal 2022 peak, while earnings haven’t come close to the fiscal 2021 top.

FedEx Corp. (FDX)

Still, this year (FedEx’s fiscal 2026 began in June) is on track to come closest to hitting those Covid highs, with analysts forecasting more than $89 billion in revenue and $18.53 in earnings per share. Next year, those numbers are expected to rise to more than $92 billion and $21.23 in EPS. These are projections, of course. But they’re reflective of a healthy and, in fact, incrementally improving global economy.

And yet, the stock still trades like it’s early April – at the height of post-Liberation Day market fears. Indeed, the stock is quite cheap on a price-to-earnings (12x forward estimates), price-to-sales (0.6x), and price-to-book-value (1.9x) basis. As long as the US and global economies don’t collapse between now and the end of the year, I think the stock could reach our target of $300 by Christmas.

Recommended Action: Buy FDX.

More By This Author:

EPD: A Higher-Yielding, Well-Managed MLPORCL: Monster RPO Figures Send The Tech Stock Soaring

META & GOOGL: Beneficiaries Of Strong Digital Ad Growth

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more