FCAU Continues To Remain An Undervalued Asset

Fiat Chrysler Automobiles N.V. (NYSE: FCAU) has recently seen a run-up for the past year. It has come from a merger with General Motors Inc. (NYSE: GM) and PSA Group (PEUP: PSA), with analysts pointing to a potential merger between FCAU and GM. Notably, FCAU has not seen much action since inception regarding price action and has recently seen an increase in interest from investors. Although the stock has already pushed higher, there is still plenty of room for significant returns. My reasoning is that FCAU is still considered to be an undervalued asset, and with a recent analysis of its financial statements, I can see subtle improvements in the company's performance in regards to operations, generating revenue, and most importantly increasing free cash flow.

In another article by Anton Wahlman, he stated that FCAU's growth outside of the U.S. is growing at a rapid pace. He provided a chart to show the latest growth by country to get a better illustration of the growth. The recent merger between GM and PSA is primarily due to GM is growing overseas. Now that FCAU is showing similar strength in international regions, the possibility of a merger with FCAU and GM can be high. Analysts were quick to jump to the conclusion that FCAU could be a target for a potential merger and is the reason for the most recent rise in the stock price. Furthermore, the CEO of FCAU has left the door open for a possible merger and has advocated for it more than once. Due to GM's new synergy, we could expect its merger process to be swifter since it has just recently gone through a similar merger. If this synergy were to occur, the stock price of FCAU would rise. However, excluding the possible merger, FCAU is showing strong progress in increasing performance in the last year. The company by itself seems to have enough weight to hold its ground and enhance the value of the company on its own.

Earnings and Income:

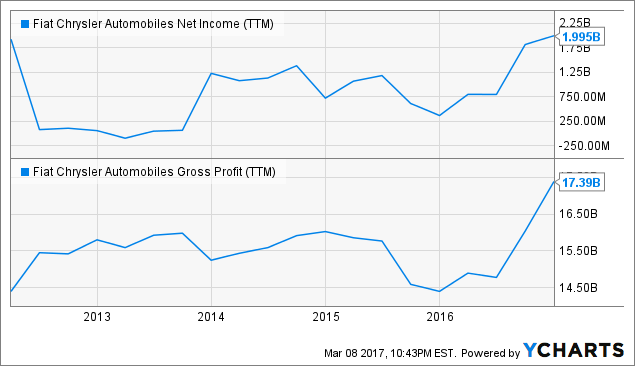

Firstly, let's go over how the company has been producing revenue and how much it retains after over a period of time to see if we can find any sentiment that may show us improvement. The EV-to-EBITDA for FCAU is at 2.42 and when compared to its industry, it is 95% stronger over 931 companies in the global auto-manufacturing industry. Many aspects of the company's financial statements are having growth year over the year such as net income, gross revenue, revenue, and earnings per share. I feel that the most important financial number is the gross income for FCAU. It allows an investor to get a better outlook of its operations and how management is handling efficiency. Overall, the business is beginning to pick up while showing signs of recovery.

FCAU Net Income (TTM) data by YCharts

Currently, some of FCAU's ratios are showing the stock's price as undervalued. The price to book ratio is .84 while the sales to price ratio are .15. Both ratios are under one, and if it remains below, it could still be considered an undervalued asset. Furthermore, its net margin is 1.62%, and operating margin is 1.89%, both producing positive numbers consistently. Alternatively, the margins are subtle and remain 60% lower than its competitors. The company must work on increasing the margins and perhaps is already doing so through efficient operations management. The business could dramatically increase its value if it were to grow these two critical factors.

(Click on image to enlarge)

FCAU Operating Margin (TTM) data by YCharts

Debt Analysis:

The companies debt situation seems to be getting better. So far long-term debt has been decreasing and thus pushing the long-term debt to equity ratio lower and closer to one. The company has issued a lot of debt over the years, and for the past two years, it has been paying it back more than double each time. Moreover, the choice of acting on paying off a lot of debt has allowed the total debt of the company to decrease year over year, putting the company in a better position. Additionally, the better position can also lead to better investment opportunities that could lead to growth.

Investments by FCAU, have been stagnant but remains in positive territory. In regards to returns on investment capital, the company produced a 6.41% return while the weighted average cost of capital is 5.94%. It brings the return on investments to .47%. It's not much, but it is better than most its industry. Moreover, the ROE is 10.52% providing average returns compared to its competitors. The ROA is 1.76% which is not impressive yet remains in positive territory over the years, offering signs of consistent small yields. As the company continues to decrease its debt and bring most of its debt ratios below one, can allow the company to take on more investments which could lead to a rise in returns.

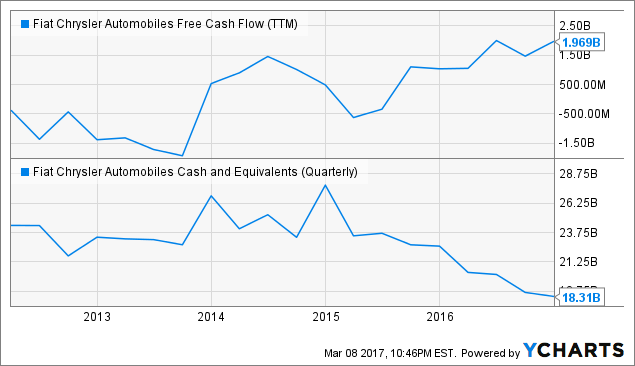

The company currently does not have any dividends. Even then, the businesses cash, and cash equivalents must be reviewed along with cash flow performance. Since 2014 the company's cash and equivalents are declining and must be watched carefully to ensure that the "bleeding" of money doesn't continue or grow at an increasing rate. Cash flow for the company is getting better and has seen a significant return compared to the previous year. The free cash flow for the company has nearly doubled year over year since 2014, showing significant gains compared to past years.

FCAU Free Cash Flow (TTM) data by YCharts

If the company or industry is seeing a decline, increased free cash flow only helps to offset any damaging factors in regards to functioning and operating the business. Lastly, the FC (F margin has also seen an increase of nearly double since 2014, which goes to show that the related increase in free cash flow has to do with producing better margins and managing more efficiently.

Finishing Up:

In completing my analysis, I believe FCAU to be an excellent long candidate to take advantage of an undervalued company. Not only is it undervalued, but the business is seeing significant progress in pushing the company to healthier levels which could bring about new investments. Moreover, there is still a possible merger that could take place with GM and could potentially allow an investor to see excellent returns. I believe the overall market to be exhausted from a non-relenting rally which seems to have no threshold as to how high the stock price can go.

(Click on image to enlarge)

Since the market deserves a pull-back, I feel that for this investment and more importantly at this current time, one should wait for FCAU to pull-back to the Fibonacci level right below at $9.30. If the price has resistance to break the support level, could provide further confirmation to a potential reversal and bounce off support. However, if the price does continue to rise, an entry price at $11.53 is an excellent entry that can produce a breakout and thus bringing momentum back to the upside. I expect the stock to break all-time highs in 2017 which brings targets to $18. Stops are the .5 Fibonacci level which sits at $8.00, thus making the stop at $7.99. As of today, most analysts put FCAU as "hold, " and the highest price expectation from analysts is at $20, making my target reasonable. To close, FCAU can withstand weak economic or industry related elements and is showing improved performance from the business end. The possible merger is just the "cherry on the top" and could potentially generate better than expected returns. The company itself seems to be able to hold itself, and I feel that excluding the potential merger, the company still can outperform and surprise investors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Any updates?

Some good stuff here. Are you going to be publishing more?