FAT Brands Gobbles Up More Restaurants

Summary

- 100% technical buy signals.

- 15 new highs and up 49.75% in the last month.

- 439.49% gain in the last year.

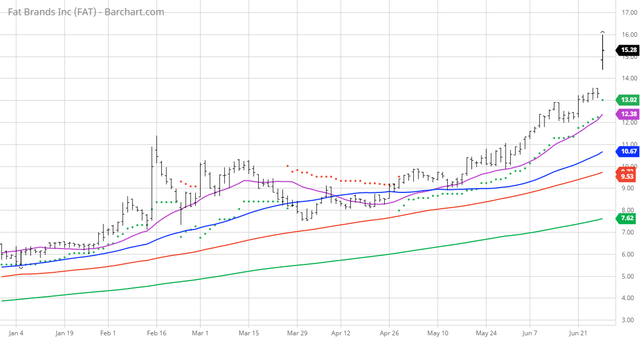

The Barchart Chart of the Day belongs to the restaurant operator FAT Brands (Nasdaq: FAT). I sorted Barchart's All-Time High list first by the highest Weighted Alpha, then used the Flipchart function to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 4/29 the stock gained 57.46.

This mornings press release says it all:

FAT Brands Inc. Agrees To Acquire Global Franchise Group For $442.5 Million

GlobeNewswire - Mon Jun 28, 5:00AM CDT

Largest Restaurant Acquisition of 2021 to include Round Table Pizza, Great American Cookies, Hot Dog on a Stick, Marble Slab Creamery and Pretzelmaker

Combined System-wide sales of approximately $1.4 billion

FAT (Fresh. Authentic. Tasty.) Brands Inc. (Nasdaq: FAT) (the "Company") today announced that it has agreed to acquire Global Franchise Group, which franchises and operates a portfolio of five quick-service restaurant concepts, Round Table Pizza, Great American Cookies, Hot Dog on a Stick, Marble Slab Creamery and Pretzelmaker, from Serruya Private Equity, Inc. and Lion Capital LLP, for $442.5 million in cash and stock.

The cash portion of the purchase price will be funded from the issuance of a new series of notes and cash on hand. The Company will also issue to the sellers $25 million in common stock and $67.5 million in Series B cumulative preferred stock. The transaction is expected to close by the end of July 2021, subject to expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act.

With the acquisition of GFG, FAT Brands will have more than 2,000 franchised and company-owned restaurants around the world with combined annual system-wide sales of approximately $1.4 billion. Approximately 87% of GFG's stores are located in the United States. Based on current projections and assumptions, including realization of expected synergies and return to pre-COVID restaurant sales, the acquisition is expected to eventually increase annual EBITDA by approximately $40 million to approximately $55-$60 million.

"This acquisition is a key strategic milestone for FAT Brands. We have been very acquisitive in recent years, seeking to add strong and growing restaurant brands to our portfolio. Now that the economy is emerging from COVID-19 and restaurants are rapidly recovering, we are pleased to have reached this agreement to incorporate a powerhouse restaurant franchising group with the support of Serruya Private Equity and Lion Capital," said Andy Wiederhorn, President and CEO of FAT Brands. "The five new restaurant concepts have been very resilient coming out of the pandemic and will complement our existing brands. Furthermore, we will acquire GFG's manufacturing operations, which will provide greater efficiencies and incremental revenue opportunities to our company."

"This is truly a transformative deal for both FAT Brands and GFG. Andy has an exciting vision for FAT Brands and through his recent acquisitions, he has been able to create brand synergies within the portfolio while maintaining an asset-light business model," said Michael Serruya, Managing Director at Serruya Private Equity and Chairman of the Board of GFG. "I look forward to our continued involvement with GFG through our company's support of FAT Brands from an equity and strategic perspective."

Lyndon Lea, the Managing Partner of Lion Capital, added:

"We are incredibly thankful to the management team of GFG, for their incessant focus on building a great business and culture, while successfully navigating an unprecedented period amidst COVID-19. We wish FAT Brands and GFG the best in the next phase of their journey."

Duff & Phelps Securities, LLC served as financial advisor to GFG and Serruya Private Equity. Sheppard, Mullin, Richter & Hampton LLP, and Greenberg Traurig, LLP acted as legal counsel to FAT Brands. Bryan Cave Leighton Paisner LLP acted as legal counsel to Serruya Private Equity and Lion Capital.

About FAT (Fresh. Authentic. Tasty.) Brands

FAT Brands (NASDAQ: FAT) is a leading global franchising company that strategically acquires, markets, and develops fast casual and casual dining restaurant concepts around the world. The Company currently owns nine restaurant brands: Fatburger, Johnny Rockets, Buffalo's Cafe, Buffalo's Express, Hurricane Grill & Wings, Elevation Burger, Yalla Mediterranean, and Ponderosa and Bonanza Steakhouses, and franchises approximately 700 units worldwide. For more information, please visit www.fatbrands.com.

About Global Franchise Group, LLC

Global Franchise Group, LLC is a strategic brand management company with a mission of championing franchise brands and the people who build them. The company builds great brands that connect people with craveable products and memorable experiences. GFG currently supports more than 1,400 franchised and corporate stores in 16 countries across five quick-service restaurant concepts: Round Table Pizza, Great American Cookies, Hot Dog on a Stick, Marble Slab Creamery, and Pretzelmaker. Global Franchise Group, LLC is an affiliate of Serruya Private Equity, Inc. and Lion Capital LLP.

Barchart technical indicators:

- 100% technical buy signals

- 217.99+ Weighted Alpha

- 439.49% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 49.75% in the last month

- Relative Strength Index 82.30%

- Technical support level at 13.10

- Recently traded at 14.8 with a 50 day moving average of 10.67

Fundamental factors:

- Market Cap $163 million

- Revenue expected to grow 85.70% this year and another 29.30% next year

- Earnings estimated to increase 100.00% this year

- Wall Street analysts issued 2 strong buy recommendations on the stock

- At present the individuals on Motley Fool have not yet discovered this stock

- 1,270 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in FAT over the next 72 hours.

Disclaimer: The Barchart Chart of the Day highlights stocks ...

more