Fastly: Keep Calm And Be Patient

Fastly (NYSE:FSLY) stock was crashing by almost 30% on Thursday as the company cut its revenue guidance for the third quarter of 2020. Adding insult to injury, many Wall Street firms also downgraded Fastly after the news hit the wires.

I already own a sizeable position in Fastly at much lower prices, and the stock is barely back to prices from two weeks ago, so I am in no rush to add to my Fastly position.

However, this looks more like a temporary setback than anything else. I am not planning to sell at all, and I may consider buying more if the stock keeps going lower in the near term.

What Happened?

Fastly announced a 5% reduction in revenue guidance for the third quarter, from $73.5-75.5 million to $70-71 million. The company provided two main reasons for this negative development in the press release:

- Due to the impacts of the uncertain geopolitical environment, usage of Fastly’s platform by its previously disclosed largest customer did not meet expectations, resulting in a corresponding significant reduction in revenue from this customer.

- During the latter part of the third quarter, a few customers had lower usage than Fastly had estimated.

The first factor is most probably lower than expected usage from TikTok. The irony of the matter is that it was recently announced that the TikTok drama is being left behind, so this should not be a problem for the company going forward. However, we are still talking about the quarter ended in September, and there is a good chance that all the uncertainty surrounding a potential ban of TikTok may have kept creators away from the platform and looking at other platforms in case TikTok was banned in the U.S.

This is reportedly a thing of the past now. To the extent that TikTok can recover its popularity in the near term, this should not be a problem for the company going forward.

The second point, lower-than-estimated usage from customers, could a bit more concerning. The company did not provide precisions about this, so we will need to wait until the coming earnings report on October 28th to get more information about what it means.

The thing is that Fastly is not a typical software-as-a-service business, the company charges clients based on their usage. Other high growth platforms like Twilio (NYSE:TWLO) and Snowflake (NYSE:SNOW) operate in the same way. This has many advantages for clients since they only pay when they get value from the provider, and they don't need to assume big financial commitments upfront.

However, this business model that is so convenient to customers and has so many benefits on the commercial side also means that revenue is inherently harder to predict and more volatile. At the end of the day, happy clients will mean happy investors too over the long term, but we need to be willing to tolerate the volatility that comes with this business model.

Needless to say, I will be paying close attention to what management has to say about this factor in the near term.

The Big Picture

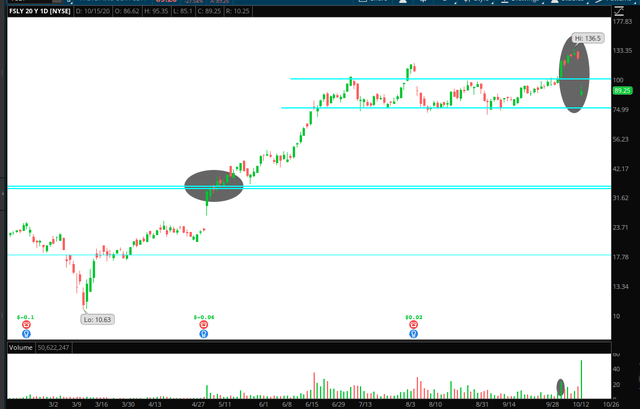

It would be easy for me to write that a 30% decline on a 5% guidance cut is unreasonable and short-sighted, but it is not so simple. Momentum cuts both ways, and Fastly stock has been on fire this year. When a stock such as Fastly makes enormous gains of more than 400% in a year, and it is trading at all-time highs, you know full well that the stock price is very vulnerable to the downside on any bad news.

In these situations, a stock can even pull back on good news, since that good news are probably reflected on prices to a good degree. On some days, Fastly stock has been up by more than 10% on no news whatsoever this year, so nobody should be too surprised to see the stock coming down so violently on a guidance cut.

Source: TOS

With the stock trading at around $90, this means that Fastly is back down to prices from 15 days ago, and long-term investors in the stock are still up substantially on the position.

What Would Make Me Sell Fastly?

When you assess a position, it is important to remain flexible and open-minded because investing is always a game of probabilities as opposed to certainties. If the evidence changes, we have to change our minds, and decisions should always be based on evidence and data as opposed to opinions.

I am certainly not going to sell Fastly on a weak quarter, driven mostly by a slowdown in TikTok usage. On the other hand, I will be closely watching the company in the coming quarters to see if there are any signs that Fastly is falling behind the competition. The comments from management regarding lower-than-expected usage from other clients certainly require more scrutiny in the near term.

Over the long term, my bullish thesis on Fastly is based on the idea that the company has enormous room for growth in areas such as security and edge computing. If management fails to deliver in those areas, then the thesis would be wrong, and the right thing to do would be selling the stock.

Volatility Is The Price To Pay For Superior Performance

Everyone wants to own multi-baggers, meaning stocks that can multiply their prices many times over the years. The returns from these kinds of stocks can be game-changing, but it is not easy to hold on to them over the long term.

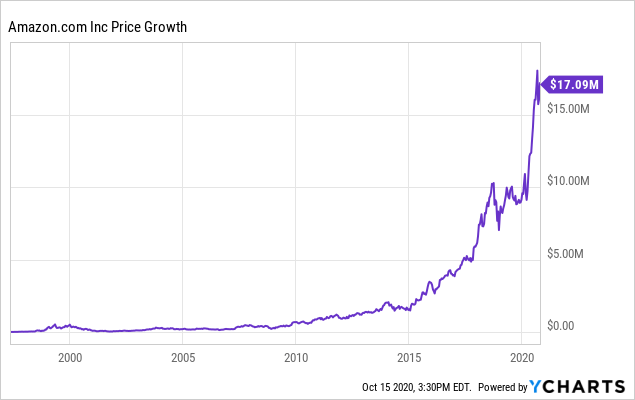

For example, a $10,000 investment in Amazon (NASDAQ:AMZN) when the company went public would currently be worth over $17 million.

Data by YCharts

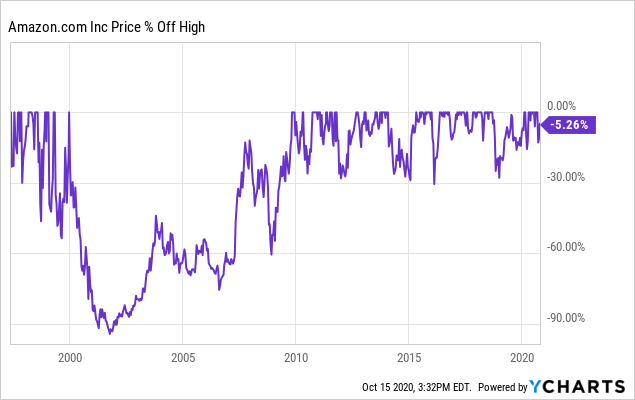

However, Amazon stock still declined by more than 30% on multiple occasions. It even lost more than 60% during the Great Recession, and it lost more than 90% when the tech bubble exploded. The returns have been staggering in the long term, but so has been the volatility.

Data by YCharts

I am not saying that Fastly will be the next Amazon, I am just showing that, even if you buy the best possible stock that you can buy for the long term, you will still need to tolerate substantial volatility and big drawdowns if you want to make massive returns over the years.

Making lots of money in the stock market is not supposed to be easy. If it were, everyone would do it, and there would be no edge in having mental fortitude and discipline. A long-term approach produces superior returns because it is hard to implement in real life.

Based on the information currently available, I am planning to hold on to my Fastly position, and I am willing to consider buying more if the stock keeps going down in the near term. I also have a plan to change my mind if the bullish thesis breaks down, but I am fully aware of the fact that volatility is the price that I have to pay for superior returns over the long term.

Disclosure: I am/we are long FSLY, AMZN, TWLO.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more

Certainly this article points out some hard truths: volatility is part of the high-performance package. That is how it works. Higher risks sometimes do produce higher rewards. And occasionally the do not. AND, never gamble more than you can afford to lose.