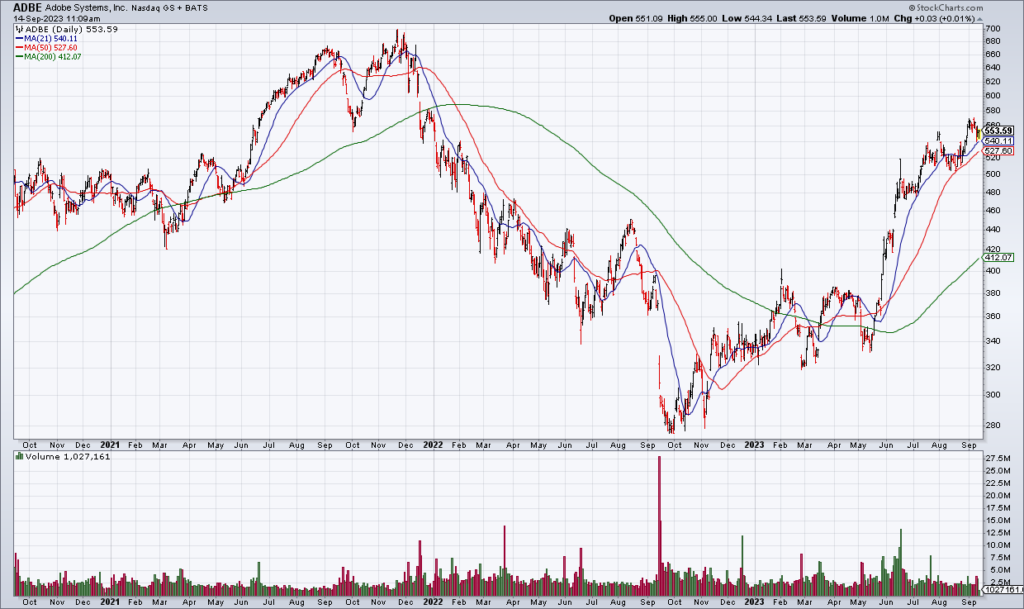

Fade ADBE Into Earnings

(Click on image to enlarge)

Adobe (ADBE) is a great company and a key player in the digital economy. That said, I think the stock has gotten too hot and should be faded into earnings Thursday afternoon.

ADBE stock has doubled in the last year but the fundamentals have not kept pace. On 12/25/22, ADBE guided FY23 revenue and EPS to $19.1-$19.3 billion and $15.15-$15.45, respectively. While they marginally increased guidance the last two quarters, on 6/15 they stood at $19.25-$19.35 billion and $15.65-$15.75, respectively. In other words, a pretty marginal increase. As a result, the stock now trades for 35x current year guidance. Clearly, there is a lot of excitement/hype regarding Artificial Intelligence (AI) but my guess is that this is probably priced into the stock at this point – as we saw when Nvidia (NVDA) and Oracle (ORCL) reported their most recent quarters.

Therefore, I am holding my fractional short position and also sold some ADBE $600 Sept15 Calls for $1.35 earlier this morning.

More By This Author:

LEN Earnings Preview

CBRL: Song Of The South And The Persian Buffett

ORCL: Overextended