Facebook Valuation: It's Not Too Late

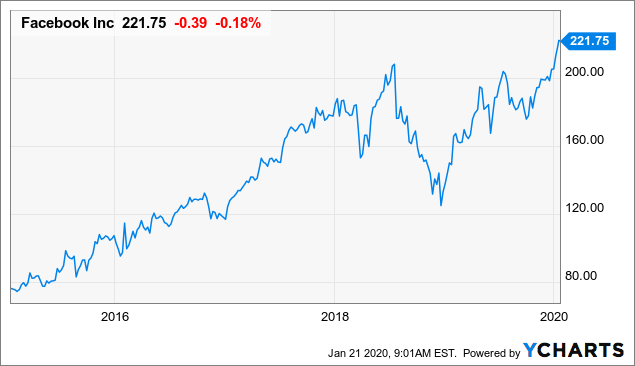

Facebook (FB) stock has been on fire lately, shares of the social network have gained over 50% in the past year, and they are trading at historical highs as of the time of this writing. With this in mind, it makes sense for investors to wonder if it still makes sense to invest in Facebook right now or the stock is too expensive at current prices.

In this respect, it's important to understand where the stock is coming from and what this means going forward. Facebook stock was considerably undervalued a year ago, and now valuation remains at reasonable levels, even under conservative assumptions.

The stock is not the bargain it used to be, and the market itself is overbought, so patience makes sense when building a position in Facebook. However, Facebook not overvalued at current prices, and the stock should be able to deliver solid returns in the years ahead. Even better, any pullback down the road could present a buying opportunity.

Keeping Things In Perspective

It is true that Facebook stock has significantly appreciated in the past year, but it is also true that the stock is not too far away from levels it first reached in July of 2018.

In fact, during 2018, Facebook had a massive drawdown of nearly 45% due to the data privacy scandals and all the negative press coverage surrounding the company. This clearly produced a big washout in investor sentiment around the stock.

(Click on image to enlarge)

Data by YCharts

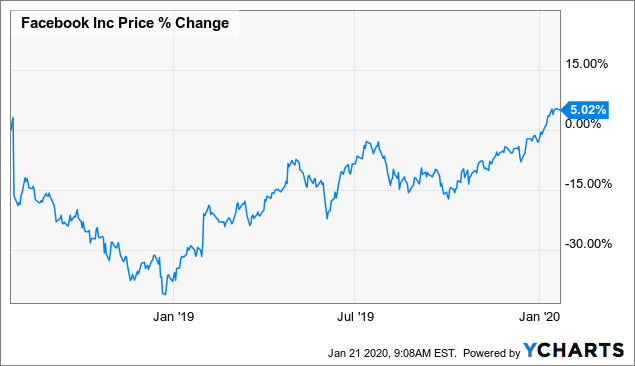

It is all a matter of perspective, and the price chart above looks very different when we look at the modest gain of only 5% that Facebook has produced from its highs of July 2018.

(Click on image to enlarge)

Data by YCharts

Importantly, price momentum and valuation are two remarkably different things. Momentum is about measuring how the stock price is evolving over time, while valuation is about comparing the stock price versus fundamental metrics of value such as earnings and cash flows.

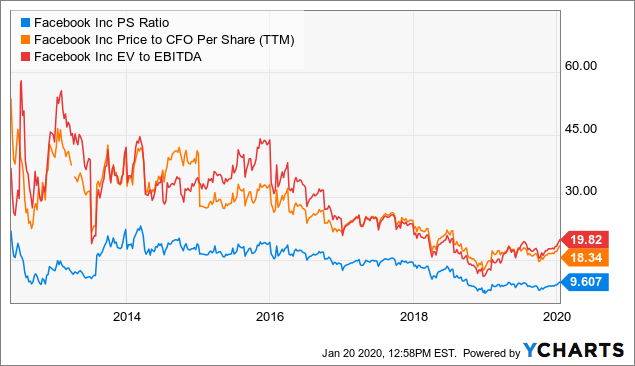

If we look at valuation ratios such as price to sales, price to operating cash flow, and enterprise value to EBITDA, those metrics are barely starting to move higher in 2020, and it's easy to see how Facebook remains attractively priced by historical standards.

(Click on image to enlarge)

Data by YCharts

Forward-Looking Valuation

The difficult thing about valuation is that the true value of the business does not depend on past earnings, but rather on the earnings that the business is going to generate in the future. Unfortunately, the future can never be known with precision, it can only be estimated, and those estimates carry a considerable margin of error. Nevertheless, it can be an insightful exercise to asses forward-looking valuation ratios based on different ranges of earnings estimates.

The table below shows the forward price to earnings ratios for Facebook based on 3 levels of earnings expectations. The lowest estimate among Wall Street firms, the average estimate, and the highest earnings estimate among the analysts following the stock.

For a company that delivered a 28% increase in revenue last quarter, Facebook looks fairly attractively priced, especially if the company can meet or exceed the average earnings estimate. A price to earnings ratio below 25 is more than reasonable, and below 20, the stock looks clearly undervalued.

(Click on image to enlarge)

Source: Seeking Alpha Essential

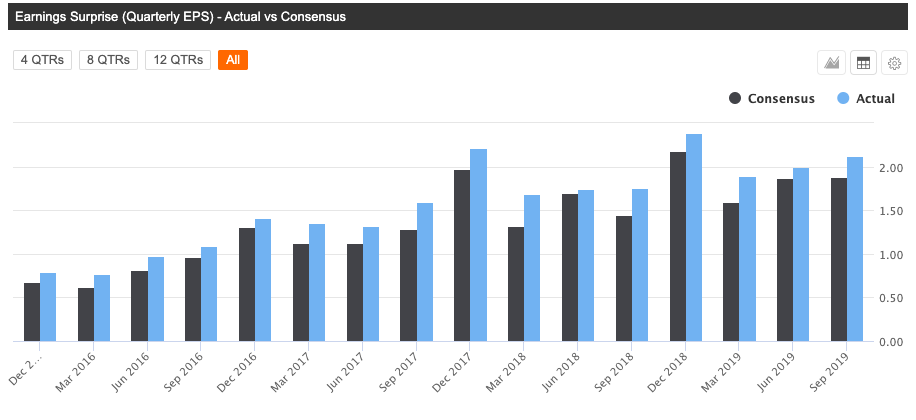

Speaking of which, Facebook has exceeded earnings expectations in each of the past 16 consecutive quarters, building quite an exceptional track-record of consistency in outperforming expectations.

(Click on image to enlarge)

Source: Seeking Alpha Essential

The fact that the company has outperformed expectations in the past does not guarantee that it will continue doing so in the future. However, it's good to know that management tends to provide conservative guidance, usually underpromising and overdelivering.

If past history is any valid guide for the future, then Facebook could easily outperform the average Wall Street estimate in the coming quarters. In such a scenario, the stock would look conveniently valued if not downright undervalued.

Relative Valuation

In order to asses valuation ratios from a comparative perspective, we need to interpret these ratios in their due context and consider other metrics such as revenue growth and profit margins for different alternatives in the industry.

In that spirit, the table below shows revenue growth on a trailing twelve months basis, projected sales growth in the next five years, and operating margin for Facebook versus Alphabet (GOOG) (GOOGL), Snap (SNAP), Twitter (TWTR), Match Group (MTCH), and Baidu (BIDU).

Social media and online advertising are industries with plenty of potential for growth and profitability, among a group of relatively strong stocks, Facebook comes out as a top name in terms of financial quality.

The company has the second strongest growth rate in revenue behind Snap, and it leads the industry in terms of profitability, with an outstanding operating margin of 42% of revenue.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

This sky-high profitability is generated in spite of the fact that Facebook has significantly accelerated spending in recent quarters, with total cost and expenses growing 32% in the third quarter of 2019. It is reasonable to expect expenses to grow at a slower rate than revenue in the years ahead, so profitability could even increase from already high levels.

Back to the valuation ratios, the table below shows EV to EBITDA, forward PE, PE to long-term growth expectations (PEG) and EV to Sales. Facebook is the cheapest stock in the group in terms of EV to EBITDA and price to earnings growth ratios, and it doesn't look too expensive at all when considering forward PE or EV to Sales.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

Facebook is one of the best companies in social media and online advertising in terms of financial performance, and valuation ratios look rather attractive in comparison to peers.

Risk And Reward Going Forward

When considering the risks, regulatory pressure, public opinion backlash, and data-privacy concerns are the top factors to keep in mind. The company does not have any further room for error in these sensitive areas, and management needs to make sure that Facebook stays on the right track.

Ideally, Facebook should focus on promoting healthy interactions and connections among its users in order to reverse, at least to some degree, the damage that the company's public image has suffered in recent years.

In addition to this, the main Facebook platform is maturing. The company is doing a great job at monetizing Instagram, and both WhatsApp and Facebook Messenger offer plenty of untapped potential going forward. Nevertheless, the transition to these platforms as main growth engines could make financial performance harder to predict in the middle term.

However, those uncertainty drivers are already accounted for in market expectations and in hence the stock price. In fact, the stock is still fairly attractively valued at current levels, even when incorporating those risk factors into the equation.

In May of 2019, I published an article entitled Facebook Is Undervalued. This article included a discounted cash flow valuation with an estimated value of $236 per share. The main thesis at the time was that the market was overreacting to the negative press coverage around Facebook.

From the article:

Facebook deserves a lot of the criticism that the company has received in recent months, and management needs to find the right ways to guarantee to users, regulators, and investors that will do the right thing to protect data privacy and guarantee a fair flow of information going forward.

However, the main point is that the uncertainty created by those struggles is already incorporated into current stock prices to a good degree. Facebook is still producing impressive financial performance and the stock is valued at attractively low levels.

Investors tend to miss the forest for the trees, often paying too much attention to the short-term news affecting the stock price and underlooking the long term fundamentals and valuation drivers. In this particular case, short-term uncertainty seems to be creating a buying opportunity for long term investors in Facebook stock.

Since then, the stock has appreciated by 23%, so the opportunity is not as large as it was at the time, and I wouldn't rush into building a large position in Facebook now that the stock is more fairly valued. Besides the stock market, in general, is quite extended in the short term, so patience is a better idea than aggressively chasing Facebook at all-time highs.

But the main thesis remains in place, and the $236 fair value estimate is based on rather conservative cash flow assumptions. In fact, recent price targets from Wall Street firms are at $275 and $280. These price targets imply an upside potential of 25%-27% from current levels, and they are not unreasonable at all when looking at the cold-hard valuation metrics.

In other words, Facebook stock is rather moderately valued at current prices, even making conservative assumptions about earnings. The stock should be able to produce solid returns going forward, and any pullback down the road should be considered a buying opportunity as long as the fundamentals remain strong.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more