Exxon Reports Record Profit Of $59 Billion In 2022; Earns $7 Million Every Hour

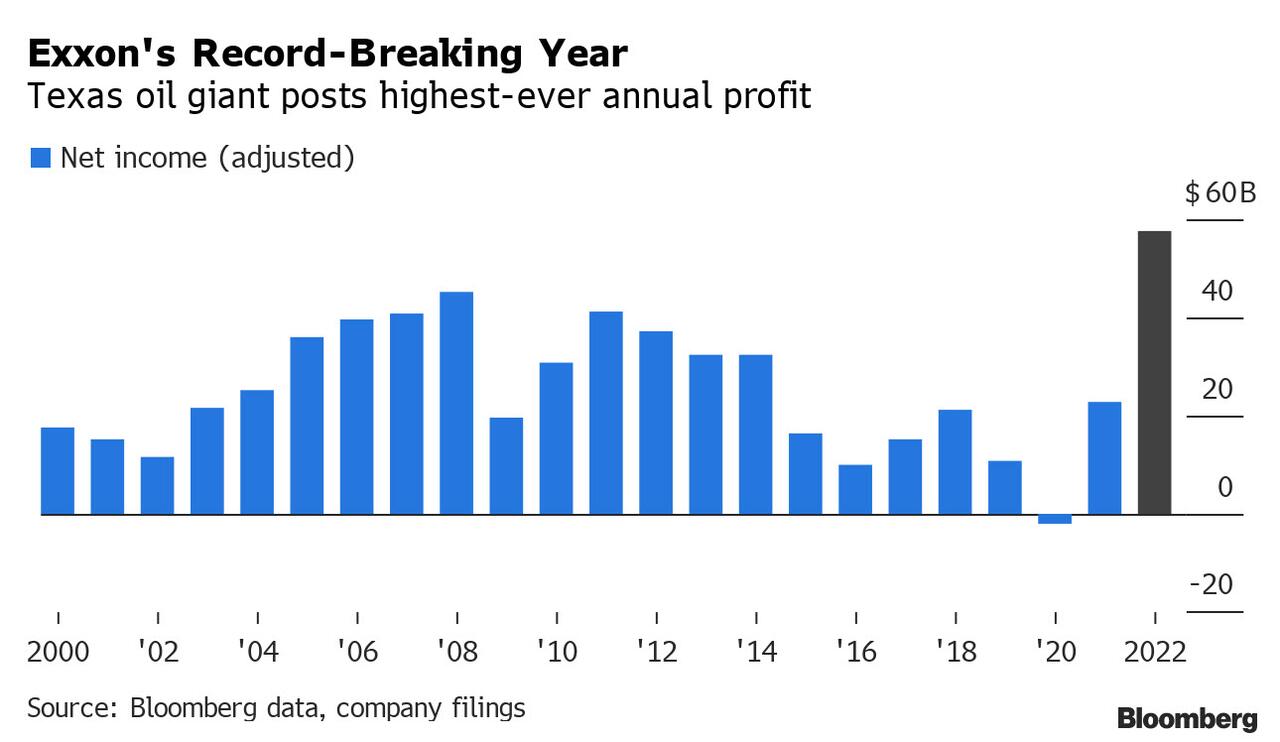

Several days after blowout earnings by its biggest competitor Chevron, this morning US E&P giant Exxon Mobil (XOM) posted blowout Q4 and full-year numbers, when it reported $59 billion in adjusted profit for 2022, taking home more than $6.7 million per hour last year, and setting not only a company record but a historic high for the Western oil industry.

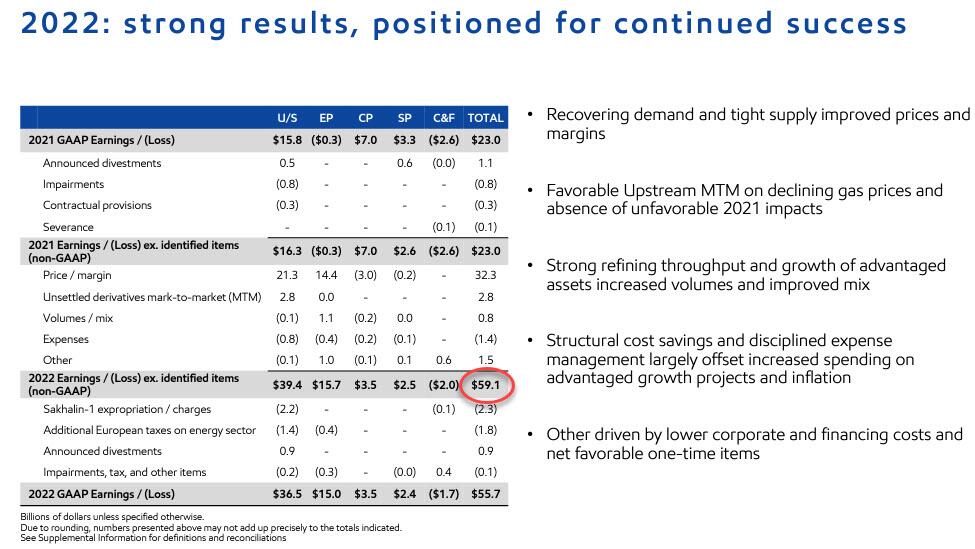

That's right: Exxon’s full-year profit, excluding one-time items, jumped 157% from 2021 to $59.1 billion, far exceeding the driller’s prior record of $45.2 billion in 2008 when oil hit $142 per barrel, 30% above last year's average price, and which at the time marked the biggest in US corporate history. Deep cost cuts during the pandemic helped supercharge last year's earnings.

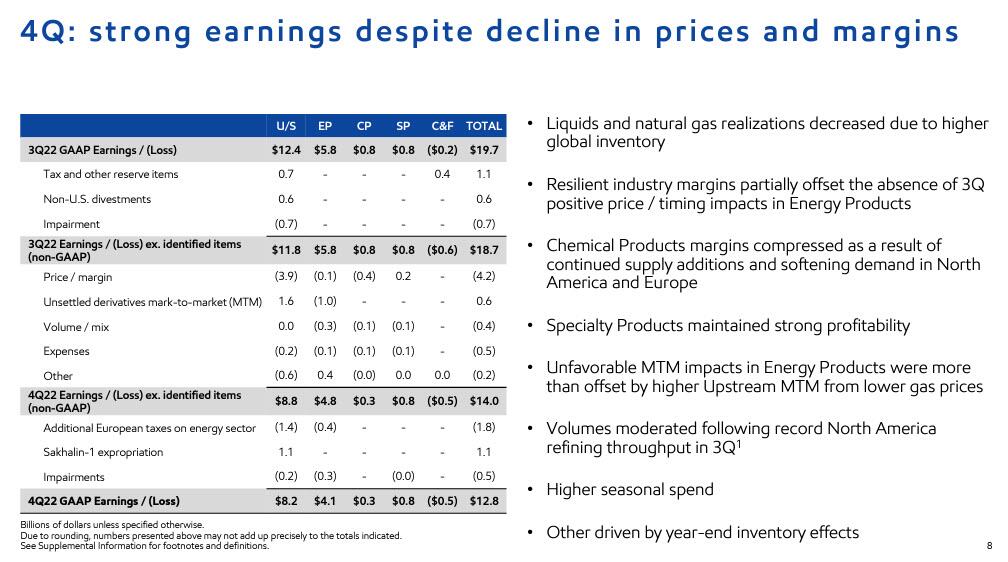

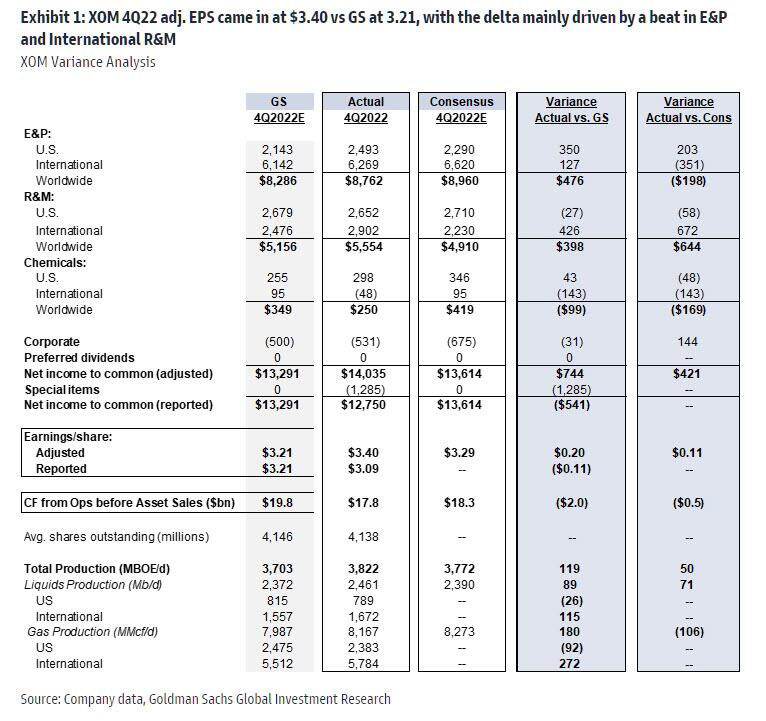

On a quarterly basis, Exxon surpassed expectations for the ninth time in 10 periods, posting an adjusted fourth-quarter profit of $3.40 a share that was 11 cents higher than the median estimate by analysts in the Bloomberg Consensus. This translated into $14 billion in fourth-quarter profit excluding charges, 60% more than the same period last year but down almost 25% from the previous quarter as oil prices eased and some operations suffered from cold-weather related outages. Here is a snapshot of what the company reported for Q4:

- Revenue $95.4BN, beating consensus expectations of $$94.7BN

- Adjusted EPS of $3.40, beating consensus expectations of $3.29.

- E&P was the largest driver of the beat across US/International, as well as International Energy and Specialty products.

- Cash flow came in at $17.8 bn excluding working capital and asset sales, missing consensus expectations of $18.3 bn.

"Overall earnings and cashflow were up pretty significantly year on year," Exxon Chief Financial Officer Kathryn Mikells told Reuters. "So that came really from a combination of strong markets, strong throughput, strong production, and really good cost control."

Exxon said it incurred a $1.3 billion hit to its fourth-quarter earnings from a European Union windfall tax that began in the final quarter and from asset impairments. The company is suing the EU, arguing the levy exceeds its legal authority.

Here is how the earnings look when compared side by side with the GS model:

And in more details:

- On a segment basis, relative to Goldman's numbers (Buy reco, $120 PT) the company beat on E&P and R&M (Energy and Specialty Products), and was slightly below on Chemicals, and more in-line on Corporate.

- On the Upstream, XOM came in above GS estimates, with the US and International business above. XOM announced $8.8 bn for adjusted E&P worldwide, versus our expectations of $8.3 bn.

- Production was above GS expectations. XOM reported 3,822 Mboe/d versus our 3,703 Mboe/d forecast, and consensus of 3,772 Mboe/d. Digging deeper, liquids volumes came in above GS forecast driven by International. On the gas side, volumes came in above expectations in International.

- R&M (including both Energy Products and Specialty Products) was above GS estimates, with XOM reporting worldwide adjusted R&M earnings of $5.6 bn for 4Q22 versus our expectations of $5.2 bn. The variance was mainly driven by International, with US more in-line vs our estimates.

- The Chemicals segment came in slightly below our forecasts during the quarter driven by International. XOM reported $250 mn of adjusted earnings versus our ~$350 mn forecast.

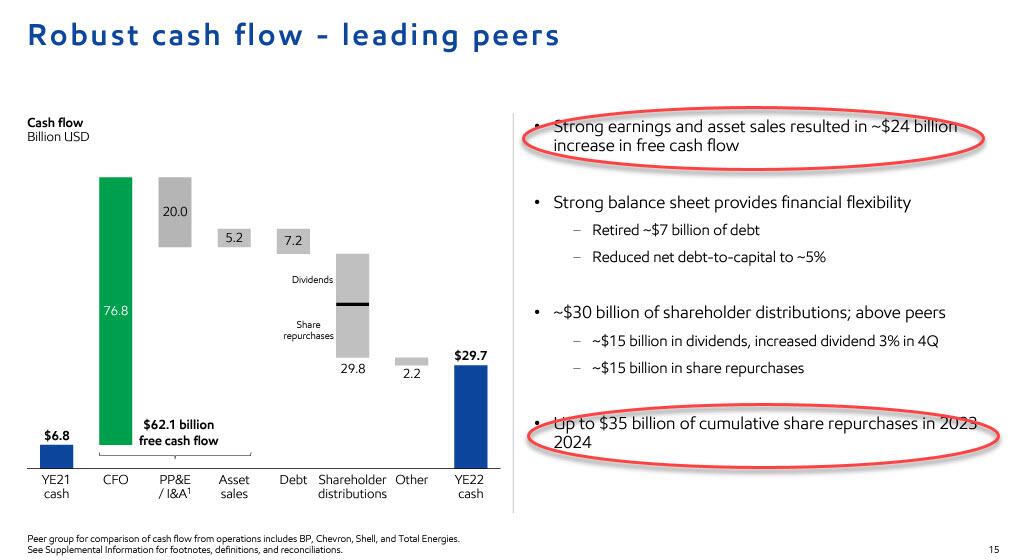

Still, despite the blowout, record earnings, because XOM did not follow CVX in reporting a just as gargantuan stock buyback, some traders decided to punt the stock, at least in early trading when it dropped as much as 4% before recovering some gains. Instead of matching Chevron's $75BN, XOM stuck with its previous guidance of $35BN in buybacks for the 2023-2024 period, although it is very likely that the company will have to boost this number.

Exxon also boasted its cash flow from operations soared to $76.8 billion last year, up from $48.1 billion in 2021.

Exxon's spending on new oil and gas projects bounced back last year to $22.7 billion, up 37% from the prior year. The company increased outlays on discoveries in Guyana, in the top U.S. shale field, and on fuel refining and chemicals.

"The counter-cyclical investments we made before and during the pandemic provided the energy and products people needed as economies began recovering," Exxon Chief Executive Officer Darren Woods said in a statement.

The results may set up another confrontation with the White House. On Friday, President Joe Biden's administration blasted oil firms for pouring cash into shareholder payouts rather than production. Windfall profit taxes are "unlawful and bad policy," countered CFO Mikells. Slapping new taxes on oil earnings "has the opposite effect of what you are trying to achieve," she said, adding it would discourage new oil and gas production.

The five supermajors are swimming in cash after a record 2022 but pressure is mounting on executive teams to satisfy Biden's contradictory demands: investor appetite for bigger payouts and buybacks versus political outrage over windfall profits during a time of war and economic dislocation.

According to Reuters, oil majors are expected to break their own annual records on high prices and soaring demand, pushing their combined take to near $200 billion. The scale has renewed criticism of the oil industry and sparked calls for more countries to levy windfall profit taxes on the companies.

Chevron was excoriated by the White House and Democratics when it disclosed plans last week to funnel $75 billion to investors in the form of stock repurchases. Investors cheered. Exxon had already expanded buybacks multiple times last year and already has signaled its intention to repurchase $50 billion of stock through 2024. Chief Executive Officer Darren Woods is likely to be probed on whether Exxon can increase the pace of buybacks again when he hosts a conference call with analysts at 8:30 a.m. New York time.

There are also signs that Wall Street, after a long hiatus, is once again keen to see oil explorers increasing crude output. As Bloomberg notes, Chevron executives faced multiple questions about growth plans last week, and several analysts noted their disappointment at the California-based company’s outlook for a flat-to-3% increase this year.

A slowdown in Chevron’s Permian Basin annual growth to 10% probably will be an “overhang” on the stock, Cowen & Co. said in a note to clients. That said, Exxon has less reason to be concerned about when it comes to growth than some of its peers. The company has a “differentiated upstream project queue” that should increase return on capital over the coming years, Goldman Sachs wrote in a Jan. 20 note.

The Texas oil giant has continued to invest in major projects in Guyana and the Permian region during the pandemic, which by Exxon’s own estimates should have the knock-on effect of driving production to the equivalent of more than 4 million barrels a day by 2027, up about 8% from current levels.

Alongside fossil-fuel growth, Exxon plans to ramp up spending on clean-energy investments by focusing on carbon capture, hydrogen and biofuels. The company cited the Biden administration’s Inflation Reduction Act as a key policy pillar that improves profitability of decarbonizing existing operations, but has said that more government support is needed for big projects such as its proposal to capture emissions from industrial facilities along the Houston Ship Channel.

The stock initially tumbled on lack of a buyback expansion, but has since recovered much of its losses.

(Click on image to enlarge)

Exxon's Q4 earnings presentation (pdf link).

More By This Author:

Hedge Funds Are Record Short Bonds As Market Cuts Dovish Fed Bets

Pending Home Sales Suffered Worst Annual Decline Ever In 2022, Despite December Surge

UMich Inflation Expectations Plunge, Democrat Sentiment Sinks

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more