Exxon Mobil Vs. Chevron: Which Company Looks Like A Better Buy?

Image: Shutterstock

It’s no secret that the market has seen some rough sailing so far throughout 2022, with investors taking hit after hit. However, Friday's strong price action seems very promising when looking forward.

We have all become too familiar with the rough macroeconomic situation we’ve found ourselves in, coming out of a once-in-a-lifetime type of pandemic. Inflation has soared, supply chains have been disrupted, and energy costs have shot through the roof.

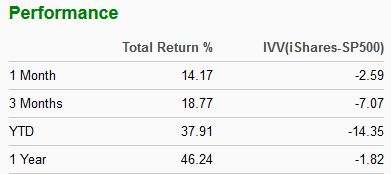

However, there have been a few bright sectors throughout the year. One such example is the Zacks Oil and Energy Sector, which currently ranks #1 out of all 16 sectors. The table below shows the sector’s performance in several different timeframes.

Image Source: Zacks Investment Research

Two companies that operate within the sector include Exxon Mobil (XOM - Free Report) and Chevron (CVX - Free Report). Being two of the top oil giants raises a valid question: Which company deserves your hard-earned cash more?

Let’s take a look at valuation levels, forecasted bottom and top-line growth estimates, and dividend metrics to get a more precise answer.

Exxon Mobil

Exxon Mobil (XOM - Free Report) shares have been blistering hot year-to-date, providing investors with a massive 63% return and easily outperforming the S&P 500’s decline of 15%. Shares have been on a strong uptrend all year.

Image Source: Zacks Investment Research

XOM currently has a forward price-to-sales ratio of 1.1X, which is just a tick above its median of 1.0X over the last five years, but this is notably below the 2018 highs of 1.4X. Additionally, the value represents a steep 75% discount relative to the S&P 500’s forward price-to-sales ratio of 4.1X.

Image Source: Zacks Investment Research

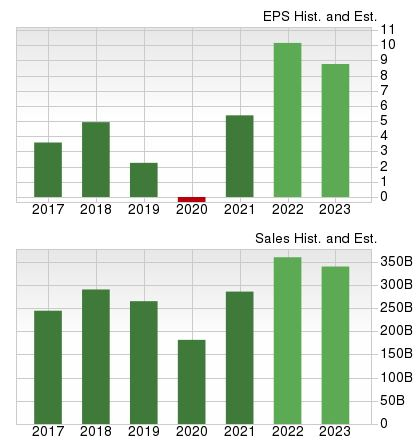

Analysts have been rapidly revising their earnings estimates across the board over the last 60 days. For the upcoming quarter, the $2.76 EPS estimate reflects a sizable triple-digit growth in earnings of 150% from the year-ago quarter.

Furthermore, the Zacks Consensus Estimate Trend has climbed extensively up to $10.17 per share for the current fiscal year, displaying a substantial 90% increase in the bottom-line year-over-year. Looking forward a bit further, the $8.81 EPS estimate for FY23 has the bottom-line shrinking a concerning 14% when compared to FY22.

Additionally, the bottom-line is expected to expand by a notable 21% over the next three to five years. For FY22, the Zacks Consensus Sales Estimate sits at $360 billion, notching an increase in the top line of a sizable 26%.

Image Source: Zacks Investment Research

XOM’s annual dividend yield sits at 3.09%, with a payout ratio sitting at 52% of earnings, which could be seen as unsustainable. However, Exxon Mobil has raised its dividend three times out of the past five years, providing a five-year annualized dividend growth rate of a strong 3.09%.

XOM is a Zacks Rank #2 (Buy) with an overall VGM Score of an A.

Chevron

Chevron (CVX - Free Report) shares have been scorching hot year-to-date, providing a stellar return of 55% that puts the S&P 500’s performance to shame.

Image Source: Zacks Investment Research

The oil giant’s forward price-to-sales ratio sits at 1.6X, which is slightly below its high of 1.9X in 2020 and is slightly above its median of 1.5X over the last five years. Additionally, the vale represents a substantial 63% discount relative to the S&P 500’s forward price-to-sales ratio.

Image Source: Zacks Investment Research

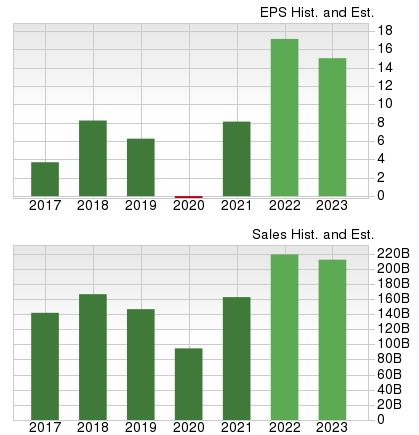

Over the last 60 days, analysts have been upwardly revising their earnings outlook across the board. The $4.65 EPS estimate for the upcoming quarter reflects a massive triple-digit growth in earnings of 171% compared to the year-ago quarter.

For FY22, the Zacks Consensus Estimate Trend has climbed 32%, displaying a surge in earnings growth in the triple-digits of 108% year-over-year. However, for FY23, the $15.00 per share earnings estimate represents the bottom-line, decreasing by 11.5% year-over-year.

Additionally, earnings are forecasted to grow by 12% over the next three to five years. Looking at revenue forecasts, the $218 billion estimate for FY22 sales displays a sizable 35% expansion in the top line from FY21.

Image Source: Zacks Investment Research

For investors looking for a stream of income, CVX has that covered with its 3.22% annual dividend yield and a payout ratio sitting at 54% of earnings. Over the last five years, Chevron has increased its dividend five times; the five-year annualized dividend growth rate sits at a notable 5.9%.

CVX is a Zacks Rank #3 (Hold) with an overall VGM Score of an A.

Bottom Line

Both companies have undoubtedly enjoyed a stellar run throughout 2022, and picking between the two is no easy choice. In times of overall market weakness, investors need to have the ability to pivot to sectors that are performing relatively well, such as the Zacks Oil and Energy Sector. Investors within this sector have enjoyed a multitude of gains, undoubtedly limiting drawdowns in other portfolio positions.

When it comes down to it, I believe that XOM would be a better play over CVX, and there are a few reasons why. XOM displays more attractive valuation levels, has a much higher forecasted long-term earnings growth rate, and, most importantly, currently has a higher Zacks Rank than CVX.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more