Extremes In Performance Of US Housing Stocks Worrying

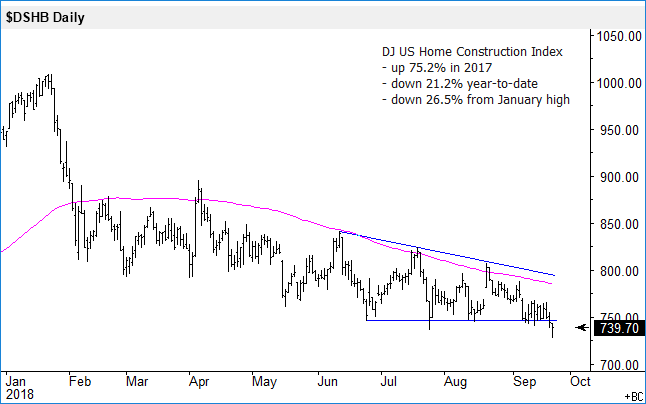

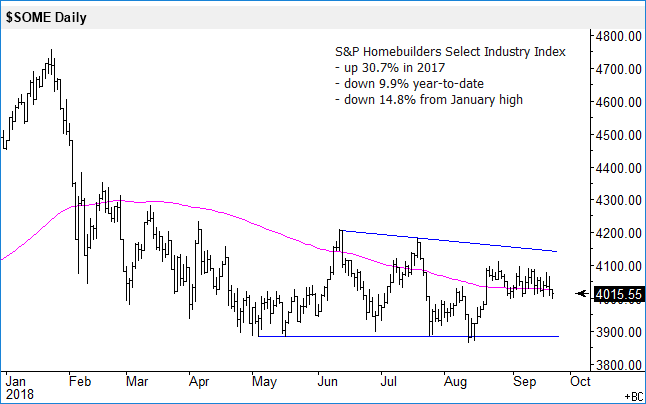

The charts below show three common indexes for US housing stocks. They were up last year in the range of 31% to 75% while the S&P 500 Index was up 19.4%.

This year, however, the indexes are down 10-21% and the Home Construction Index is in a bear market territory, if one uses 20% decline from the top as the threshold level.

The S&P 500 Index is up 9.6% year to date. I think it is worrisome to see such extremes in performance between years, especially given the importance of housing stocks for the broad market.

Disclosure: The analysis provided here is usually part of the analysis the author uses when he is designing and managing his investment portfolios.

Disclaimer: The analysis presented ...

more

There was a spike in building of the high priced housing because credit was cheap and it looked like it would stay cheap for a while. Then suddenly the prospect of more expensive credit dampened the fire, along with the market becoming saturated with large expensive houses. Suddenly there was a real shortage of folks willing to pay $2500 a month on a mortgage, and so the houses are now empty, at least around here. The realtors are sending out so many more advertisements that the desperation is obvious. Greed has found it's reward.