Exploring The Regular Insider Buying At Biostage Inc.

Warren Buffett’s (BRK-A) first rule about investing is “don’t lose money”. His second rule is “don’t forget rule #1”.

Based on Buffett’s track record, I’m willing to take his advice.

The complication I have is that I’m not as smart as Warren Buffett. Not even close. That makes it harder for me to avoid companies that could put me offside rules number one and two.

To help me avoid making critical mistakes I decided to add a layer of defense to my investing process. That layer of defense is focusing exclusively on companies that are either being bought by proven world class investors (like Buffett) or by company insiders.

The way I figure it, insiders know the company they work for better than anyone and the world’s greatest investors make fewer investing mistakes than most of us. By limiting what I focus on to companies that have made it through this filter I believe I’m exposing myself to a less risky sample.

Plus companies with insider buying and those that are being bought by the world’s top investors are likely to not just be less risky but also have significant upside as well. By doing this I believe I’m high-grading my selection pool.

Biostage Inc (BSTG) – Regular Insider Buying

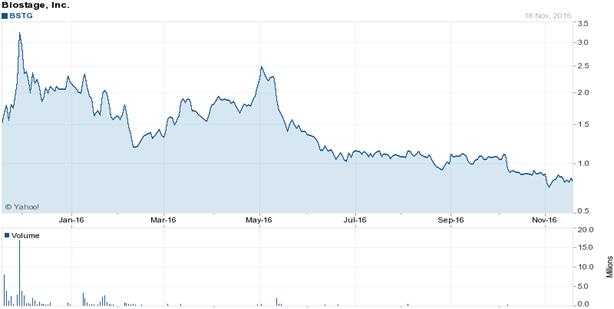

Image source: yahoo finance

As you can see from the stock chart above, Biostage’s share price experienced a decline back in May of this year. Since then insider buying has been pretty steady and it has come from a variety of different insiders.

Source: Yahoo finance

All of this insider buying has taken place at share prices higher than where the stock currently trades.

Biostage is a small company. I take insider buying at smaller companies much more seriously than I would if it occurred at a large cap. At a large cap the executives and directors tend to be multi-millionaires who can drop a couple of hundred thousand dollars just for show.

At a smaller company the insiders who are buying are much likely to be doing so because they are trying to make some money. These people are like the rest of us and don’t make ten million dollars a year.

What Does Biostage Do?

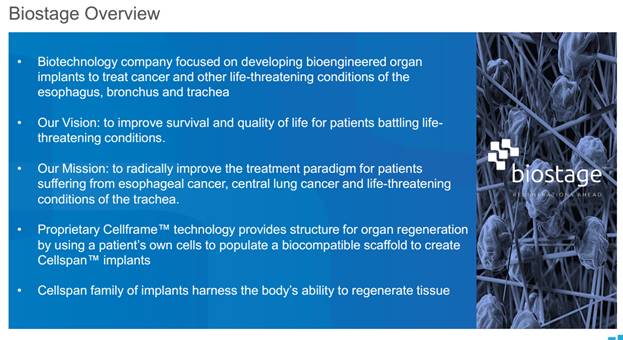

Biostage is a pioneering biotechnology company in the emerging field of regenerative medicine.

Regenerative medicine is defined as "process of replacing, engineering or regenerating human cells, tissues or organs to restore or establish normal function”.

The goal that Biostage is trying to achieve is to regenerate and restore organ function of the esophagus, trachea or bronchus damaged by cancer, trauma, infection or congenital diseases.

Biostage’s Cellframe technology is engineered to stimulate the body’s signaling pathways and natural healing process to regenerate and restore organ function. The Cellframe technology combines a synthetic scaffold with tissue engineering and cell biology to create a revolutionary method of addressing organ damage.

In English….it means that the company is working on a way to help the body regenerate an esophagus, trachea or bronchus that has been damaged by cancer or other cause.

The Specific Cancers It Can Help With

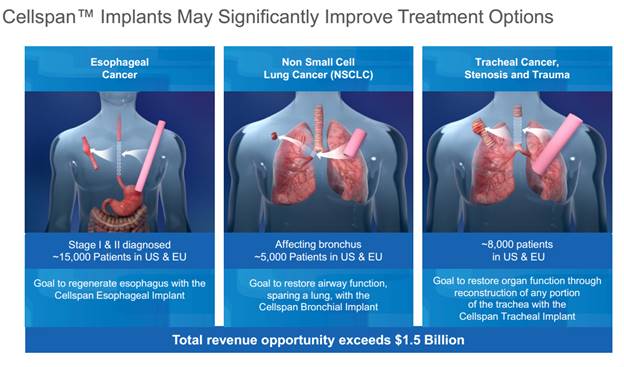

Esophageal, bronchial and tracheal cancers and trachea trauma have a devastating impact on patients. Current treatment options (when available) carry an unacceptable mortality rate and can drastically reduce the quality of life.

Biostage through Cellframe is developing radically new ways to treat these life-threatening conditions. Clinical trials are being designed with the potential to demonstrate improved mortality rates, reduced complications, and enhanced patient quality of life.

Esophageal Cancer: A Deadly Disease

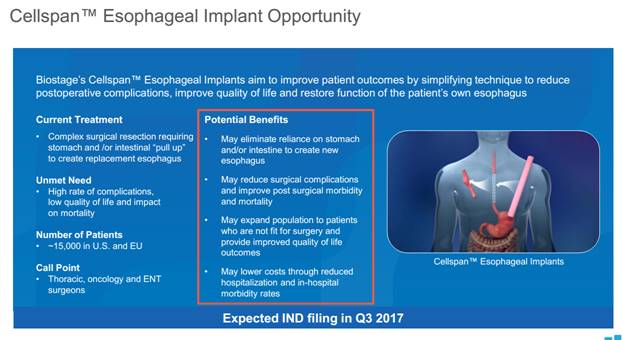

Esophagectomy is the current standard of care for resectable esophageal cancer. It is a complex surgery that involves the use of an intestinal segment that is resected with its arteries and veins and then repositioned in the chest to become a replacement esophagus.

It carries a mortality rate at 90 days that can be as high as 19 percent. The post-operative complications which include respiratory failure, pneumonia, leakage of gastrointestinal fluid in the chest can all be life threatening.

Biostage’s Esophageal implant seeks to improve upon this by eliminating the need to use the stomach or intestine to create a new esophagus.

This could reduce surgical complications as well as expand the ability to treat patients who wouldn’t have been fit for the current surgery.

Central Lung Cancer: Isolated in the Bronchus

In lung cancer, although none of the four main cell types is exclusively central or peripheral in location, the majority of small-cell lung cancers and squamous cell carcinomas are centrally located in the bronchi. When the cancer affects the main bronchi or the tracheal bifurcation (carina), a pneumonectomy, the removal of an entire lung, may be necessary which reduces respiratory capacity by 50% and has a complication rate up to 50% and a post-surgical mortality rate of 8% to 15%. Biostage’s Cellspan bronchial implants are intended to preserve the lung enabling safe reattachment of the main airway.

Tracheal Cancer and Trauma: Limited Treatment Options

In tracheal cancer and trauma, when there is extensive damage to the trachea, currently there is no standard technique that allows to preserve tracheal length and function following resection, leading to high rates of complications and mortality. Biostage’s tracheal implants are intended to reduce complications and cost.

Stage Of Development And Finances

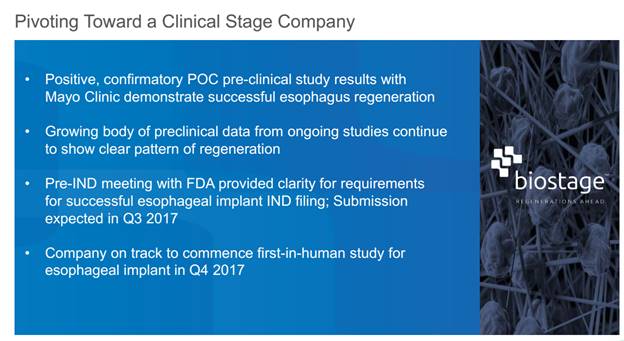

Biostage announced favorable preliminary preclinical results of large-animal studies for the esophagus, trachea and bronchus in November 2015. Based on our preclinical testing to date, the Cellspan esophageal implant product will be the company’s lead development product.

On May 12, 2016, Biostage reported an update of recent results from pre-clinical large-animal studies. The company disclosed that the study has demonstrated in a predictive large-animal model the ability of Biostage Cellspan organ implants to successfully stimulate the regeneration of sections of esophagus that had been surgically removed for the study.

Cellspan esophageal implants, consisting of a proprietary biocompatible synthetic scaffold seeded with the recipient animal’s own stem cells, were surgically implanted in place of the esophagus section that had been removed.

Study animals were returned to a solid diet two weeks after implantation surgery. The scaffolds, which are intended to be in place only temporarily, were later retrieved via the animal’s mouth in a non-surgical endoscopic procedure. After 2.5 months, a complete epithelium and other specialized esophagus tissue layers were fully regenerated. Animals in the study demonstrated weight gain and appear healthy and free of any significant side effects, including a few that were more than 90 days post implantation, and are receiving no specialized care.

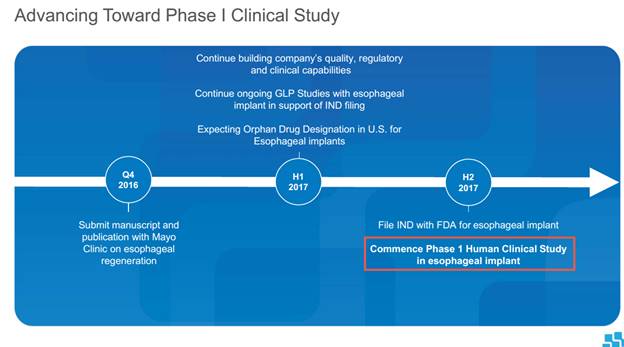

The company believes that its recent studies provide sufficient data to initiate Good Laboratory Practice (GLP) studies to demonstrate that its technology, personnel, systems and practices are sufficient for advancing into clinical trials. GLP studies are required to advance to an Investigational New Drug (IND) application with the U.S. FDA, which would seek approval to initiate clinical trials for Biostage Cellspan esophageal implants in humans. Biostage’s goal is to complete an IND filing by year-end 2016.

That would be followed by a human clinical study with an esophageal implant by the last quarter of 2017.

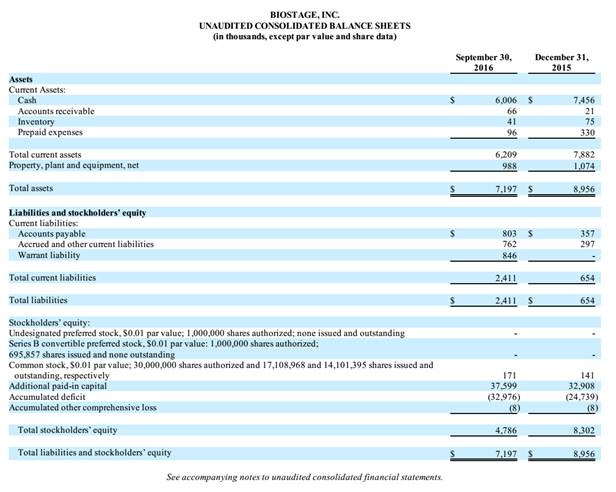

Biostage obviously is not a cash generating business at this point. Quarterly cash burn is about $2 million and the company has $6 million of cash on its balance sheet. That would have it coming to market somewhere in the first half of 2017 looking for some additional cash.

Source: Biostage 10Q

At this point Biostage would be beyond my ability to make an predictions about what kind of future cash flows the company might someday generate. That will keep it out of my portfolio. I do find the recurring insider buying interesting though, clearly the people who know this company the best believe that the progress being made will drive the share price higher in the future. For that reason I will keep Biostage on my watchlist.

Disclosure: I don’t own any shares of companies mentioned in this article

Totally agreed with what you wrote. It hasn’t been long since I started to consider insider buying in my stock analysis. Like you wrote, insider buying can be a strong indicator of where the company is heading. The organization insiders wouldn’t buy the stocks for nothing. They know that something is cooking inside the house.

Most of the time insider buying is done because they know that they are getting the stocks at fair value and their value will be maximized in the future. For us, as a public investor, it's really useful information about the company. There might be plenty of reasons behind insider selling but one and only motive of insider buying is to- make money. And our motive too, is to make money.

So, following the moves of corporate insiders can be rewarding. It’s always worth it to dig the stats of insider buying of any publicly traded companies.

I couldn't agree more.