Expanding The Dividend Aristocrats Ecosystem With ESG Screening And FMC Weighting

Image Source: Pixabay

Amid rising interest rates and the uncertain macroeconomic environment last year, dividend-focused strategies received substantial inflows throughout 2022. On top of these recent macroeconomic trends is also the longer-term, structural development of increasing investor demand for investments that align with their personal and societal values. Against this backdrop, S&P Dow Jones Indices (S&P DJI) recently launched the S&P ESG High Yield Dividend Aristocrats® FMC Weighted Index, S&P/TSX Canadian ESG Dividend Aristocrats FMC Weighted Index, and S&P International Developed Ex-North America & Korea ESG Dividend Aristocrats FMC Weighted Index.

Dividend Aristocrats Methodology + ESG and FMC Weighting

The three indices start by incorporating the Dividend Aristocrats methodology of selecting companies that have increased or kept stable their dividends over the long term. This methodology can provide a ballast for investors in times of uncertainty, since the ability to consistently grow dividends over a long period of time can be an indication of financial strength, discipline, and durable earning power.

Next, the indices exclude companies in the lowest quartile of S&P DJI ESG Scores. Additional ESG exclusion reviews are conducted quarterly based on business activities, as well as United Nations Global Compact (UNGC) breaches. These ESG screens serve to enhance the already stringent qualifications of the Dividend Aristocrats methodology. Lastly, the remaining constituents are float market capitalization (FMC) weighted. The FMC weighting approach enhances the overall liquidity of the index as well as reduces turnover and transaction costs for investors.

Over the long term, Exhibit 1 shows that the three FMC weighted ESG Dividend Aristocrat indices generated materially higher risk-adjusted returns versus their respective benchmarks. The full period risk-adjusted returns for the U.S., Canadian, and International Developed versions were improved by 9.1% (0.98 vs. 0.90), 16.8% (0.67 vs. 0.58), and 27.8% (0.44 vs. 0.34), respectively. In addition, all three indices exhibited both lower volatility as well as lower max drawdowns over the full period.

Looking at Exhibit 2, the three ESG Dividend Aristocrats FMC weighted indices hold significant yield advantages over their benchmarks. Over the full period examined, the average dividend yields for the US, Canadian, and International Developed FMC-weighted ESG Dividend Aristocrat versions were 2.60%, 3.58%, and 3.10%, respectively, compared with 1.76%, 2.98%, and 2.91% for their respective benchmarks.

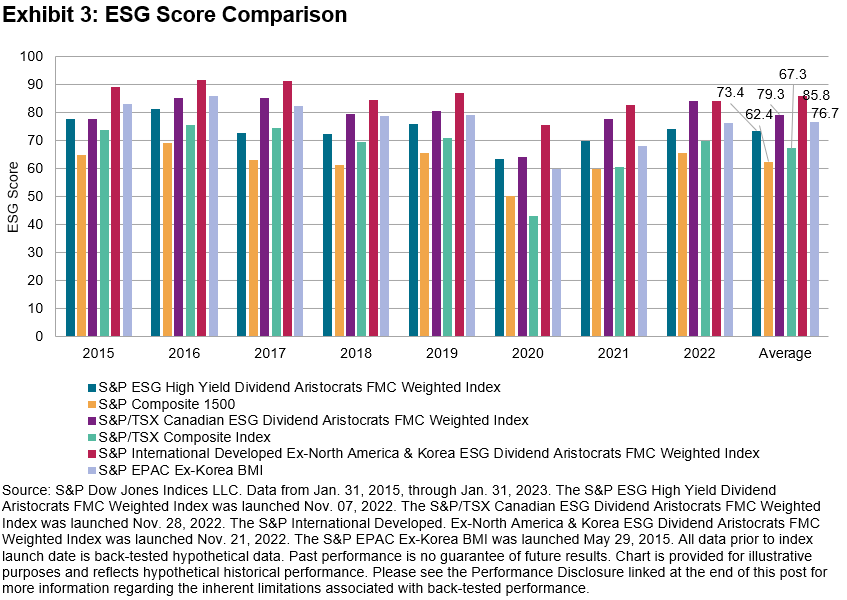

Exhibit 3 shows the notable S&P DJI ESG Score improvement for the three FMC-weighted ESG Dividend Aristocrats indices versus their respective benchmarks. As expected, all three versions demonstrated material ESG improvement over the full-time period examined. For the US version, the ESG score was improved by over 17% (73.4 versus 62.4), the Canadian version improved by almost 18% (79.3 versus 67.3), and the international developed version showed an over 11% improvement (85.8 versus 76.7).

The three recently launched FMC weighted Dividend Aristocrats ESG indices may be worth considering for investors seeking long-term historical risk-adjusted outperformance, enhanced dividend yields, and companies that have shared values. For those seeking exposure to these qualities, the FMC-weighting approach provides an additional potential benefit of increasing liquidity and lower transaction costs.

More By This Author:

International Women’s Day Embraces EquityS&P U.S. Indices Year-End 2022: Analyzing Relative Returns To Russell

Commodities Could Not Escape The Sea Of Red Seen Across Asset Classes In February

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.