ExlServices - Chart Of The Day

Summary

- 100% technical buy signals.

- 16 new highs and up 12.24% in the last month.

- 80.04% gain in the last year.

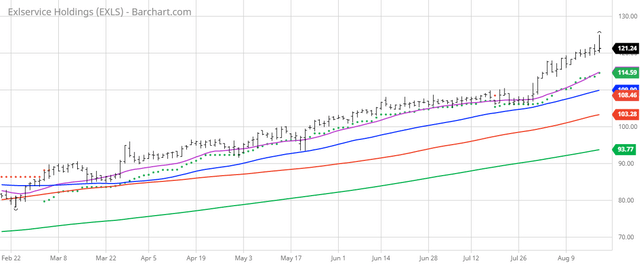

The Barchart Chart of the Day belongs to the business services outsourcing company ExlServices (Nasdaq: EXLS). I found the company by sorting Barchart's All-Time High list first by the highest number of new highs in the last month, then used the Flipchart function to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 7/20 the stock gained 11.60%.

ExlService Holdings, Inc. provides operations management and analytics services in the United States, the United Kingdom, and internationally. The company offers business process management (BPM) services to the insurance industry in the areas of claims processing, subrogation, premium and benefit administration, agency management, account reconciliation, policy research, underwriting support, new business processing, policy servicing, premium audit, surveys, billing and collection, commercial and residential survey, and customer services. It also provides BPM services related to the care management, utilization management, disease management, payment integrity, revenue optimization, and customer engagement for the healthcare industry; BPM services related to business processes in corporate and leisure travel, such as reservations, customer service, fulfillment, and finance and accounting; and finance and accounting BPM services, including financial planning and analysis, strategic finance, decision support, regulatory reporting, and compliance services. In addition, the company offers BPM services for banking and financial services industry comprising residential mortgage lending, retail banking and credit cards, commercial banking, and investment management; BPM services related to enhancing operating models, enhancing customer experience, reducing costs, shortening turnaround time, and simplifying compliance for clients; and industry-specific digital transformational services. Further, it provides predictive and prescriptive analytics in the areas of customer acquisition and lifecycle management, risk underwriting and pricing, operational effectiveness, credit and operational risk monitoring and governance, payment integrity and care management, and data management. The company was founded in 1999 and is headquartered in New York, New York.

Barchart technical indicators:

- 100% technical buy signals

- 89.35+ Weighted Alpha

- 80.04% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 12.24% in the last month

- Relative Strength Index 70.97%

- Technical support level at 119.16

- Recently traded at 121.07 with a 50 day moving average of 109.90.

Fundamental factors:

- Market Cap $ 4 billion

- P/E 32.37

- Revenue expected to grow 14.20% this year and another 10.00% next year

- Earnings estimated to increase 25.50% this year, an additional 5.60% next year and continue to compound at an annual rate of 13.00% for the next 5 years

- Wall Street analysts issued 5 strong buy, 3 buy, 4 hold and 1 underperform recommendation on the stock

- The individual investors following the stock on Motley Fool voted 72 to 7 that the stock will bat the market with the more experienced investors voting 12 to 2 for the same result

- 1,690 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or ...

more