Evergreen Private Equity Funds Attracting Assets

Image Source: Pexels

Evergreen funds are a relatively new concept in the private equity (PE) world compared to traditional closed-end funds. They were introduced to address the negatives of the traditional way to invest in private equity which had been in the form of partnerships.

- Investors in the partnerships were limited partners who received Schedule K-1’s at the end of the year. K-1s typically arrive well after the April 15th filing date, requiring extensions. The preparation of the K-1s and the need to file extensions increased the costs of investing in these vehicles.

- Investors in the partnerships have to make commitments with capital calls coming at unknown dates. The uncertainty of the timing of the calls causes investors to have to hold their remaining commitments in the form of high quality, short-term investments.

- High expense ratio. Management fees were typically 2% plus a carry (performance) fee of 20% once returns exceeded a hurdle rate (such as 7% with catchups for years when performance was below the hurdle). And the expense ratio is charged on the committed amount, not the called amount. Thus, it drags down returns, especially in the early years (the so-called J-curve effect).

- High minimums (such as $1 million or more).

- Long-term commitment.

Evergreen funds have attracted more than $35 billion by addressing these negatives.

- They typically provide 1099s (instead of K-1s), which are delivered on time for the April 15 filing date.

- There are no capital calls, eliminating the J-curve effect.

- Minimums, such as $25,000-50,000, tend to be much lower, democratizing PE.

- Lower expense ratios.

- Periodic liquidity availability.

The two most common structures in this category are tender offer funds and interval funds.

- Interval funds: These funds have predetermined intervals (usually quarterly, semi-annually, or annually) when investors can redeem their shares.

- Tender offer funds: These funds allow investors to tender (offer to sell) their shares for redemption at certain points during the year. Unlike interval funds, the timing and amount of share repurchases are at the fund manager’s discretion.

Unlike mutual funds and ETFs, which have simple expense ratios, the expense ratios of evergreen funds are more complex and cover several components. Thus, it is important for investors to have a complete understanding of the charges.

- Management fees. Fees charged by the fund manager to cover the costs associated with managing the fund’s investment activities and operations. Some funds charge on net assets. Others charge on gross assets (includes assets acquired through the use of leverage), which not only increases fees charge, but can also lead to misaligned interests by creating an incentive to take excess risks.

- Acquired fund fees & expenses (AFFE). The management fees and expenses incurred by any underlying funds in which the evergreen fund invests. While investors should not ignore AFFE, neither should they be a disqualifier because funds that invest in secondaries (typically bought at significant discounts) will naturally incur higher AFFE relative to funds that invest only in co-investments which can be made on a no-fee and no-carry basis. It is also important to note that private equity is the one asset class where there is evidence of persistence in performance. In addition, the dispersion between top-quartile and bottom-quartile managers in private equity is meaningfully wider than that of private debt and public equities. Thus, investors should be somewhat less fee sensitive in the pursuit of alpha.

- Interest on borrowed funds. The interest expenses incurred from borrowing activities used for liquidity/liability management or, to a lesser extent, for return enhancement purposes. The cost associated with borrowing depends largely on the amount of leverage used, the types of assets in the fund, and the prevailing interest rate environment. While leverage can enhance returns by amplifying gains, it cuts both ways and can amplify losses as well.

- Incentive fees (carried interest). These fees are typically structured as a share of the profits earned by the fund (e.g., 20% of the profits above a specified hurdle rate).

- Other expenses. This category includes various administrative, custodial, and operational costs such as accounting, legal, compliance services, and transfer agent costs.

- Expense waivers. Can temporarily reduce or eliminate fees, providing short-term relief from high expenses, making the fund more attractive to investors. While beneficial in the short term, waivers are typically temporary and may not reflect the long-term cost structure of the fund.

Analysis of Evergreen PE Fund Fees & Expenses

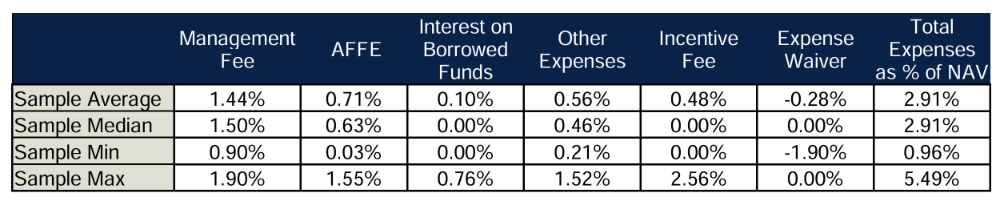

Using data found in publicly available SEC filings, Cliffwater identified 19 PE-focused tender offer funds and interval funds that were operational at the end of 2023, subject to AUM minimums, and analyzed their expenses. They used the lowest-cost institutional share class for each fund. The following chart illustrates each expense component’s contribution to the overall cost. Note the wide dispersions—the least and most expensive funds have total expenses of 0.96% and 5.49%, respectively.

Evergreen PE Fund Fees and Expenses

A surprising finding was that there was no relationship between fund size and the level of “other expenses” for evergreen PE funds—larger funds should correlate with lower operational/administrative costs as they benefit from economies of scale. They also found that about half the funds charged on a gross asset basis.

Investor Takeaways

While the expenses for the evergreen funds are high relative to those of traditional asset classes like public stocks and bonds, compared to the typical “2 and 20” structure that most traditional PE funds charge, the all-in fees for evergreen funds are in most cases meaningfully lower.

Because the empirical research has found that private equity is one asset class where there has been evidence of persistence in performance among both the top and bottom performers, and that there is a wide dispersion of returns between top and bottom performers, while expenses are important, they should not be the only consideration. The most common interpretations of this persistence in performance are either skill in distinguishing better investments or the ability to add value post-investment (e.g., providing strategic advice to their portfolio companies or helping recruit talented executives). The research, however, offers another plausible explanation—based on their reputational value, successful firms can charge a premium for their capital.

Reputation and the Cost of Venture Capital (VC)

The empirical research (for example in these articles about venture capital costs, initial success, and persistence) has found that successful VC firms obtain preferential access to investments and better terms, as both entrepreneurs and other VC firms want to partner with them. That enables them to see more deals, particularly in later stages, when it becomes easier to predict which companies might have successful outcomes. It is the access advantage that perpetuates differences in initial success over extended periods of time. That access has enabled high-reputation VCs to acquire startup equity at about a 10%-14% discount, leading to a perpetuation of the advantage. However, these edges applied only to venture capital, not to leveraged buyouts. The bottom line is that investors should be willing to pay somewhat higher expenses for superior persistent past performance.

Investors should also consider multi-manager funds (such as Cliffwater’s CPEFX with an expense ratio of just 0.96%—the lowest—on net assets) that provide broad diversification across leading PE managers, as well as typically allocating heavily to direct co-investments in their portfolios, which minimizes costs, as well as secondaries (which are typically bought at significant discounts of 8-12% in even good times and much higher discounts during times of volatility).

More By This Author:

Data-Driven Approach To Clustering Similar Macroeconomic RegimesAdding Leveraged, Long-Short Factor Strategies To Improve Tax Alpha

Explaining The Performance Of Low-priced Stocks: The Penny Stock Anomaly