Evaluating The Investment Potential Of Gold Mining In Today’s Market

Image Source: DepositPhotos

Most people would agree that in the investment world, timing is everything. As we navigate through the first quarter of 2024, investors are increasingly turning their attention to gold mining companies.

Is it the right time to invest?

The allure of gold has been undeniable throughout history. Its reputation as a safe haven asset in times of economic turbulence has made it a popular choice among investors. Today, as we navigate through unprecedented economic conditions, gold's appeal seems to be on the rise. It is not just retail participation but central banks across the globe have been on a buying spree lately.

Gold mining companies, the entities responsible for mining and extracting this precious metal from the earth, are at the forefront of this surge in interest. These companies offer a unique proposition: not only do they benefit from rising gold prices, but operational improvements through technology and exploration successes can provide additional upside potential.

Legendary investor Stanley Druckenmiller acquired stakes in Barrick and Newmont as Big Tech might be reaching its peak. His move indicates a potential shift in market sentiment, raising eyebrows as gold prices hover near $2,000 amidst economic uncertainty.

However, investing in gold mining companies is not without its risks. The process of extracting gold is complex, costly, and fraught with challenges. From operational issues to environmental concerns, these risks can impact a mining company's profitability and, in turn, the return on investment.

Current Demand and Supply

In Q3 2023, the demand for gold, excluding over-the-counter transactions, was 8% higher than the five-year average, reaching 1,147 tons. The gold price dropped by 6% compared to the same quarter in 2022. Including over-the-counter transactions and stock movements, the total demand saw a year-over-year increase of 6%, amounting to 1,267 tons.

A record high production was also observed in gold mines, with an output of 971 tons for the quarter, contributing to the total gold supply of 1,267 tons. Furthermore, the volume of recycled gold saw an 8% increase to 289 tons.

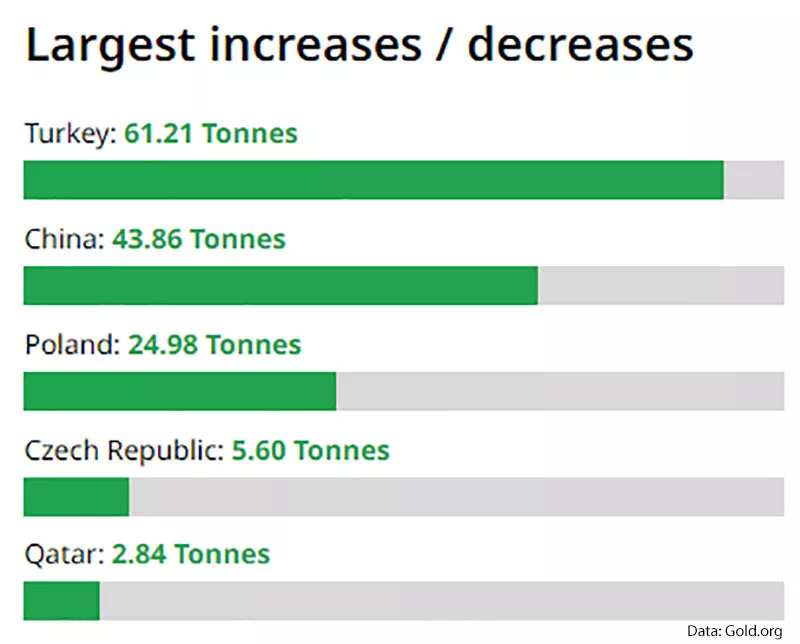

Examining demand by sector, central banks added 337 tons to their reserves, constituting the third-highest quarterly acquisition. However, this was below the peak of 459 tons observed in the third quarter of 2022. The year-to-date figures for central bank purchases were 14% higher than previous year and reached an unprecedented 800 tons on October 31, 2023. In the last quarter of 2023 countries like Turkey, China, Poland, Czech Republic and Qatar were net buyers of gold.

So, is it the right time to invest in gold mining companies? The answer largely depends on your investment goals and risk tolerance. If you're looking for a hedge against economic uncertainty and believe in the long-term value of gold, investing in gold mining companies could be a strategic move. Because even though the Miners have not performed very well in past decade the opportunity to buy it at this rate might be getting slimmer day by day. According to this report, The gold mining industry should grow to $249.6 billion by 2026, at a compound annual growth rate (CAGR) of 3.1% from 2021 to 2026. Moreover, gold miners are currently undervalued relative to gold, and it could reverse and overshoot during gold bull market.

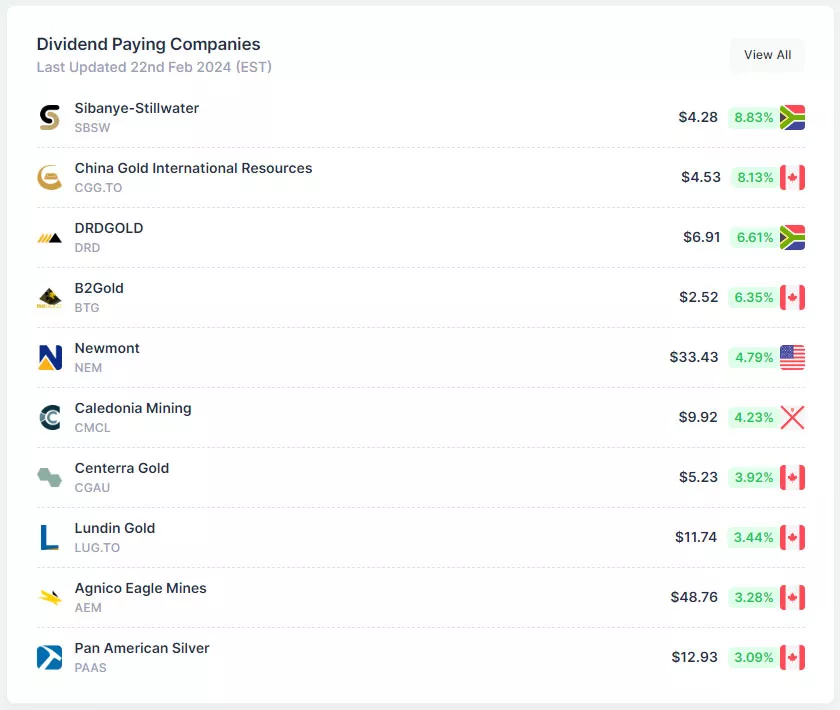

We've also noticed a strong pattern of rising dividends among gold miners. Smaller large caps and larger mid-caps are predicted to outperform mega-caps in this sector.

Going Forward

While the timing of investment in gold mining companies may depend on various factors, the current economic climate has certainly put the spotlight on this sector. Investing in it is a complex decision that depends on a variety of factors. These factors can include the overall health of the economy, the price of gold, the stability of the mining industry, and the performance of each individual mining company in itself.

The current economic climate can have a significant impact on the gold mining sector. For instance, during times of economic uncertainty or instability, investors often turn to gold as a “safe haven” investment. This can increase the demand for gold, which in turn can benefit gold mining companies.

However, investing in gold mining companies is not without risks. Therefore, potential investors should carefully consider these factors and conduct thorough research before making an investment decision.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investing in gold mining companies involves risks, including the loss of your ...

more