EV Week In Review: Tesla Prevails Despite Hertz Deal Haziness, Nio Investors Take Setback In Stride, & More

Most EV stocks advanced in the week ending Nov. 5 amid sector-wide optimism. EV market leader Tesla, Inc. (TSLA) started the week on a tentative note, but picked up momentum over the course of the week. Here are the key events that happened in the EV space during the week.

Tesla's Hertz Deal Tentativeness, Vehicle Recall, and More

After riding on the back of the Hertz Global Holdings, Inc. (HTZZ) deal optimism, Tesla shares came down from stratospheric levels this week. It was Tesla CEO Elon Musk who brought the stock down with his comments early in the week by suggesting the collaboration with Hertz is not a finalized a deal yet.

Later, a Wall Street Journal report said the two parties are engaged in talks regarding the timing of the delivery of bulk orders. In other Tesla-related news, Cathie Wood's Ark Invest continued to trim its stake, offloading about $148 million in Tesla shares during the week.

Tesla also suffered negative press after it had to recall 11,700 vehicles due to a software communication error that may potentially lead to rear-end collisions.

As Tesla shares went through the roof this week, talks about a potential stock split began doing the rounds. Loup Funds co-founder Gene Munster said in an exclusive comment to Benzinga that a stock split could be forthcoming next year.

Nio Confirms October Deliveries Disappointment

Nio, Inc. (NIO), which warned last weekend of the potential impact of a manufacturing line upgrade, reported a 27.5% year-over-year decline and a 65.5% month-over-month plunge in vehicle sales for October.

Surprisingly, the stock advanced on the day of the release of October deliveries, as Nio executives talked up the stock. Abounding order flow signaled by the company also helped mitigate negativity. Meanwhile, Nio's peers XPeng, Inc. (XPEV) and Li Auto, Inc. (LI) reported fairly robust deliveries for the month.

Lucid Moves Swiftly

Lucid Group, Inc. (LCID), which handed over deliveries of its first Lucid Air Dream Edition cars to its customers last weekend, announced its newest retail location – the Lucid Studio at Tysons Corner Center in the Washington, DC, Metro Area. The new Studio will open its doors to the public on Saturday.

Fisker Appeases Street With Reiterated Guidance for Production Start Time:

Pre-revenue EV maker Fisker, Inc. (FSR) reported a third-quarter loss that was wider than expected. The stock, however, reacted positively as the company confirmed the Nov. 2022 production start time of its Ocean SUV.

The company also announced a partnership with Tesla battery supplier CATL to procure lithium iron phosphate batteries.

Ford Says F-150 Lightning Reservations Swell

Ford Motor Company (F) said in its monthly deliveries release that reservations for its F-150 Lightning pickup truck have crossed 160,000. Despite reporting a 4% drop in October sales, Ford's EV transition appears to be on track. The company said the E-Transit van has been sold out and the Mustang Mach-E was the second most sold electric SUV, with sales jumping 76.9% in October.

Volkswagen Finds Competition Seething in EV World

German automaker Volkswagen AG's (VWAGY) CEO Herbert Diess told employees to prepare for the "revolution" needed to take on electric car pioneer Tesla and Chinese manufacturers. "In the new automotive world, we are faced with competition the likes of which Volkswagen has never seen before," Diess reportedly said in a speech at the carmaker's flagship plant in Wolfsburg.

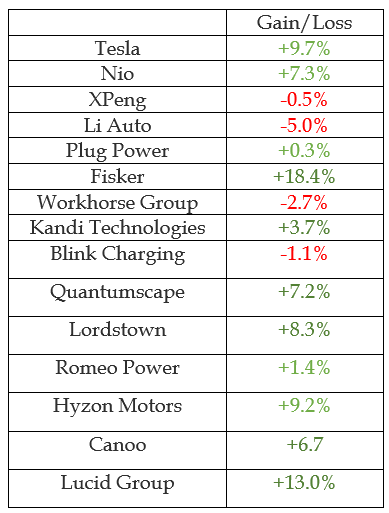

EV Stock Performances for The Week

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The EV revolution is indeed upon us, and a whole lot of them promise to be on the road in the short future. My question is how will they all be recharged? Their range does not exceed petroleum fueld vehicles, and yet the number of recharge stations is vastly smaller. No matter where they are recharged, the quantity of Kilowatt-Hours must arrive via the present electrical power grid, and that grid was not built with the larger demand in mind. So there will be some :interesting developments" in the EV future.

Electric powered vehicles do make sense, at least for a lot of people.

But the computer driven car is a fools chase and worse yet, it will provide no benefit at all for the money, for that vast majority of the population that never has any accidents. AND, In addition, that concept of weekly software updates is so totally invalid that it is certainly a show stopping problem. The microsoft syndrom is totally wrong for vehicle safety systems, which should be obvious to everybody.