Equity Market Chart Book - Wednesday, Aug. 31

Coincident economic indicators continue to confirm that the US economy is not (yet) in recession, but leading economic indicators increasingly suggest recession risk ahead. Additionally, Powell implied the Fed would likely end up inducing a recession as a necessary evil in its war on inflation. He wants to err on the side of doing too much rather than too little. In his Jackson Hole speech, Powell cited lessons of the 1970s and it seems he’s concerned about being remembered as another Arthur Burns (former Fed Chair), who was widely blamed for allowing the inflation of the 70s. The market declined sharply on Powell’s hawkish stance. However, from a medium/longer-term perspective, the market is probably happy to trade a mild recession for low inflation (if indeed those outcomes materialize). Between the two, (low) growth and (high) inflation, I think inflation is the bigger concern for markets.

There is a wide range of plausible paths that the market can take from here. But in my view, risks remained skewed to the downside. The 1946-49 analog likely continues to be relevant and might suggest a sideways market with periods of downside volatility. To review the history of S&P bear markets, the mean bear market duration is 17 months (with a massive range: of 1-42 months), the median is 13 months, and the central tendency is 8-21 months. The mean decline is 39% (also with an extensive range), the median is 34%, and the central tendency is 27-49%. As mentioned earlier this month, markets tend to be down in the first half of a recession and up in the second half. Also, bear market declines tend to be back-end loaded, with the largest declines coming in the last third (of time duration) 11 out of 16 times, with the average decline in the last third double that of the 1st or 2nd third. Obviously, we don’t know the duration ex-ante. But we can note that the depth and duration of the drawdown through mid-June are shorter and shallower than the historical central tendencies. Additionally, the market typically bottoms in a recession rather than before a recession.

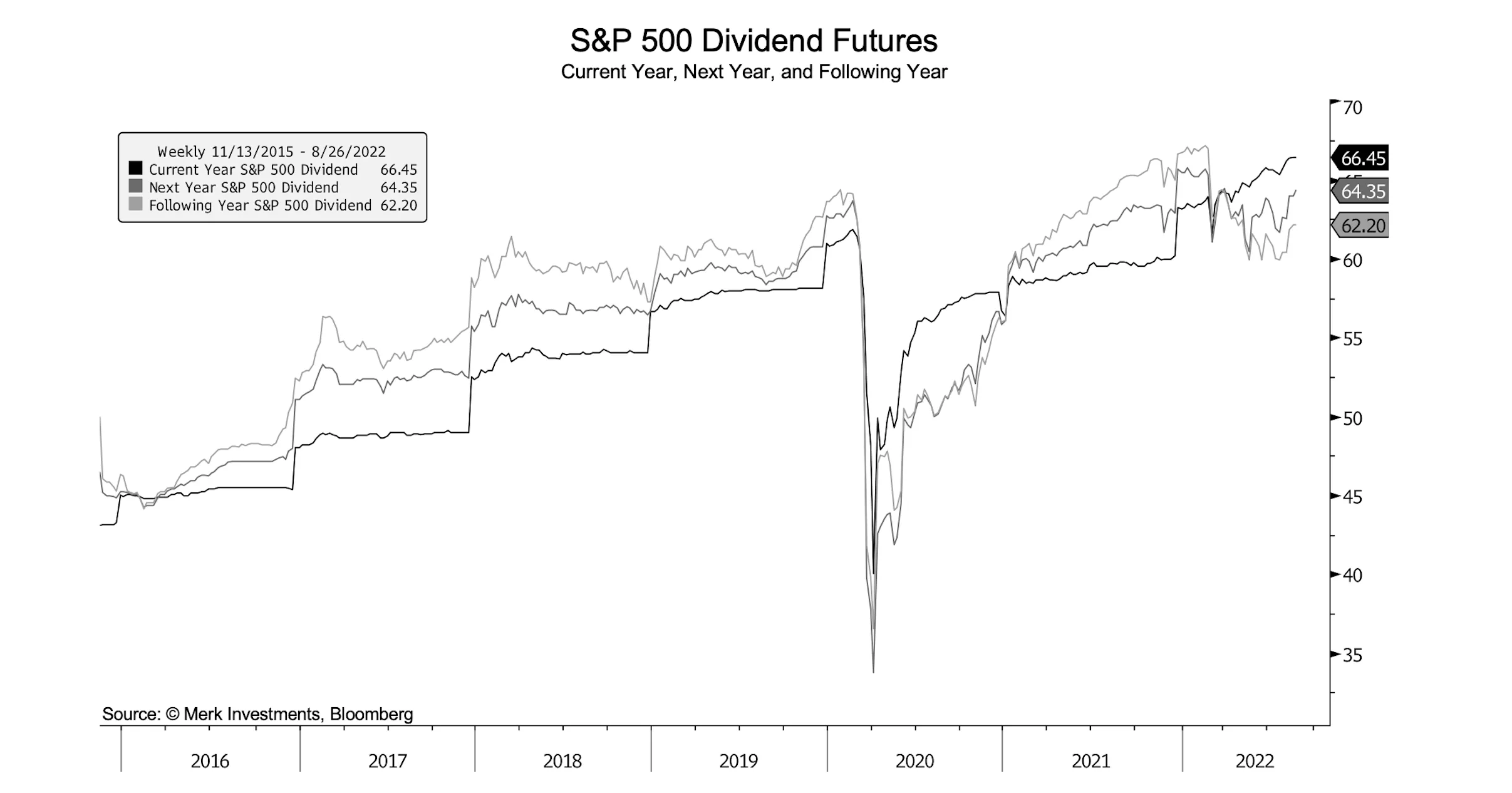

An upside scenario would be either a soft landing (looking less likely) or a market that trades higher through a recession (e.g., like in 1927 and 1945), which might happen if the market has already fully discounted a recession. In my view, the market has likely only partially discounted a recession, and of course, the depth and duration of any coming recession will matter too. S&P 500 dividend futures are pricing in dividend cuts for 2023 and 2024, at the very least implying that the market is already pricing in a high probability of recession. Dividends are typically only cut in a bona fide recession (not in a mere earnings recession). If and when a recession does materialize, we would likely still see downside volatility in the equity market, but the trough could be shallower than many expect (the recession is probably more priced in than most think). On that note, analyst estimates of forwarding 12-month earnings for the S&P don’t necessarily provide an accurate picture of what is actually priced into markets—as witnessed by the market reaction to Q2 earnings season, which was disappointing relative to analyst estimates and yet the market rallied. The market is almost certainly pricing in weaker earnings than the published projections, but that also means the market is trading at a higher multiple than the stated forward P/E would imply. Stubbornly high-interest rates, on both the short end (2yr) and long end (10yr), may pressure the multiple.

The adage "sell the rumor, buy the news” might be appropriate in the coming year with respect to a recession materializing. Once a recession is obvious in the coincident data (e.g., the unemployment rate spikes), that’s probably the time to consider getting more constructive on the broad market and on higher beta, more cyclical exposures. For now, defensive sectors like Consumer Staples and Utilities are likely to remain in market leadership on a relative basis in the ongoing growth slowdown and into a probable contraction. Closer in on the risk spectrum, short-dated inflation-protected bonds (TIPS)—currently providing positive real returns—would potentially be an attractive, more conservative allocation.

The US dollar is likely to remain strong if we are going into a US/global recession. The time to be bearish on the dollar, and bullish on international equity exposures, is likely in the early stages of a global recession and once Fed swap lines are activated. Global recessions typically create a short squeeze on the world reserve currency (given the amount of US dollar borrowing abroad). That stress is observable in “cross-currency basis” (the difference between interest rate differentials and forward currency points) and is typically alleviated by Fed swap lines (dollar lending from the Fed to foreign central banks).

The market tends to move in a way that creates the maximum amount of frustration for the greatest number of people. So, it’s important to think about what counterintuitive path the market might take in order to achieve that objective. From my perspective, the uncertainty level is high and the conviction level is low. The outlook remains highly data-dependent. As always, everyone needs to put probability and reward-to-risk assessments in the context of their strategy, process, and time horizon.

More By This Author:

Business Cycle Chart Book

Equity Market Chart Book - Wednesday, July 27

Equity Market Chart Book - Wednesday, June 29