EPD: A Sterling Dividend Stock For The Long Term

Image Source: Unsplash

I’ve held two stocks in my investment newsletter through thick and thin, over a decade or more. One is Enterprise Products Partners LP (EPD), and this is why...

Both stocks are conservative investments with a great long-term record. Both pay regular dividends. And both have adopted a rising dividend policy since their inception.

I chose both stocks after reading the book The Single Best Investment by money manager Lowell Miller. He summarized his #1 investment strategy with this formula: Quality Stocks + High Dividends + Reinvestment of Dividends = High Total Return.

Using Miller’s simple formula, I recommended EPD as a high-dividend growth stock right after the financial crisis of 2008. EPD continued to pay a solid dividend during the crisis – and it’s still going strong after 16 years.

It’s now a member of the Dividend Aristocrat Club (having increased its dividend for 25 years or more). The total return (the rise in the price of the stock plus dividends) comes to 232%.

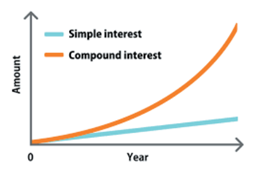

Not bad, considering all the ups and downs of the oil business and the stock market. But here’s the shocking truth: If you reinvested your dividends over those 16 years, your total return is ALMOST DOUBLE, or 461%!

To achieve these phenomenal returns, you need to do one simple thing when you buy good quality stock: Click on the button that says “reinvest all dividends.” It’s that simple.

As Warren Buffett once said: “My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

Recommended Action: Buy EPD.

More By This Author:

Argan: A Construction Play With Momentum, Technical Support On Its SideHow To Trade Oil Amid "Risk On And Off" Environment

PLTR: A Great Way To Play A Likely Market Rally

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more