Energy Transfer: Attractive 9.5% Yield, But Know The Big Risks

Energy Transfer (ET) offers a big 9.5% yield, and it trades at a very attractive EV-to-EBITDA relative to peers. However, if you’re going to invest, you may want to consider the big risks ET is currently facing (i.e. the price is low and the yield is high for a reason). This article provides an overview of Energy Transfer, reviews the big risks the organization faces, and concludes with our views on whether Energy Transfer is worth considering as an investment.

Overview:

Energy Transfer has one of the largest energy networks transporting natural gas, natural gas liquids, crude oil and refined products through more than 83,000 miles of pipelines spanning the country. The company recently completed a simplification transaction whereby Energy Transfer Equity (ETE) was merged with Energy Transfer Partners (ETP) to create a simplified entity known as Energy Transfer LP (ET). The transaction had multiple benefits, mainly it better aligned partner interests and it improved the financial strength (decreased risk, improved cost of capital) for the combined organization (for example, the transaction resulted in an improved credit rating from S&P—Energy Transfer is rated BBB-, the lower end of investment grade, with a stable outlook).

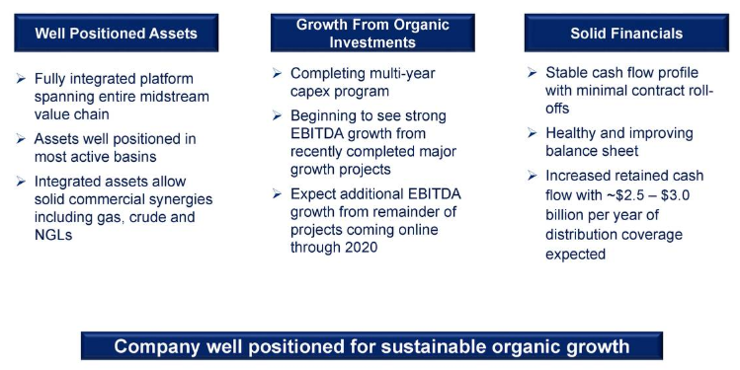

Energy Transfer is positioned for growth from well positioned assets, organic investments and stronger financials.

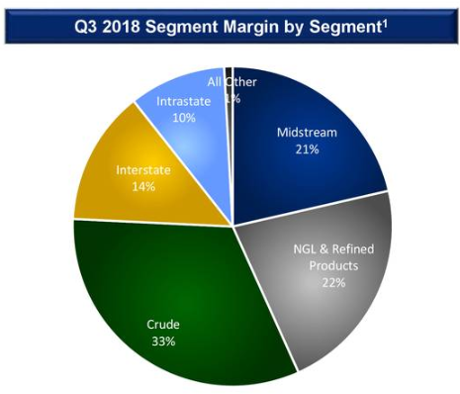

Also very important, Energy Transfer has a diversified earnings mix with primarily fee based business.

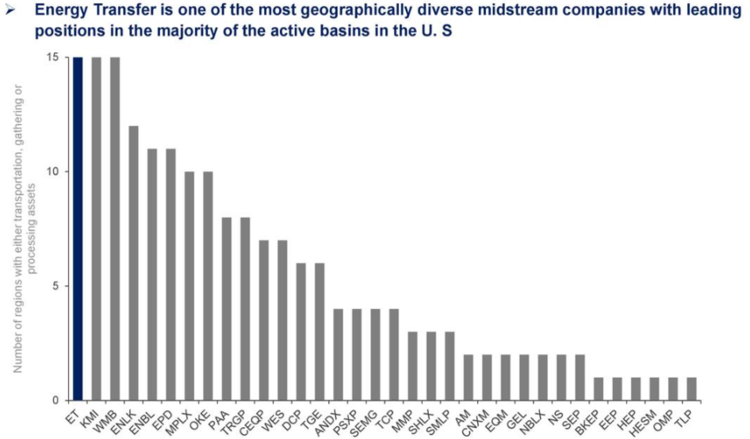

It is one of the most geographically diverse midstream companies with leading positions in the US.

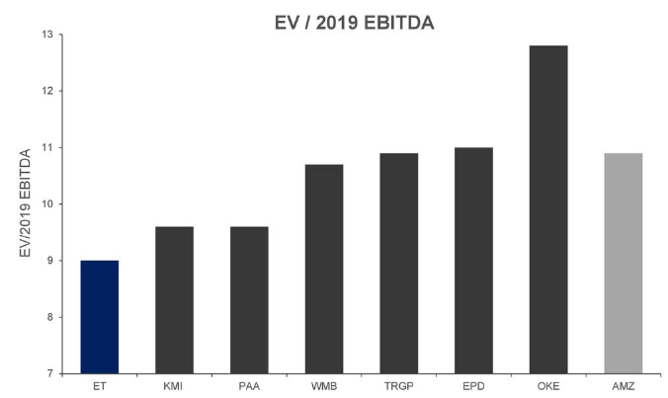

However, despite Energy Transfer’s improved leadership position, it still has one of the lowest industry valuations on an EV to EBITDA basis.

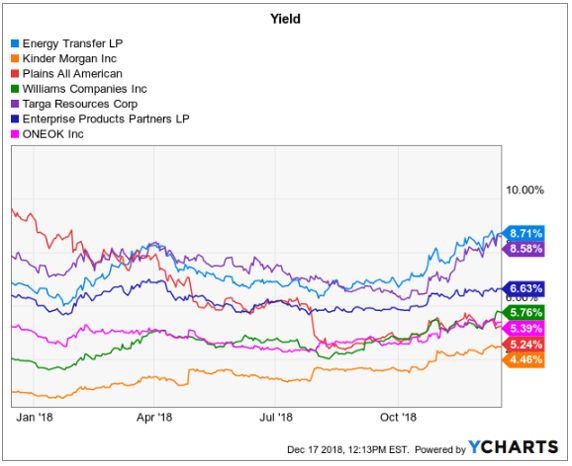

And Energy Transfer’s distribution yield is very high relative to most peers.

Why Is the Price Low?

Considering Energy Transfer’s yield is so high, its business has improved, and its valuation appears relatively low, why isn’t the market bidding up its price? Shouldn’t investors be willing to pay up for Energy Transfer, thereby driving its price significantly higher? We’ll have more to say about this in a minute, but let’s first consider why the price has gotten so low in the first place.

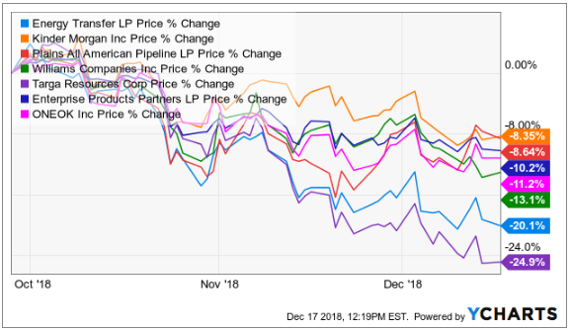

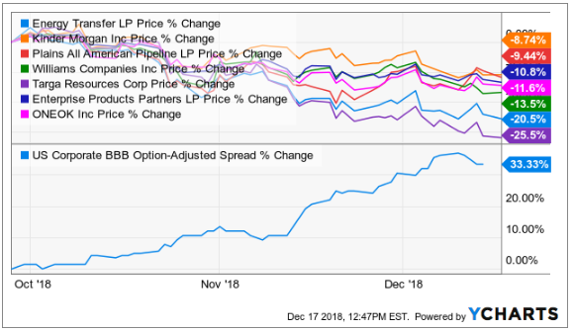

Credit spreads (Risk Off): If you’ve been paying attention, the market has sold off since the start of this quarter, with higher risk names leading the charge lower. Energy Transfer falls into the higher risk category for a variety of reasons including uncertainty about the newly combined entity, its relatively high level of debt, its low investment grade credit rating, oil prices, and the uncertainty about its capital expenditures on all of its new growth projects that are not yet online. We’ll have more to say about all of these risks later, but from many market participant’s standpoint, these all combine to make Energy Transfer higher risk, and higher risk securities sell of when credit spreads widen, as shown in the following chart.

Credit spread is the difference in yield between low risk bonds (such as treasuries) and higher risk bonds of similar maturity. And as this spread has widened during this quarter’s risk off market conditions, so too have higher risk securities (such as Energy Transfer) sold off. As we mentioned above (and will cover more later) Energy Transfer has a relatively large load of debt, and widening credit spreads have market participants indiscriminately concerned about companies with higher risk debt. Arguably, the market may have sold off too far, as overly fearful investors have been too quick to hit the sell button, and some babies are being thrown out with the bathwater, but we’ll have more to say about that later. Widening credit spreads are a big reason Energy Transfer’s sell off has been relatively steep this quarter.

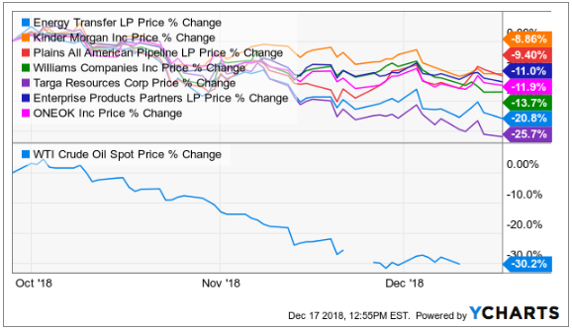

Oil Price Declines: Continuing with our theme of indiscriminate market selling, high-debt high-yield securities are almost inextricably linked with energy prices (e.g. oil, because so many high yield securities are in the energy sector), and as energy prices sell off, so do high-yield securities—whether or not they are dependent on oil prices, as shown in the following chart.

As we’ve mentioned previously, a significant portion of Energy Transfer’s business is based on fees not dependent on short-term oil prices. However, Energy Transfer and its peers trade with significant correlation to the significant moves in oil prices, and the recent decline in oil prices has pressured security prices lower. In the long-term, Energy Transfer’s fee based business could suffer if the companies paying the fees go bankrupt due to low energy prices, but in the short-term there is arguably too strong of a correlation between Energy Transfer and the price of oil. Energy Transfer may have sold off more than it should have as oil prices have declined.

Energy Transfer has sold off as market wide credit spreads have widened, as oil has declined, and as investors have continuing uncertainty about the recent simplification transactions. But let’s formalize the actual big risks that Energy Transfer faces.

The Big Risks:

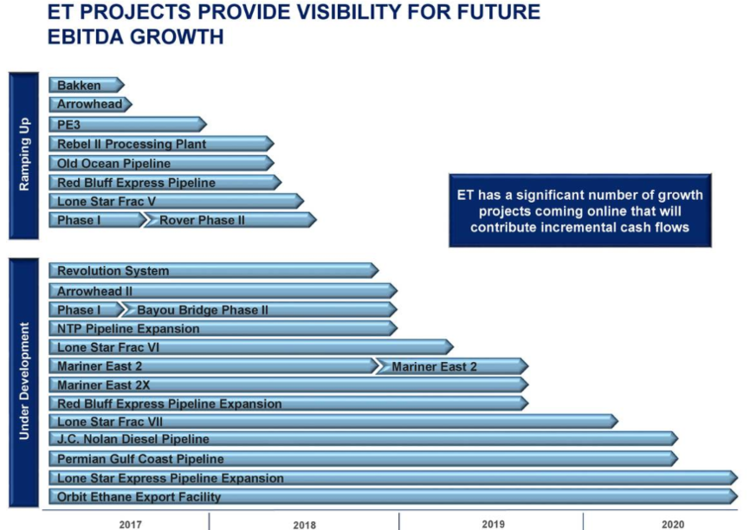

Growth Projects Uncertain: Energy Transfer has been spending heavily on growth projects that have not yet come online, and uncertainty about the timing and eventual completion of those projects has investors rightfully concerned. Here is a look at the extensive projects in Energy Transfer’s growth pipeline and when they might actually come online.

Energy Transfer is counting on these growth projects to generate significant future EBITDA to cover future distributions and to pay down significant amounts of debt. However there remains uncertainty as to the actual timing of when (and if) all of these capex intensive projects will actually start contributing to future EBITDA.

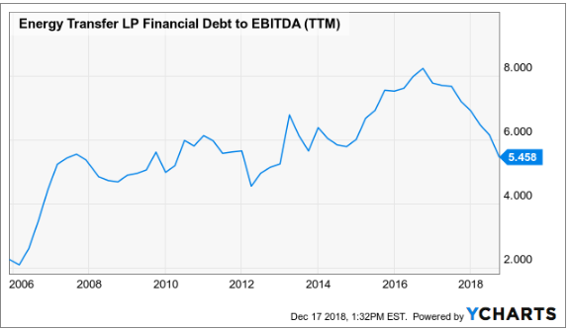

Energy Transfer has A Lot of Debt: Energy Transfer has a lot of debt relative to its EBITDA, and this one of the metrics that makes investors nervous. For perspective, during the last earnings call, Chief Commercial Officer & Director, Marshall McCrea said, with regard to the credit rating agencies:

“about the agencies of what they would like to see us do… they would like to see us get to a 4.5 debt to EBITDA and possibly we would be considered to move up or not. But also with that, we will maintain a 1.6 coverage ratio or greater. So we have a laser-focus year to get to that as soon as we can. And we think we are going to get there sooner than most people think.”

Here is a look at the current and historical debt to EBITDA ratio.

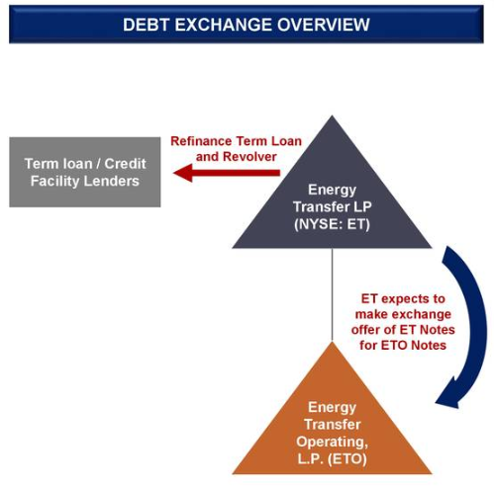

And for more perspective, here is a look at Energy Transfer’s financial policy, as described in a December 5th investor presentation.

Energy Transfer believes it has the flexibility and liquidity to make meaningful improvements to its debt profile, sooner than later. And contributing to those expected improvements will be the company’s upcoming debt exchange offer, which it believes is now increasingly feasible following the simplification transaction.

And as long as there are no major disruptions to Energy Transfer’s growth projects (which are expected to start contributing to EBITDA soon, as described previously), we believe Energy Transfer can support its debts and distributions going forward. Nonetheless, it’s the business uncertainty, widening credit spreads, and low energy prices that have contributed to Energy Transfer’s sharply reduced unit price.

Additional Considerations:

Before getting into our opinions about investing in Energy Transfer, there are a variety of additional variables that are worth considering, as described below.

Analysts Love Energy Transfer: For what it’s worth, the street loves the Energy Transfer. According to the following FactSet chart, of the 18 analysts covering the company, almost all of them have a buy recommendation. The average price target is $21.94, thereby giving the shares more than 50% upside.

Inside Ownership: Also, for what it is worth, industry insiders own large positions in Energy Transfer. For example, Kelcy Warren owns 9.2% of the shares outstanding, and he's increased his position this year.

K-1 at Tax Time: Be aware that if you invest in Energy Transfer, the company distributes K-1 packages, usually in March, and this can also have important consequences if you invest via your Individual Retirement Account. Here is what the company has to say on its website:

“ET is a publicly traded master limited partnership. Unitholders are limited partners in the Partnership and receive cash distributions. A partnership generally is not subject to federal or state income tax. The annual income, gains, losses, deductions, and credits of the Partnership flow through to the Unitholders, who are required to report their allocated share of these amounts on their individual tax returns as though the Unitholder had received these items directly. You will receive a K-1 tax package summarizing your allocated share of the Partnership’s reportable tax items for the tax year. We estimate that Schedule K-1 tax packages will be distributed to Unitholders of record in March for the proceeding calendar year.”

DRIP Plan: Energy Transfer offers a distribution reinvestment program (DRIP) which can be an excellent way to reinvest your distributions. There is currently no discount on the purchase of additional units via the plan, but it does have the potential to offer a discount of 0% to 5% in the future. The details are available here.

Conclusion:

Energy Transfer’s EV/EBITDA is low, and its distribution yield is high, for the same reason—the company is risky (due largely to uncertainty about future EBITDA from high capex growth projects yet to come online, and due to its heavy debt load). However, Energy Transfer’s EV/EBITDA may be too low, and its distribution yield may be too high, for the same reasons—overly fearful investors have indiscriminately sold units as credit spreads have widened and oil prices have fallen).

In our view, the best time to invest is usually when other investors are afraid. Energy Transfer is not without risk, but it seems investors have overreacted to near-term uncertainties, and the shares offer very significant price appreciation potential in the future (+50% upside, per the sell side analysts) so long as the current investment environment does not get dramatically worse. We do not currently own Energy Transfer, but we have ranked it #6 in our recent article titled "The More It Falls: Top 10 Big Yields Worth Considering," and we may initiate a new position in the coming days, within our diversified investment portfolio, because we believe Energy Transfer offers outsize rewards (distributions and price appreciation) relative to its risks.

Disclosure: We do not currently own Energy Transfer, but may initiate a new position in the coming days.