Energy Remains Cheap And Actionable

Image Source: Unsplash

The opportunity in the energy sector remains clear—in fact, the situation hasn’t changed since I last wrote to Smart Money Monday readers about it in June 2022.

At the time, the energy ETF—the Energy Select Sector SPDR Fund (XLE)—was up over 60%. It finished 2022 up 57%, vastly outperforming the broader S&P 500 index, which was down 18%.

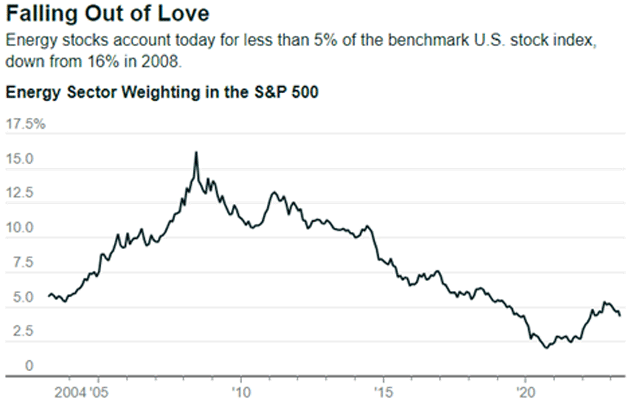

And yet energy as a percentage of the overall S&P 500 was at extremely low levels on a historical basis.

Well, it’s the same story today: Energy as a percentage of the S&P 500 is at a staggering 4.5% of the overall index.

Source: Barron’s

One way to own energy is through XLE.

Here’s the crux of the bet:

-

Energy is cheap on an absolute basis. The S&P 500 energy sector currently trades at 11X forward earnings.

-

Energy is cheap on a relative basis. The S&P 500, ex energy, trades for 20X forward earnings.

-

At a company level, energy companies are focusing on the right things: free cash flow, share repurchases, and dividends.

As you know, I’m a bottom-up investor. I look at companies on a one-by-one basis. We’re in the thick of earnings season, so here’s what a few energy companies are saying…

Chevron’s Astounding Figure

Multinational energy corporation Chevron (CVX) returned $7 billion to shareholders in the form of buybacks and dividends in the second quarter of this year. It’s in the middle of closing its $7.6 billion acquisition of PDC Energy (PDCE). While it waits for this to close, CVX has paused share repurchases.

However, after the deal closes, the company plans to resume buybacks at a rate of $17.5 billion per year.

At today’s price, this pencils out to around 6% of the entire market cap of the company. That’s an astounding figure, especially for a company of this size.

Chevron is doing the right things. And at 12X forward earnings, this stock is much too cheap.

Warren Buffett’s Favorite Energy Stock

Occidental Petroleum (OXY) also put up a solid earnings report.

As a reminder, Warren Buffett (through Berkshire Hathaway) is a large owner of OXY. He owns common stock, preferred stock, and a big pile of warrants. Warrants give you the right to buy stock at a certain price for a set period.

Occidental is also doing all the right things. It’s focused on free cash flow generation, as well as paying down debt and redeeming its outstanding preferred stock.

Cleaning up the balance sheet through debt paydown has earned OXY an investment-grade rating from Fitch. That’s yet another positive catalyst and set up for the company.

Because of Berkshire Hathaway’s increased purchases and OXY shrinking the share count through buybacks, Berkshire now owns over 25% of the company.

OXY trades for around 12X next year’s earnings.

This Watch Lister Is Still Cheap

One name I suggested adding to your watch list last year was Ovintiv (OVV).

Like the rest of the space, Ovintiv is quite cheap. It recently completed an acquisition of additional acreage in the Midland Basin for $4 billion. In conjunction with that purchase, it also sold some acreage for $800 million.

And again, like the rest of the energy space, it’s doing the right things. The company is focused on free cash flow, dividends, share repurchases, and maintaining a strong balance sheet.

OXY and CVX trade for low double-digit forward earnings multiples. On the other hand, Ovintiv trades for just 7X forward earnings based on analyst estimates.

That’s very cheap.

Macro View

The macro picture still taints oil and gas companies. The view is that EVs will take over, and we’ll no longer need oil and gas in our daily lives.

That view just doesn’t mesh with reality.

According to the Energy Information Administration, oil demand continues to grow at around a 1% clip per year. Sure, wealthier countries like the US and parts of Europe may see demand flat to down as consumers shift toward electric vehicles.

But worldwide, demand will continue to increase—especially in developing countries.

Energy stocks, as a group, are much too cheap. Chevron (CVX), Occidental Petroleum (OXY), and Ovintiv (OVV) all seem like solid buys here—not just for getting energy exposure, but also for generating solid returns going forward.

More By This Author:

The October Surprise For Tens Of Millions Of AmericansThis Sector Is In A Recession - Time To Buy?

Victory Lap: Microsoft-Activision Gets The Green Light