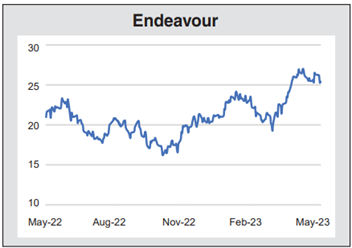

Endeavour Mining: A Global Gold Miner That Produces At An Incredibly Low Cost

Image Source: Pixabay

Since gold began trading freely in the US, there have been periods of spectacular gains in silver, but no five-year period in which silver has outperformed gold. Overall, during that nearly 50-year period, gold has outperformed silver by about 800 percentage points. That is one reason I’m recommending one of the world’s most dynamic gold miners, Endeavour Mining (EDVMF).

Silver has an even longer history than gold as a monetary metal, and it is also an exceptional thermal and electric conductor with many industrial uses. In modern times, that has actually harmed its relative performance vis-à-vis gold. When the economy is strong, silver will outperform gold, but it typically attracts a lot of speculative demand, leaving it extremely vulnerable when the economy weakens.

Basic arithmetic shows why this leads to underperformance. If a commodity climbs by 50% and then falls by 50%, its total change is a loss of 25%. On the other hand, a 10% gain and a 10% loss leave you with a loss of 1%.

Endeavour Mining has a leading position in the world’s most productive gold region, Western Africa. In each of the six countries in which the company operates, it is the largest gold producer, which results in multiple cost-saving synergies. By virtually any metric, Endeavour stands out.

Among miners with production of more than 1 million ounces a year, the company’s all-in-sustaining cost of producing gold is the lowest. Perhaps most striking is that its cost of finding an ounce of gold in 2022 was $25. Since mid-2016, when the company began its exploration program, 15 million ounces of gold have been discovered.

The company has singled out 70 targets for exploration, which based on past results are expected to yield up to 20 million or more ounces of gold. Over the next 10 years, the company expects to double its yearly gold production.

The fact that the stock’s P/E and P/B are among the lowest in the industry reflects the risks associated with Western Africa. Clearly a discount related to the location is merited, but relative to valuations of other gold miners, the discount is excessive.

Next to South Africa, West Africa is the fastest-growing part of the fastest-growing continent. Keep in mind that one of most successful gold miners of the past 20 years or more was Randgold, which between 2000 and 2019, when it was purchased by Barrick Gold (GOLD), outperformed the average gold stock by about 20-fold. All the mining was done in an Africa that was much less efficient than the one we see today.

My recommended action would be to consider buying shares of EDVMF.

More By This Author:

Eastman: Chemicals, Metals And Recycling

Enterprise Products: "Defense With An Offensive Punch"

Fresnillo: "A Cornucopia Of Riches"

Disclosure: None.

See our Leeb's Real World Investing June issue for our recommended silver plays.