Elon Musk Mocks Nikola Motors As “Dumb.” Is He Right?

“Staggeringly dumb.”

That’s the latest insult Elon Musk threw at Nikola Motors (NKLA), which has rocketed a crazy 500%+ since April. Love him or hate him, no one denies Musk is a genius. He built Tesla (TSLA)—easily the world’s most innovative car company—from scratch. When he’s not running Tesla, he works a “side job” as a rocket scientist for his private space company, SpaceX.

So, you’d think only fools would bet against Musk. But that’s what we’ve been doing lately. No, we haven’t been “shorting” Tesla. Instead, we invested big in hydrogen energy—including Nikola Motors.

Musk HATES the idea of using hydrogen energy to power vehicles. Hydrogen is the most abundant element in the universe. It’s been used as an energy source for decades. In fact, NASA has been using it since the ‘50s as rocket fuel for its space missions.

But Musk hates hydrogen fuel cells. He’s called them “fool cells.” And says using them to power vehicles is “mind-bogglingly stupid.” His basic objection is that using hydrogen to store energy can never be as efficient as storing electricity in a battery.

Musk Is Not Alone in His Hatred for Hydrogen

Years ago, hydrogen-powered vehicles were supposed to be the next big thing. For a time, hydrogen was running neck and neck with electric cars as the top bet to replace gasoline-powered cars. As recently as 2017, a poll of car company executives said hydrogen-powered vehicles would win out over electric vehicles.

But thanks largely to the success of Tesla, electric vehicles took off. And hydrogen never amounted to much. Hydrogen lost the popularity contest, and once-hot hydrogen stocks turned ice cold.

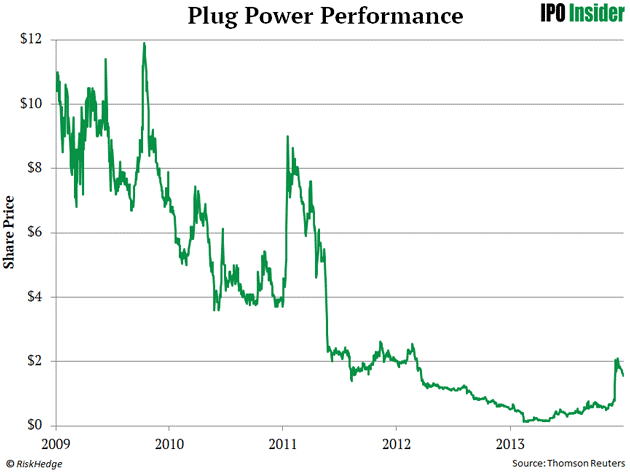

Here’s Plug Power (PLUG), a leading hydrogen fuel cell company. Plug plummeted 98% from March 2009 to February 2013, while the S&P 500 rallied more than 120% over the same stretch.

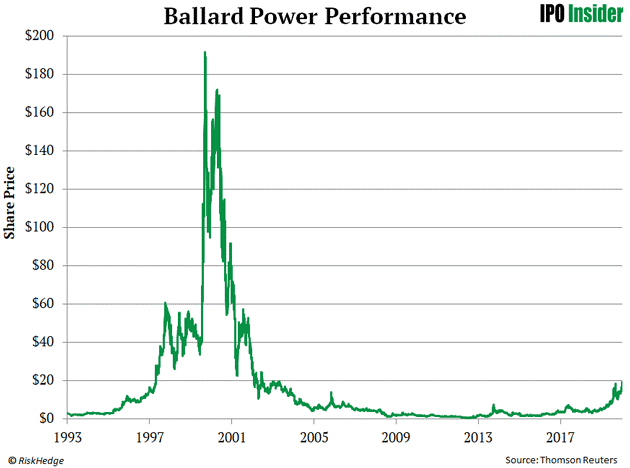

Investors hated Ballard Power (BLDP), too. In fact, it hasn’t set a new high since 1999.

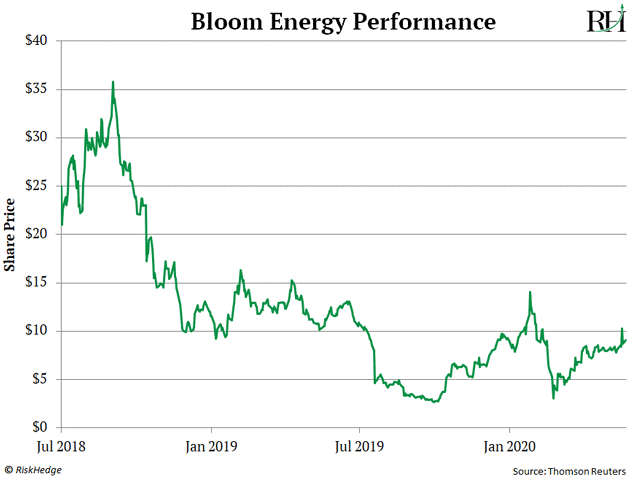

Then, there’s Bloom Energy (BE). It’s plunged 39% since it IPO’d in 2018.

No one wanted anything to do with hydrogen stocks. They were arguably the most hated stocks on the planet.

And Then, Seemingly Out of Nowhere, Hydrogen Stocks, Such As Nikola Motors, Took Off

Plug Power has rocketed more than 4,300% since early 2013. Ballard Power has spiked over 3,000% over the same period. Bloom Energy has rallied 239% since bottoming out. In other words, hydrogen stocks went from being the “ugly ducklings” of green energy to some of its hottest stocks.

But Nikola Motors (NKLA) has left every other hydrogen stock in the dust this year. If the name sounds familiar, it’s because Nikola is named after the same guy Tesla is: scientist Nikola Tesla.

Nikola’s vision is to disrupt the $1.2 trillion semi-truck market. Although it has secured 14,000 pre-orders, you could argue it was the most hated hydrogen stock out there. The company hasn’t sold a single real truck yet.

Some folks even accused Nikola of peddling “vaporware.” In tech circles, this is a mocking term for a product that’s announced, marketed, and hyped-up, but never actually created.

After researching Nikola and talking to folks in the industry, We knew the doubters were wrong.

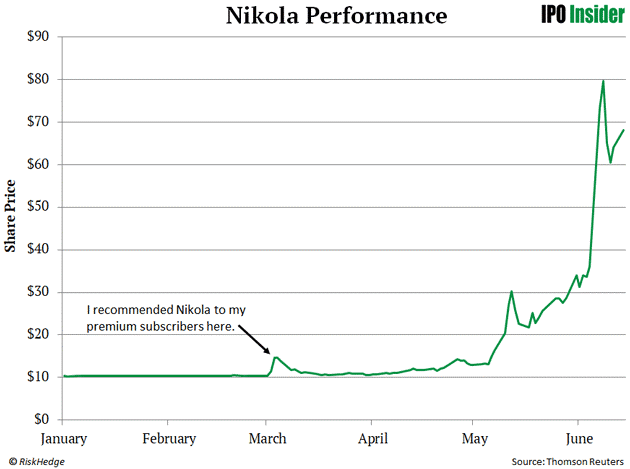

We publicly recommended buying Nikola just hours after it “went public” on March 3. If you didn’t hear a thing about Nikola’s IPO, you’re not alone. Nikola went public via a quiet, obscure transaction called a “reverse-merger” that 99.99% of investors were unaware of.

Fast Forward to Today...

Nikola has been one of the top-performing stocks in the world. From $11.50 in April, it briefly surged above $90 last week. Full disclosure—we fully exited two weeks ago when it surged an almost unbelievable 103% in a day, and closed at $73.27.

Why did hydrogen stocks, and Nikola in particular, flip from “hated” to “loved?” You could point to a lot of reasons. One is that expectations fell into line with reality. Folks realized that America will never run on hydrogen cars. But as a specialized solution, hydrogen vehicles could still be big.

For example, big companies with huge fleets of trucks like UPS and FedEx are already starting to use them.

Many environmentalists have gotten on board with hydrogen, too. Hydrogen fuel cells are very clean. They don’t produce exhaust or any other form of pollution. Their only byproduct is water and heat.

Nikola’s charismatic founder Trevor Milton played a part too. He’s energetic and masterful at getting investors to buy into his vision.

Frankly, though, none of this mattered all that much in our analysis. Hydrogen came up on our radar for one reason: It was irrationally hated by investors. After many hydrogen stocks plunged 90%+, investors left them for dead. Expectations plunged to zero, which cleared the way for big, quick profits.

And keep in mind, by the time Nikola “went public” in March, it was crystal clear that sentiment toward hydrogen had flipped for the better. All three of the hydrogen stocks I mentioned earlier had doubled or better heading into March.

Put that evidence together, and it’s not hard to see why Nikola blasted off. Although no one could have predicted 500% gains in three months.

So is Musk right? Are hydrogen-powered vehicles “dumb?” I’ll leave that to the scientists. But as an investment, hydrogen stocks have been very good to us. And with the exception of Nikola—which has already soared more than most folks’ wildest dreams—I expect they’ll continue higher from here.

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy ...

more

Nikolas stock has recently declined from their previous market high. Do you believe that they will re-surge, or the "bubble" popped and investors are focused on intrinsic value?

#ElonMusk has an amazing knack to keep #Tesla as a winner, even though it probably shouldn't be.