Elliott Wave Technical Forecast: Block, Inc. - Thursday, April 17

ASX: BLOCK, INC - XYZ (SQ2) Elliott Wave Technical Analysis | TradingLounge

Greetings,

Our Elliott Wave update for the Australian Stock Exchange (ASX) focuses on BLOCK, INC - XYZ (SQ2). Based on the current wave structure, ASX:XYZ may be in the early stages of a bullish (3)-orange wave. However, for this bullish outlook to gain strong confirmation, the price must remain above the invalidation level for at least 5–7 days.

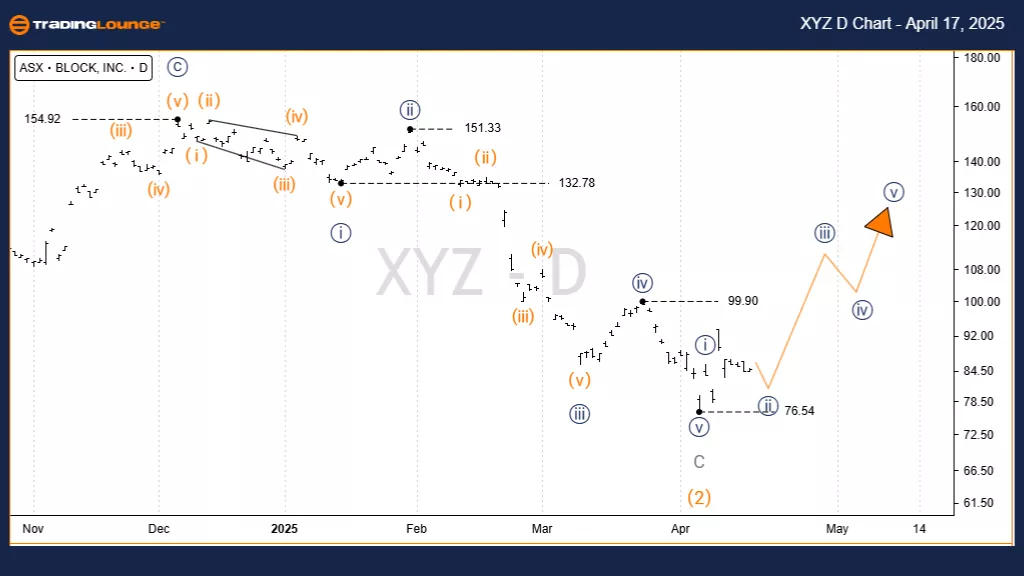

ASX: BLOCK, INC - XYZ (SQ2) Technical Analysis Overview (1D Semilog Chart)

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave ii))-navy of Wave (3)-orange

Details:

Wave (2)-orange appears to have completed, with wave (3)-orange now unfolding upward. A breakout above $93.49 would confirm this long-term bullish scenario, potentially targeting previous highs around $110.

Invalidation Point: $76.54

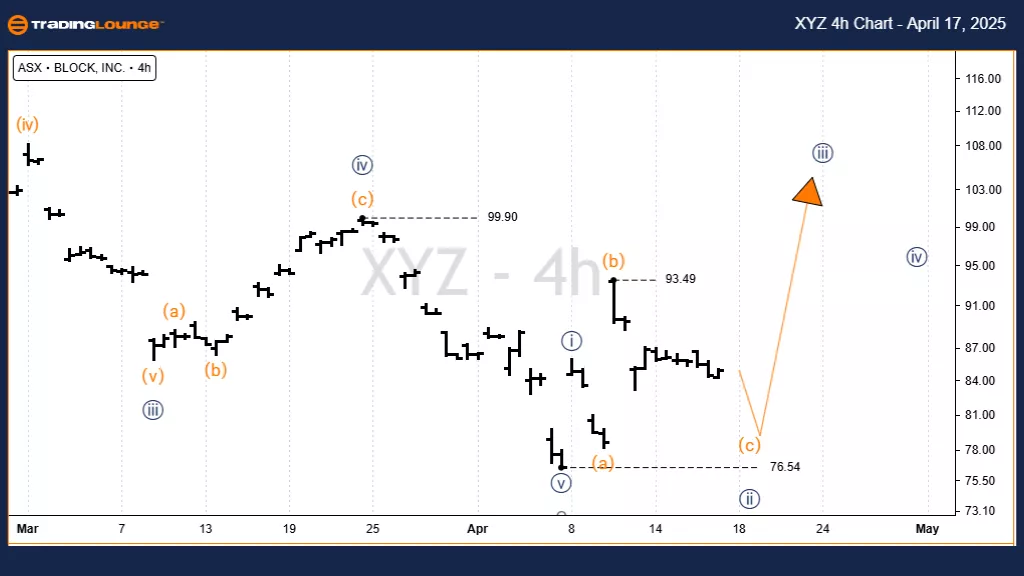

Technical Summary: 4-Hour Chart Analysis

Function: Major trend (Minute degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave ((I))-navy of Wave (3)-orange

Details:

Zooming into the 4-hour chart, we observe wave (3)-orange developing, currently progressing through the internal wave sequence from ((i))-navy to ((v))-navy. As long as the price stays above $76.54, this near-term bullish outlook remains valid.

Invalidation Point: $76.54

Conclusion

This analysis of ASX: BLOCK, INC - XYZ (SQ2) delivers a comprehensive outlook, combining wave structure insights and key price levels to guide traders. The bullish thesis gains strength with price action above key validation zones, offering a framework for confident decision-making. Our goal is to deliver professional-grade, actionable market insights.

Technical Analyst: Hua (Shane) Cuong, CEWA-M

More By This Author:

Elliott Wave Technical Analysis: Ethereum Crypto Price News For Thursday, April 17

Elliott Wave Technical Forecast: Newmont Corporation - Wednesday, April 16

Elliott Wave Technical Analysis: Palo Alto Networks Inc. - Wednesday, April 16

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more