Elliott Wave Technical Analysis: The Walt Disney Co. - Tuesday, Nov. 19

DIS Elliott Wave Analysis Trading Lounge

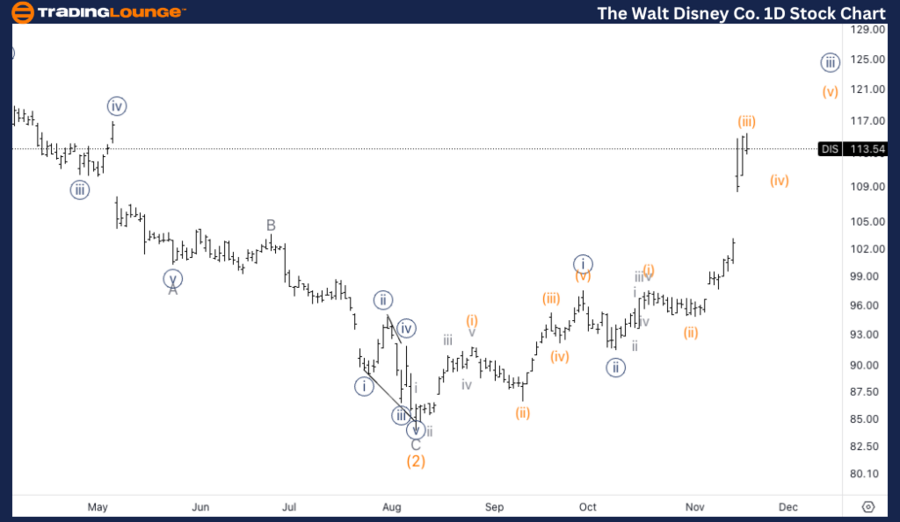

The Walt Disney Co., (DIS) Daily Chart

DIS Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave {iii} of 1.

DIRECTION: Upside in wave 1.

DETAILS: The longer term counts presents some challenges as it is yet unclear whether or not the longer correction is completed or not. As we are now trading above TradingLevel1 at 100$ we are gaining confidence in the upside potential to unveil.

The Walt Disney Co., (DIS) 1H Chart

DIS Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (iii) of {iii}.

DIRECTION: Top in wave (iii).

DETAILS: We seem to have topped in wave (iii) of {iii} after a sharp acceleration higher. Looking for a pullback in wave (iv) to end near the wave iv of one lesser degree, as well as around equality with the same degree wave (2) at around 112$.

In this Elliott Wave analysis, we will review the trend structure of The Walt Disney Co., (DIS) using both the daily and 1-hour charts to assess the current wave position and potential price movements.

* DIS Elliott Wave Technical Analysis – Daily Chart*

On the daily chart, Disney (DIS) is progressing in wave {iii} of 1 as part of a larger impulsive structure. The longer-term Elliott Wave count has some uncertainty due to the complex correction Disney has been in. However, breaking above TradingLevel1 at $100 has bolstered confidence in the upside scenario, suggesting that the correction may be over, and the stock is poised for further gains in this impulsive structure.

* DIS Elliott Wave Technical Analysis – 1H Chart*

On the 1-hour chart, it appears that wave (iii) of {iii} has topped after a sharp move higher. The next expected move is a corrective wave (iv). The pullback could find support near the previous wave iv of one lesser degree, around the $112level, where it would also match equality with the preceding wave (2), setting the stage for the final push higher in wave (v).

Technical Analyst : Alessio Barretta

More By This Author:

Unlocking ASX Trading Success: Rea Group Ltd - Tuesday, Nov. 19

Elliott Wave Technical Analysis: Euro/British Pound Forex For Tuesday, Nov 19

Wave Technical Analysis: Bitcoin Crypto Price News For Tuesday, Nov 19

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.865bbfba3d1fefb931d8d96c3e8ad2ca.png)