Elliott Wave Technical Analysis: Salesforce Inc. - Wednesday, Jan. 8

CRM Elliott Wave Analysis Trading Lounge

Salesforce Inc., (CRM) Daily Chart

CRM Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Complex

POSITION: Wave 4 of (3).

DIRECTION: Pullback in 4.

DETAILS: We are looking at a potential wave 4 near completion. It is yet unclear whether this is a wave 4 of (3) or else we are within wave 1 of. (3) suggesting much more upside potential is available.

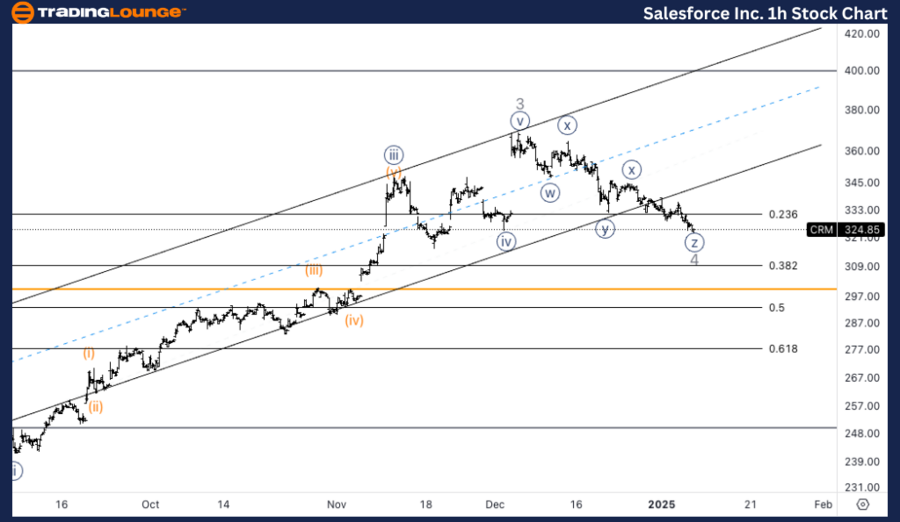

Salesforce Inc., (CRM) 1H Chart

CRM Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Complex

POSITION: Wave {z} of 4.

DIRECTION: Bottom in wave 4.

DETAILS: We are anticipating a potential complex correction in wave 4. As we approach the area of the previous wave {iv} we could expect a bottom soon in place or else at least a pullback higher soon.

This analysis focuses on the current trend structure of Salesforce Inc., (CRM) utilizing the Elliott Wave Theory on both the daily and 1-hour charts. Below is a breakdown of the stock's position and potential future movements.

* CRM Elliott Wave Technical Analysis – Daily Chart*

Salesforce appears to be in the midst of a wave 4 pullback, which could be nearing completion. At this point, it's unclear whether this correction is part of wave 4 of (3) or if we're within the early stages of wave 1 of (3), suggesting potential for further upside. A confirmation of the wave position is necessary to clarify the next likely move. For now, expect the pullback in wave 4 to complete soon, either continuing the uptrend in wave (3) or setting up a larger bullish continuation.

* CRM Elliott Wave Technical Analysis – 1H Chart*

The 1-hour chart suggests that wave {z} of 4 is in its final stages, indicating a possible bottom forming soon. We are approaching the area near the previous wave {iv}, which is a typical zone for the end of corrective waves. A reversal or at least a pullback higher is expected, which would confirm the completion of wave 4 and the start of a potential upward move.

Technical Analyst : Alessio Barretta

More By This Author:

Unlocking ASX Trading Success - Cochlear Limited

Elliott Wave Technical Analysis - Swiss Market Index - Wednesday, Jan. 8

Elliott Wave Technical Analysis: Euro/U.S. Dollar - Wednesday, Jan. 8

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.72b74b763c76d937b5e5e6fc18067e2f.png)