Elliott Wave Technical Analysis - Chevron Inc.

CVX Elliott Wave Analysis Trading Lounge

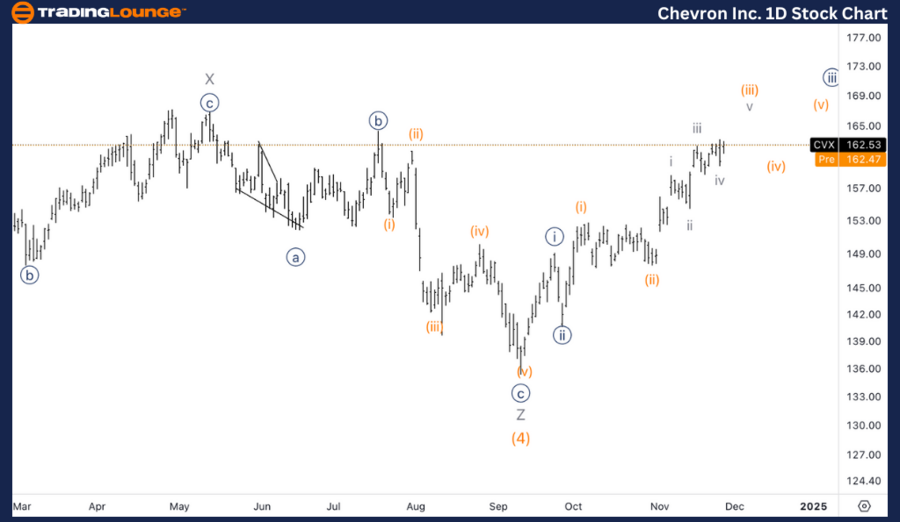

Chevron Inc., (CVX) Daily Chart

CVX Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Minute {iii}.

DIRECTION: Upside within {iii}.

DETAILS: Looking for upside into wave {iii} as we seem to be missing another wave (iii) and (iv) within {iii}, suggesting we could get towards 200$.

Chevron Inc., (CVX) 1H Chart

CVX Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (iii) of {iii}.

DIRECTION: Upside in wave v of (iii).

DETAILS: Looking for upside into wave (iii) as we seem to be missing another leg higher into wave v. As iii was shorter than i, v must be shorter than iii so we should expect equality at 168$ as maximum target.

This analysis focuses on the current trend structure of Chevron Inc., (CVX) utilizing the Elliott Wave Theory on both the daily and 1-hour charts. Below is a breakdown of the stock's position and potential future movements.

* CVX Elliott Wave Technical Analysis – Daily Chart*

Chevron (CVX) is progressing within minute wave {iii} of the larger impulsive structure, with additional upside expected. There appears to be missing subdivisions for waves (iii) and (iv) within {iii}, suggesting a further extension in this move. The target for this wave structure lies near $200, marking the expected completion of wave {iii}.

* CVX Elliott Wave Technical Analysis – 1H Chart*

On the 1-hour chart, Chevron is advancing within wave v of (iii). With wave iii shorter than wave i, wave v is expected to be constrained to be shorter than wave iii, limiting its maximum target to $168 based on equality with previous wave structures. This suggests a measured but steady move higher in the near term as wave {iii} approaches completion.

Technical Analyst : Alessio Barretta

More By This Author:

Unlocking ASX Trading Success - Unibail-Rodamco-Westfield

Elliott Wave Technical Analysis - TASI Index

Elliott Wave Technical Analysis - U.S. Dollar/Japanese Yen - Wednesday, Nov. 27

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.10c9bb89294880f686be499e6d9feb70.png)