Elliott Wave Technical Analysis: Berkshire Hathaway Inc. - Friday, Feb. 28

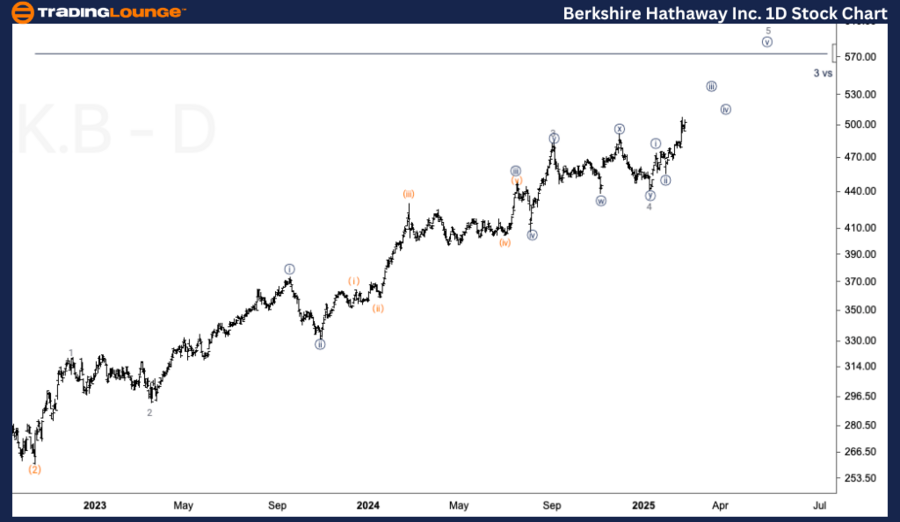

Berkshire Hathaway Inc. (BRK-B) Elliott Wave Analysis – Daily Chart

- Function: Trend

- Mode: Impulsive

- Structure: Motive

- Position: Wave 5 of (3)

- Direction: Upside into wave 5

Details:

- Expecting upside continuation into wave 5, with targets around $570.

- Key support above $500 is needed to confirm the bullish momentum.

Berkshire Hathaway Inc. (BRK-B) Elliott Wave Analysis – 1H Chart

- Function: Trend

- Mode: Impulsive

- Structure: Motive

- Position: Wave (iii) of {iii}

- Direction: Upside in wave (iii)

Details:

- Recent upmove from the January bottom is unfolding in threes and fours.

- Expecting further bullish momentum before a larger-degree top in wave {iii}.

Conclusion

This equities analysis highlights key market trends across multiple stocks and ETFs using Elliott Wave Theory.

- Stocks like BRK-B, LLY, MELI, and V show impulsive trends, signaling further upside potential.

- Corrective patterns in AVY, PG, and SMH indicate areas where traders should be cautious.

- Key resistance and support levels are critical in confirming future market moves.

More By This Author:

Unlocking ASX Trading Success: James Hardie Industries Plc - Friday, Feb. 28

Elliott Wave Technical Analysis: Euro/U.S. Dollar - Friday, Feb. 28

Elliott Wave Technical Analysis: NEOUSD Crypto Price News For Friday, Feb 28

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!

.thumb.png.7e56f5d6f13fb88e722d4a72b3ae004c.png)