Elliott Wave Suggests Alibaba Group Can Reach $130 In 2025

Image Source: Pixabay

Hello everyone! In today’s article, we’ll examine the recent performance of Alibaba Group (BABA) through the lens of Elliott Wave Theory. We’ll review how the rally from the November 22, 2024, low unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock.

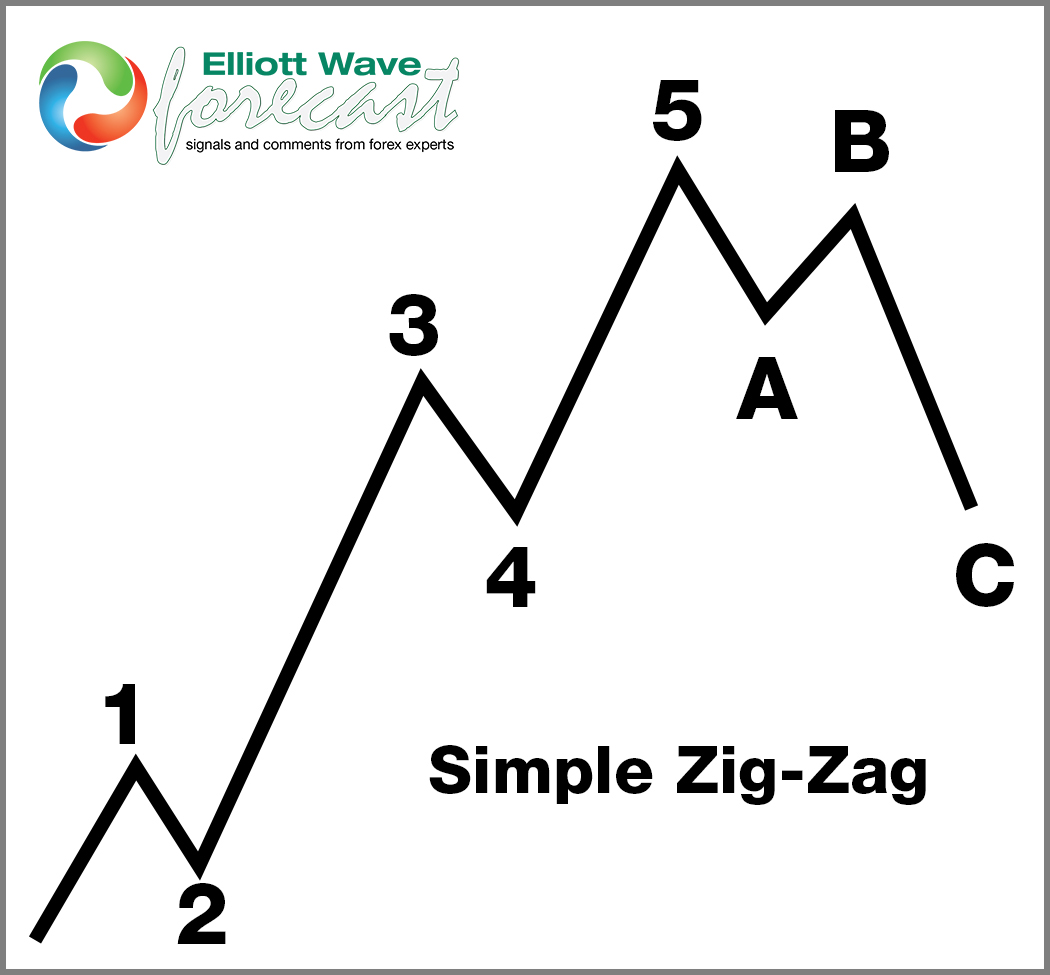

5 Wave Impulse Structure + ABC correction

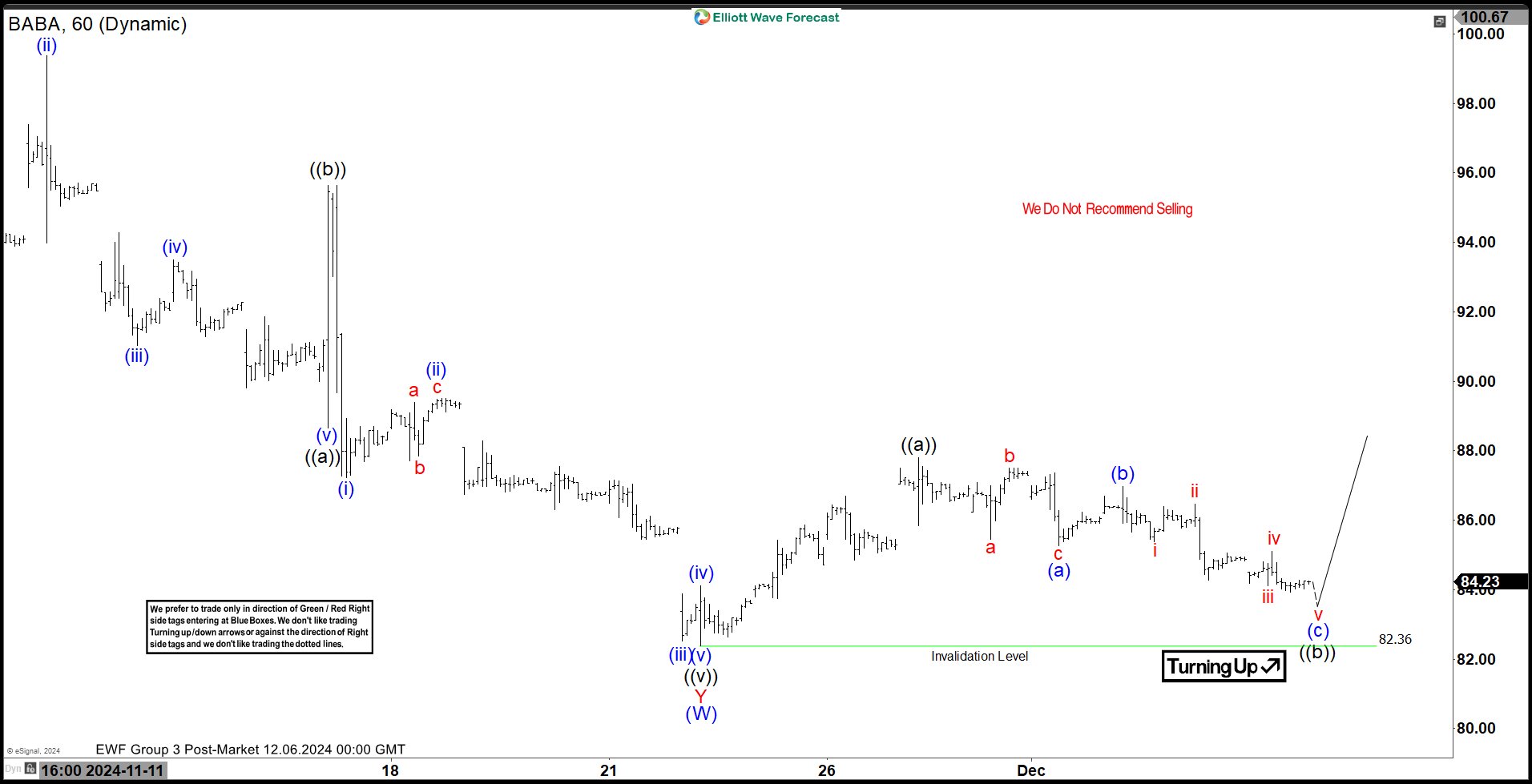

$BABA 1H Elliott Wave Chart 12.06.2024:

In the 1-hour Elliott Wave count from December 06, 2024, we see that $BABA completed a 5-wave impulsive cycle beginning on November 22, 2024, and ending on November 27, 2024, at the black ((a)). As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 3 swings, likely finding buyers above $82.36.

This setup aligns with a typical Elliott Wave correction pattern (ABC), where the market pauses briefly before resuming the main trend.

$BABA 1H Elliott Wave Chart 12.09.2024:

The most recent update, from this morning, shows that $BABA reacted as predicted. After the decline from the black ((a)) peak, the stock found support, leading to a renewed rally. As a result, traders could adjust to go risk-free, which confirmed that the bullish trend remains intact.

What’s Next for $BABA?

With the current rally, $BABA appears well-supported. Based on the Elliott Wave structure, we expect the stock to continue its upward trajectory, targeting the $100 – $104 range. A break above $117.82 will open a bullish sequence towards $130 – 168.

Conclusion

In conclusion, our Elliott Wave analysis of Alibaba Group (BABA) suggests that it could continue its bullish run, with significant upside potential in the medium term. Therefore, traders should monitor the $100 – $104 zone as the next target, keeping an eye out for any corrective pullbacks. By using Elliott Wave Theory, we can identify potential buying areas and enhance risk management in volatile markets.

More By This Author:

The Impact Of A Potential WWIII On Financial MarketsElliott Wave Analysis: BAC Found Support From Blue Box

Elliott Wave View: Strong Impulsive Rally In American Airlines Favors Upside

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more