Elliott Wave Expects New All Time High In Nvidia

Image Source: Pixabay

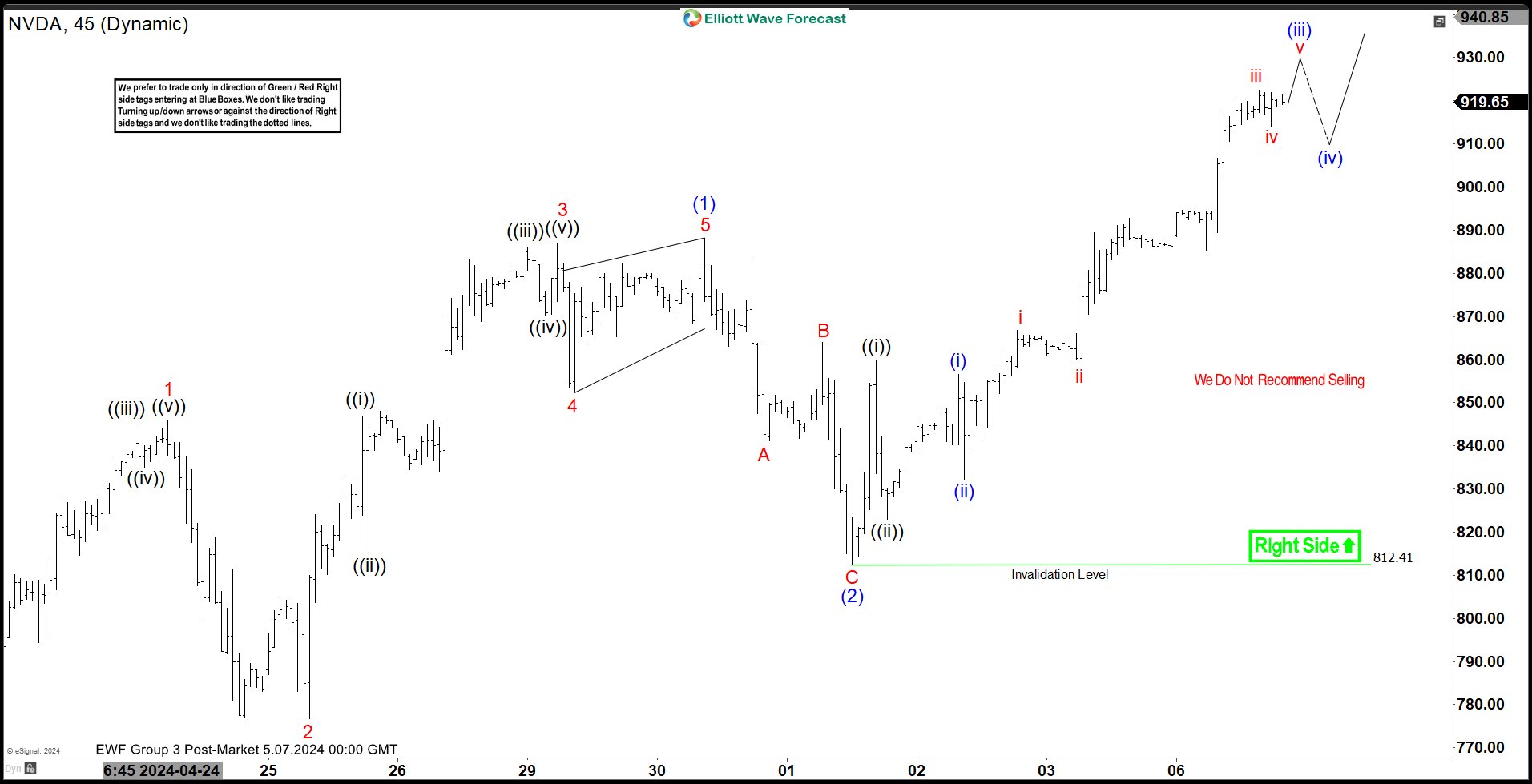

Short Term Elliott Wave View on Nvidia (NVDA) suggests the stock ended correction on 4.20.2024 at 756.06. From there, the stock starts a new impulsive rally. Up from 4.20.2024, wave 1 ended at 846.07, and the pullback in wave 2 ended at 776.80. The stock extends higher in wave 3 towards 887 and dips in wave 4 ended at 852.66. Final leg wave 5 ended at 888.19 which completed wave (1) in a higher degree. The stock then pulls back in wave (2) with an internal subdivision as a zigzag Elliott Wave structure. The stock has resumed higher in wave (3).

Up from wave (2), wave ((i)) ended at 860, and dips in wave ((ii)) ended at 823. The stock then nested higher with wave (i) ending at 856.6 and pullback in wave (ii) ending at 832. Wave i of (iii) ended at 866.84 and dips in wave ii of (iii) ended at 859.17. The stock resumed higher in wave iii of (iii) towards 922.2 and the pullback in wave iv of (iii) ended at 910.31. Expect the stock to extend higher by 1 more leg to end wave v of (iii). Afterward, it should pull back in wave (iv) to correct the cycle from the 5.2.2024 low before it resumes higher again. Near term, as far as the pivot at 812.4 low stays intact, expect a pullback to find support in 3, 7, or 11 swings for further upside.

Nvidia 45 Minutes Elliott Wave Chart

NVDA Elliott Wave Video

Video Length: 00:06:21

More By This Author:

XME Elliott Wave: Buying The Dips At The Blue Box AreaDo Not Miss Buying Opportunities - Palantir Should Resume Higher

Elliott Wave Analysis On EURJPY Expects Support Soon

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more