Elliott Wave Analysis: Tesla Sustains Strong Upward Rally

Image Source: Pexels

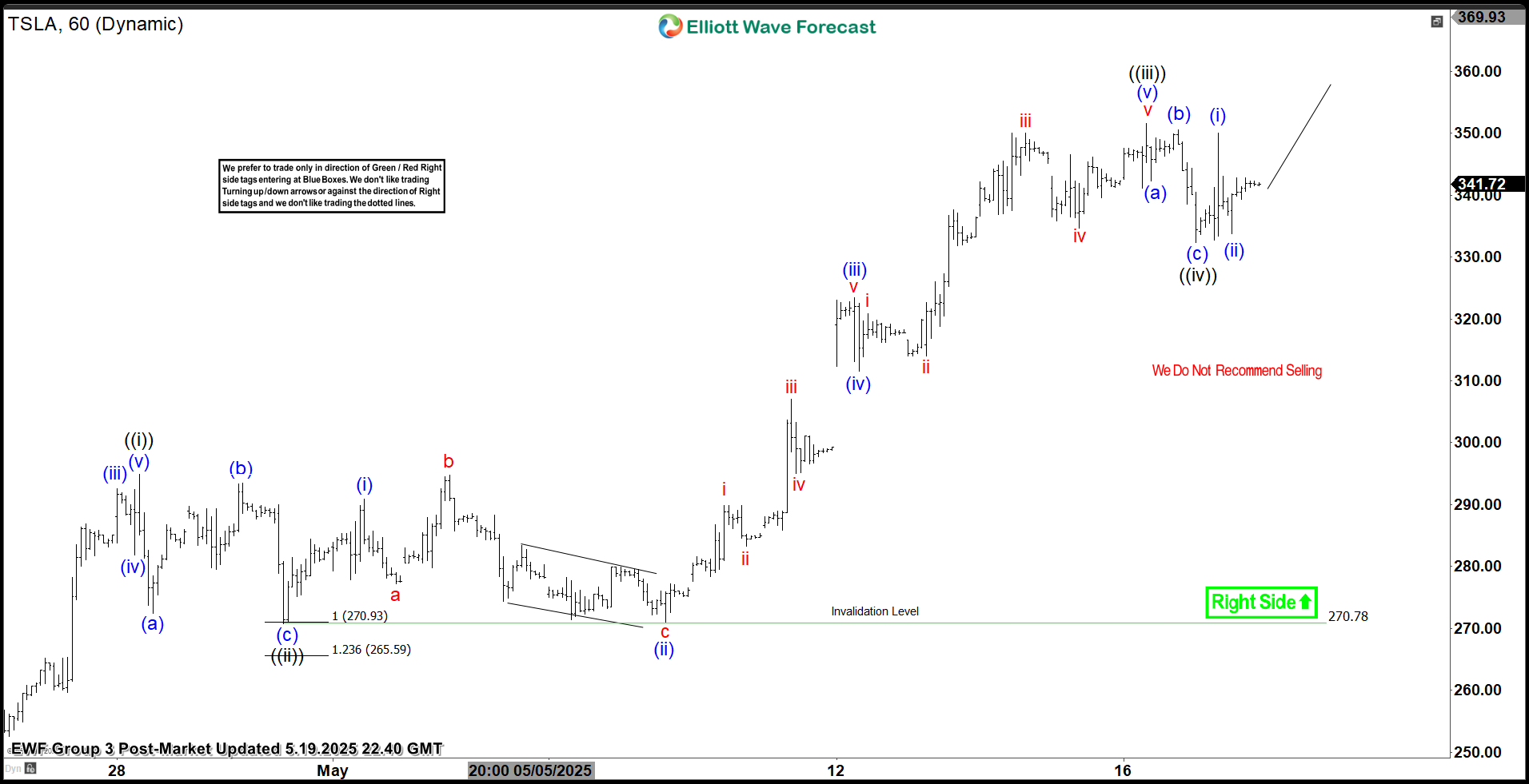

The current price cycle for Tesla (TSLA), starting from its low on April 22, 2025, is unfolding as a five-wave impulse structure, a common pattern in technical analysis signaling strong directional momentum. As illustrated on the 1-hour chart, the stock has been advancing since this low, with distinct waves forming within the broader structure.

From the April 22 low, the first wave, labeled ((i)), peaked at $294.85, followed by a corrective pullback in wave ((ii)) that found support at $270.78. The stock then surged higher in wave ((iii)), demonstrating robust bullish momentum. Within this wave, the internal structure unfolded as follows: wave (i) reached $290.87, followed by a pullback in wave (ii) to $271. The rally resumed in wave (iii), pushing the price to $323.48, before a minor correction in wave (iv) concluded at $311.50. The final leg, wave (v), culminated at $351.52, completing wave ((iii)) of the broader impulse.

Subsequently, a corrective wave ((iv)) unfolded as a zigzag pattern. From the wave ((iii)) peak, wave (a) declined to $342.33, followed by a wave (b) rally to $350.56. The corrective move concluded with wave (c) at $332.29, marking the end of wave ((iv)).

Looking ahead, as long as the price remains above the key support level of $270.78, any near-term pullbacks are likely to attract buyers in a 3, 7, or 11-swing corrective pattern, setting the stage for further upside in the ongoing impulse structure.

Tesla (TSLA) 60-Minute Elliott Wave Technical Chart

TSLA Elliott Wave Technical Video

Video Length: 00:03:18

More By This Author:

Elliott Wave Update: Gold Miners At Key Support, Set For Potential Upside MoveElliott Wave Analysis: Silver Dip Anticipated To Spark Buyer Activity

Elliott Wave Insights: Bitcoin Nearing Wave 3 Completion

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more