Elliott Wave Analysis: Nasdaq Continues Bullish Cycle, Reaching New All-Time High

Image Source: Unsplash

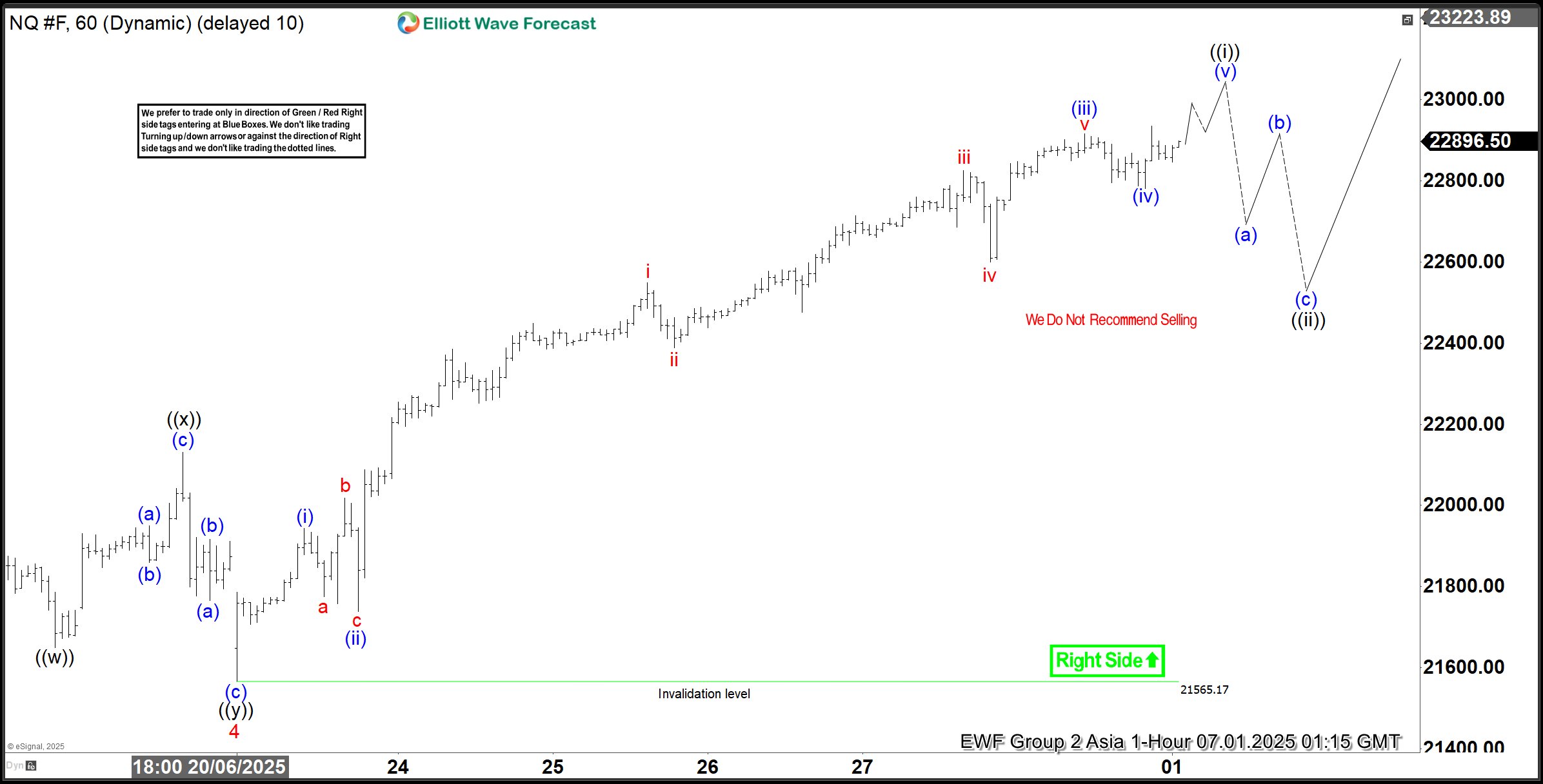

The Nasdaq (NQ) has surged to a new all-time high, reaffirming the strength of its ongoing bullish trend. The index established a significant low on April 7, 2025, at 16,460, following a sell-off triggered by tariff war concerns. This low marked a critical turning point, from which the Nasdaq embarked on a robust upward trajectory, unfolding in a five-wave impulse structure as per Elliott Wave analysis.

From the April 7 low, wave 1 peaked at 18,357.25. A corrective wave 2 then followed which bottomed at 16,735. The index then rallied in wave 3, reaching 22,222, before a shallow wave 4 pullback concluded at 21,565.17, as illustrated on the one-hour chart. Currently, wave 5 is in progress, exhibiting an internal impulse structure in a lesser degree. Within this wave 5, wave (i) topped at 21,944.25, with wave (ii) finding support at 21,738.25. Wave (iii) extended to 22,915, followed by a wave (iv) correction that ended at 22,781. The final wave (v) is expected to conclude soon, completing wave ((i)) of the higher-degree wave 5.

Looking ahead, a wave ((ii)) pullback is anticipated to correct the cycle from the June 23, 2025 low, likely unfolding in a 3, 7, or 11-swing pattern before the index resumes its ascent. In the near term, as long as the pivot low at 21,565.17 holds, any dips should find support in a 3, 7, or 11-swing structure, paving the way for further upside. This technical outlook underscores the Nasdaq’s resilience and potential for continued gains, provided key support levels remain intact.

Nasdaq 60-Minute Elliott Wave Technical Chart

Nasdaq (NQ) Elliott Wave Technical Video

Video Length: 00:03:51

More By This Author:

EURUSD Elliott Wave Update: Upward Momentum ResumesElliott Wave Insight: GDX Climbs Higher After Three Wave Decline

Nasdaq 100 ETF Affirms Bullish Outlook With Five Wave Rally

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more