Eli Lilly: What Lepodisiran Could Mean For This Big Pharma Play

Image Source: Pixabay

Lepodisiran is being developed by biotech giant Eli Lilly & Co. (LLY), a stock that’s in my model portfolio. Here’s the tale of this new drug, how it could help millions of heart-ailment sufferers, and how this furthers the “less-is-more” strategy that will make Lilly the “King of the Mountain” in biotech, highlights Bill Patalon, chief stock picker at Stock Picker’s Corner.

Lepodisiran targets “elevated lipoprotein(a)” — also known as Lp(a) — which is a genetically inherited cardiovascular risk factor that affects about 20% of Americans. And about a quarter of the global population has Lp(a) levels elevated enough to significantly increase heart-disease risk.

It’s early to estimate the market for this drug. But “Blockbuster” status — $1 billion or more at peak — is possible. Indeed, in one estimate I saw, Lepodisiran could reach $1.5 billion in revenue by 2037.

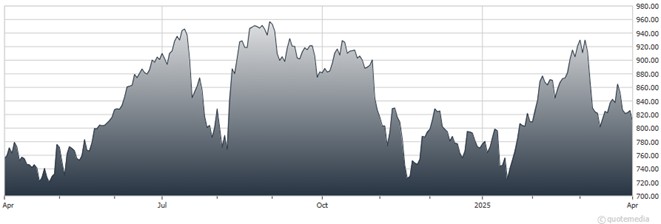

Eli Lilly & Co. (LLY) Chart

In this Phase II trial — the second of three rounds that mark the path of Food and Drug Administration approvals for the US market — Lepodisiran demonstrated a 93.9% reduction in Lp(a) at the highest dose over the 60 days to six months that followed the treatment.

The “durability” of the response is what really stunned experts. Patients who got two 400 mg doses maintained a 91% reduction at one year and a 74.2% reduction at about a year and a half.

Here’s what this suggests: A twice-a-year dosing is enough to target a key challenge in heart-disease management since frequent treatment often leads to people missing doses or otherwise not following through.

And here’s where Lilly’s “less-is-more” strategy comes into play. Let’s face it: People hate taking medicine. That’s true of pills, shots, or creams.

Lepodisiran is administered as a subcutaneous injection. This means you inject it under the skin — directly into the fatty tissue of the body. But you don’t need weekly or monthly shots — less is more. It’s pursuing that same path with the weight-loss technologies that have made it a blockbuster leader.

My recommended action would be to consider buying shares of Eli Lilly & Co.

About the Author

William (Bill) Patalon III is the chief stock picker of Stock Picker’s Corner (SPC). Before he moved into the investment research business in December 2005, he spent 22 years as a reporter, most of it covering financial news as a journalist, columnist, and editor.

His most memorable interviews include former President Richard M. Nixon, General Electric CEO John F. “Jack” Welch, Forbes magazine publisher and former Presidential candidate Steve Forbes, and business-turnaround specialist and helicopter-industry pioneer Stanley Hiller Jr.

Bill has a BA in Print Journalism from Penn State University and an MBA in finance from the Rochester Institute of Technology.

More By This Author:

Amid Market Chaos, Don't Do ThisBYD Company Limited: Stick With This EV Giant Amid Tariff Turmoil

Could The US See An Argentina-Style "J-Curve" Recovery?

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more