Elevance Health: A Healthcare Benefits Play With A Solid Dividend

Image Source: Pixabay

Elevance Health Inc. (ELV) is a healthcare benefits company serving nearly 46 million members through its plans. The company offers managed care plans to a wide range of markets, including individual, commercial, Medicare, and Medicaid, writes Ben Reynolds, editor of Sure Dividend.

Its two largest customer segments are government programs (~60% of annual sales) and commercial businesses (~30% of sales). Elevance generates annual revenues of $177 billion and has a market capitalization of around $93 billion.

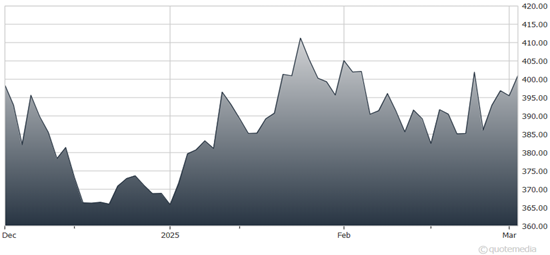

Elevance Health Inc. (ELV) Chart

On Jan. 22, Elevance raised its dividend by 4.9% to a quarterly rate of $1.71 per share. On Jan. 23, Elevance reported its Q4 and full-year 2024 results. Quarterly revenue grew by 5.9% to $45 billion, beating estimates by $280 million.

Adjusted earnings per share (EPS) fell to $3.84 from $5.62 last year, missing expectations by $0.01. Full-year revenue grew 2.9% to $175.2 billion, with adjusted EPS at $33.04, slightly above the $33 estimate but down from $33.14 in 2023.

Revenue growth stemmed from higher premium yields in Health Benefits and higher product revenue for CarelonRx, partially offset by declining Medicaid membership. The benefit expense ratio rose 320 basis points to 92.4% in Q4 and 150 basis points to 88.5% for the year due to Medicaid cost trends.

Further, Health Benefits revenue grew 3% to $37.6 billion, while medical membership declined by 1.1 million (2%) year-over-year, primarily due to Medicaid eligibility changes. Offsetting this decline were gains in Employer Group fee-based and Affordable Care Act memberships. Carelon revenue surged 19% to $14.7 billion, driven by Carelon Services growth and acquisitions.

Shares have recently been seen trading at 11.2 times this year’s expected earnings. Our fair value multiple is 15 times earnings, indicating a potential 6% annual boost from valuation expansion over the next five years. When combined with the 1.8% starting dividend yield and 9% expected growth, this implies a potential for 16.8% annual total returns.

My recommended action would be to consider buying shares of Elevance Health.

About the Author

Ben Reynolds is the CEO and founder of Sure Dividend. Sure Dividend helps individual investors build high-quality growth stock portfolios for rising passive income over the long run. Sure Dividend analyzes 600+ income securities to find the best dividend growth stocks. His work has appeared on Forbes, MSN Money, The Street, and other leading financial sites.

More By This Author:

VWIGX: An International Fund For This Evolving MarketAgco Corp.: An Agriculture Stock For The Post-Mag-7 World

AL: An Aircraft Leasing Play With A Full Order Book

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more