Election Pattern Alert: How Volatility And Demand Spikes Point To A Bullish 2025

Watch the video above from the WLGC session before the market opens on 12 Nov 2024 to find out the following:

- Is now a good time to enter the market, or should investors wait for a pullback and consolidation period?

- What are the bullish indicators suggesting a potential rally in 2025, and how do they compare to 2016 and 2020?

- How election cycles historically influence stock market volatility and demand patterns.

- And a lot more...

Video Length: 00:04:23

Market Environment

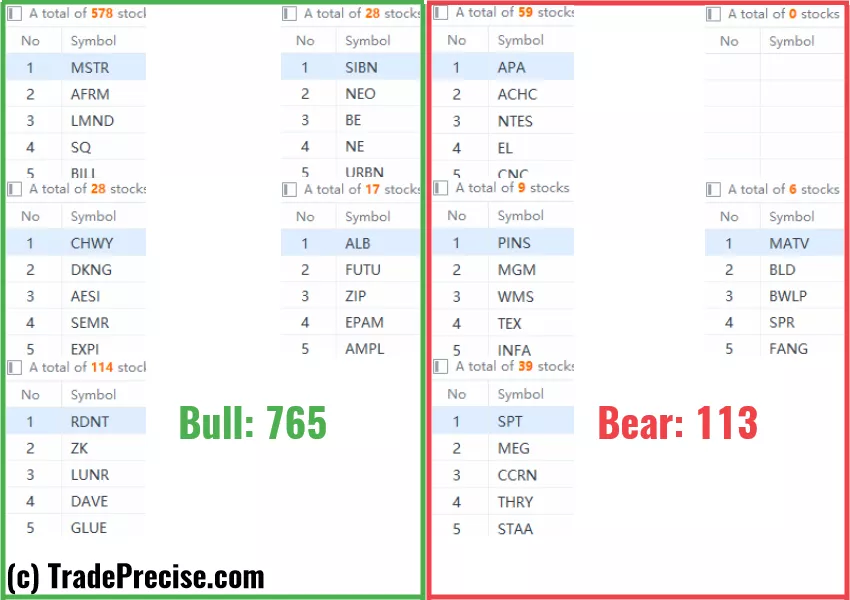

The bullish vs. bearish setup is 765 to 113 from the screenshot of my stock screener below.

3 Stocks Ready To Soar

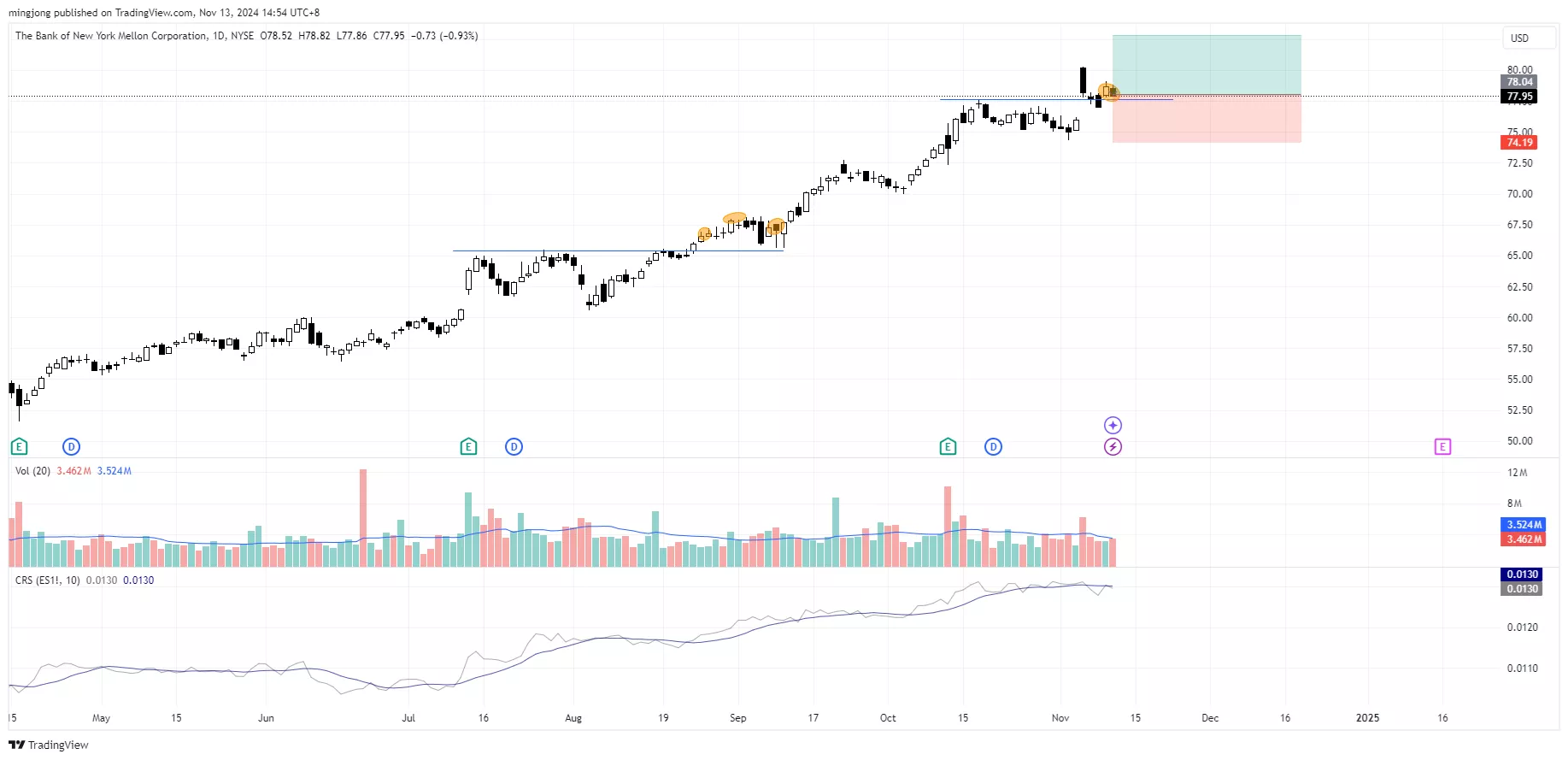

21 actionable setups such as RBLX, BK, WELL, were discussed during the live session before the market open (BMO).

Many stocks are overbought and over-extended since last Tuesday’s discussion, yet the long-term weekly charts show the early uptrend phase as many stocks just had the first strong impulsive up wave from the accumulation structures.

There are plenty of opportunities to participate in those bottoming stocks based on the price action as discussed in the entry setups video with the post-election pattern as a strong tailwind.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Massive Rally In The S&P 500 If The Key Level Holds Up

Election Patterns: Could This Market Structure Signal The Next Big Move?

Affirm Stock Bottoming Structure: Key Levels And Trade Opportunities

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.