Economic Growth, QE Infinity And The Great Disconnect

2020 represents the complete triumph of liquidity over fundamentals – Matt King, Citigroup, 2021 Outlook

There’s not a lot to say about the market today so I’m going to step back and explain the cause of economic growth, why that’s not what’s driven financial markets in 2020 and how that has resulted in what Jeremy Grantham has characterized as “The Great Disconnect”.

Economic growth is caused by an increase in productivity. That is, for some reason, the economy is able to get more output per unit of labor. The causes of this are increased capital intensity, innovation, a better educated workforce, etc… For example, increased capital intensity means workers are working with more and better capital which allows them to get more done per unit of labor.

Innovation, new inventions or new ways of doing things, also increases productivity. Think about the personal computer and how much that has increased our productivity. One of my favorite fictional examples comes from Ayn Rand’s “Atlas Shrugged”. Two of the heroes, Hank Reardon and Dagny Taggart, are exploring an abandoned motor factory when they stumble across a motor that can make energy from atmospheric electricity. Imagine what this would do to economic production. All of a sudden manufacturing firms that use a lot of energy in production wouldn’t have to spend all that money on energy. They’d just have to invest in the motor and their costs would drop significantly. This would fatten their margins, allowing them to reinvest in the business by buying new capital equipment or hiring more workers. Of course, the energy industry would become like the horse and buggy but the benefits to the overall economy would far outweigh the concentrated costs to the energy industry, whose assets and workers would be freed up to do new, productive things.

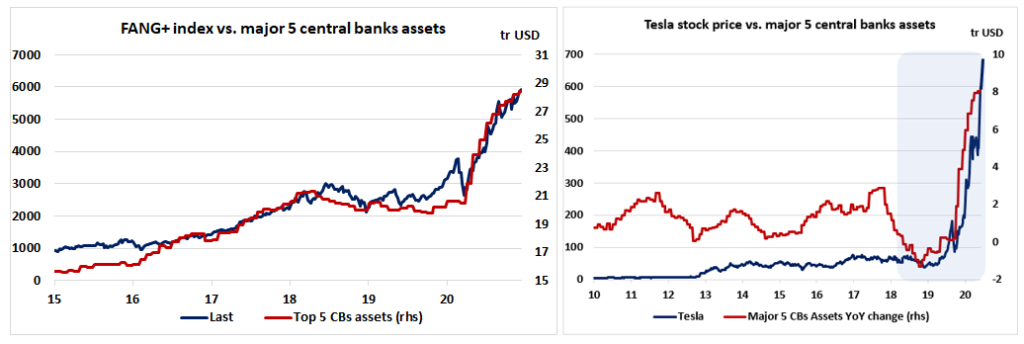

If you look at any chart of the major indexes this year, you’d think productivity was skyrocketing and economic growth exploding but that couldn’t be further from the truth. What is propelling financial markets around the world isn’t any improvement in the real economy but massive injections of liquidity by global central banks. According to Mike Bird in yesterday’s WSJ, the three major central banks – the Fed, the ECB and the BoJ – have injected $8 trillion into financial markets this year (“How The 2020 QE Boom Might Trip Up Central Bankers”, Mike Bird, WSJ, December 30).

While this has been good for holders of financial assets, it is actually a negative for long term growth because it has created a massive asset bubble, characterized by extreme overvaluation and “irrational exuberance”, that will pop creating enormous economic carnage. Printing money doesn’t create economic growth, increasing productivity does. This is now the third major bubble in the last 20 years (Dot Com, Housing, Everything Bubble).

The only financial market participant I’m aware of to have called for this disconnect of the price of financial assets and fundamentals and recommend going long on this basis is Rothko Research (For a recent take of theirs see “Letter To Equity Bears: Do Not Underestimate The Force Of Liquidity”, Rothko Research, Seeking Alpha, December 9). Rothko thinks this liquidity driven market can continue for another year before topping in early 2022.

When does the madness end? Unfortunately, market timing is much more of an art than science. There is no technical indicator that can tell you when the market or an individual security has topped or bottomed. Therefore, what you have to do is create a mosaic of fundamentals, technicals, sentiment, macro, history, etc.. in order to understand where we might be in the evolution of the bubble.

Zooming out to analyze the big picture seemed like the right thing to do on the last trading day of 2020. I wish you all a Happy New Year.