Earnings Season Disappoints, But Stocks Still Appear To Be Cheap

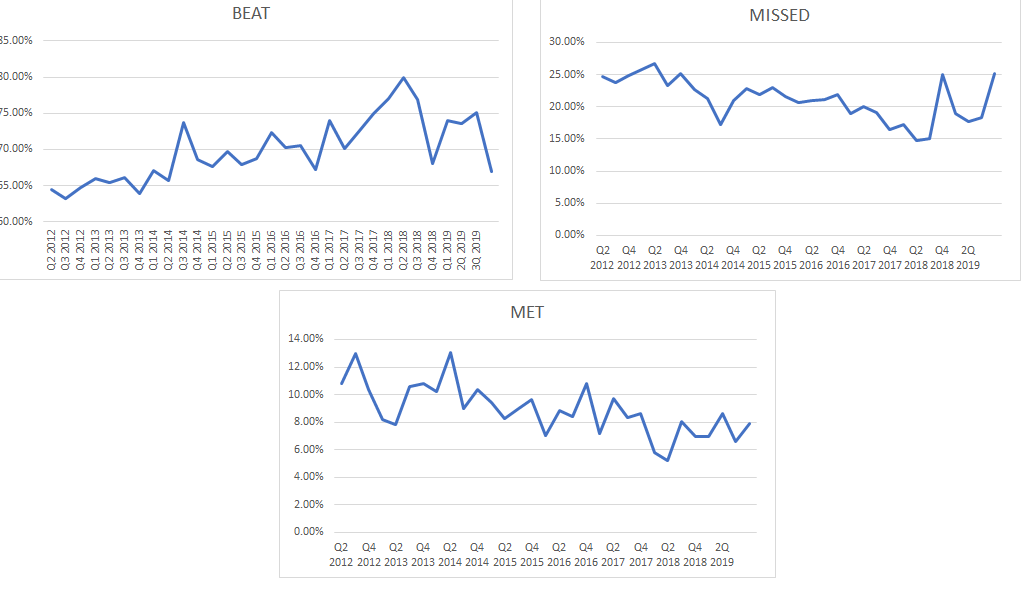

Earnings results continue to pour in, and it’s not looking pretty. Through January 31, 227 companies have reported results, representing just about 45% of the entire S&P 500. Of those companies, roughly 67% have beaten earnings, while 25% have missed earnings, and 8% have met estimates. That is well below the historical average since the second quarter of 2012 of 70%, 21%, and 9%, respectively.

(Data from S&P Dow Jones)

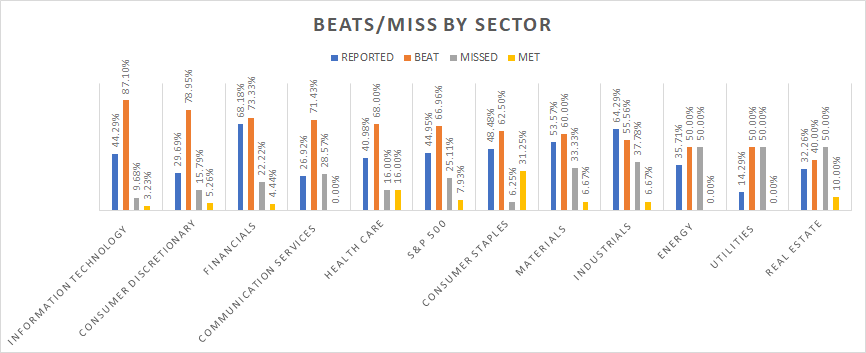

If you are wondering how this could be, and you are as shocked as I am, it is because most of the widely followed and highly publicized companies, like Apple (AAPL), Microsoft (MSFT) and Amazon (AMZN), have reported strong results. Likewise, the sectors have performed very well, with Technology and Consumer discretionary performing, with 87% of technology companies beating results and 77% of discretionary beating results. However, that number drops dramatically, with only 40% of Real Estate companies topping results, while only 50% of Energy and Utilities are beating results.

(Data from S&P Dow Jones)

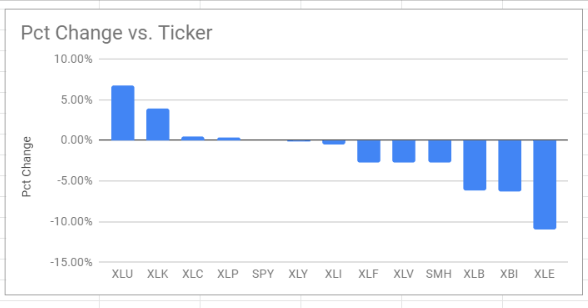

Technology will have a much bigger weighing and importance in terms of overall earnings since it controls a more significant percentage of the total earnings powers of the S&P 500. It is probably one reason why the technology and growth sectors of the market are outperforming the cyclical parts of the market.

So why are utilities the best performing sectoring to start the year? That’s easy, rates are falling, and sentiment has shifted to risk-off for now.

However, it does also suggest that growth is likely to continue to outperform.

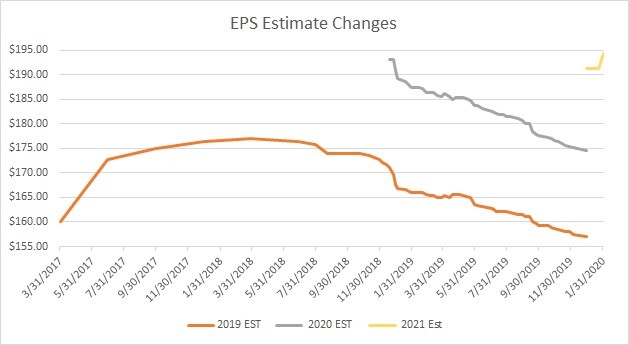

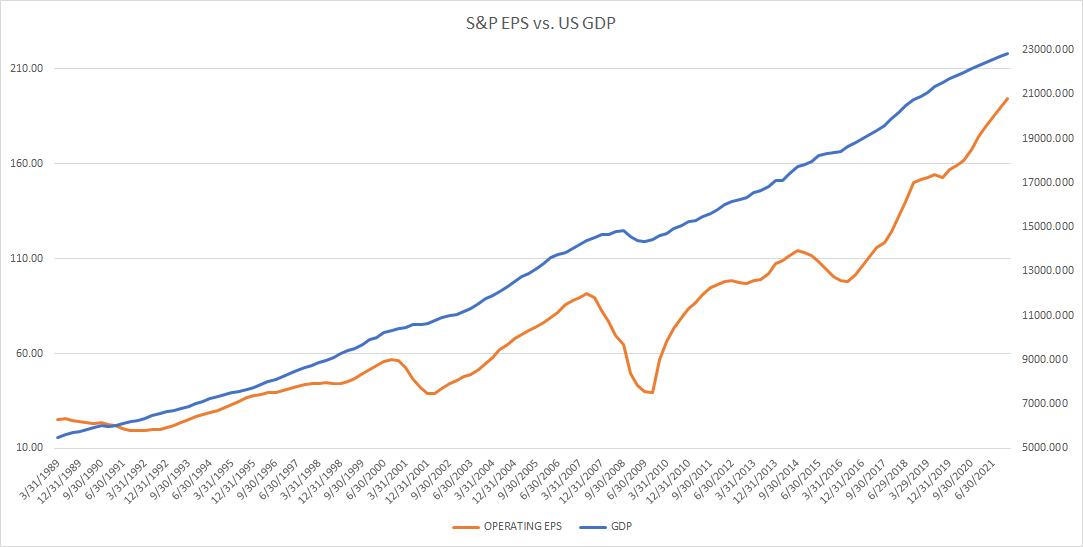

Earnings estimates for 2019 continued to fall and projected to rise by around 3.65% this year to $157.12, which is down from $157.45 last week. Meanwhile, estimates for 2020 now show growth of 11.1% to $174.59, and to 11.25% for 2021 to $194.23.

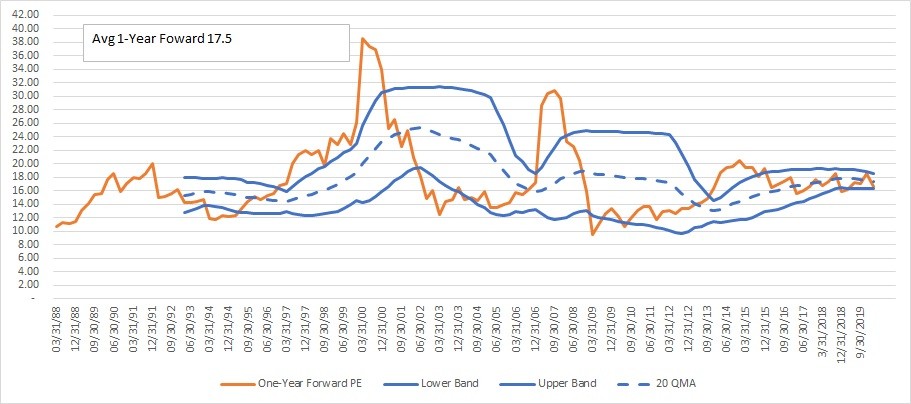

Given the earnings revisions and the move lower in equity prices this week, due to coronavirus fears, we have seen earnings multiples come down. With the S&P 500 trading at 16.6 times one-year forward earnings, it happens to put the index well below its historical average of 17.46, and below the one-year forward 20 quarter moving average P/E of 17.4, while placing it closer to the low end of the historical lower stand deviation.

Based on this analysis, stocks are cheap. Valuations suggest that the S&P 500 could be worth between 3,157 to 3,594, with a mid-point of 3,376. However, consider the low-interest rate environment, it seems more likely that, over time, the index will trade to the upper end of the range.

However, the significant risk here, as always, is the direction of the economy and GDP growth.

Disclaimer: This article is my opinion and expresses my views. Those views can change at a moment's notice when the market changes. I am not right all the time and I do not expect to be. I ...

more

What earnings were you watching? All the big boys I have smashed!