Earnings Season: 3 Companies Enjoying Margin Expansion

Image Source: Pexels

Earnings season has been a primarily positive period so far, with many companies enjoying post-earnings positivity.

And to the likes of investors, many companies, including Netflix (NFLX - Free Report), Eaton (ETN - Free Report), and Arista Networks (ANET - Free Report), have enjoyed margin expansion. Let’s take a closer look at how each currently stacks up.

Netflix

Concerning headline figures in its latest print, Netflix posted a 17% beat relative to the Zacks Consensus EPS estimate and posted sales modestly ahead of the consensus, with both items showing considerable growth from the year-ago periods.

Netflix enjoyed a solid quarter, posting $2.1 billion in free cash flow and seeing its year-to-date operating margin moving higher to 28.1% (20.6% in FY23). The company also maintained its free cash flow outlook of $6 billion for FY24 and repurchased 3.6 million shares throughout the period.

The company’s growth outlook remains bright, with consensus expectations for its current fiscal year suggesting 52% earnings growth on 15% higher sales. The stock sports a Style Score of ‘A’ for Growth.

Image Source: Zacks Investment Research

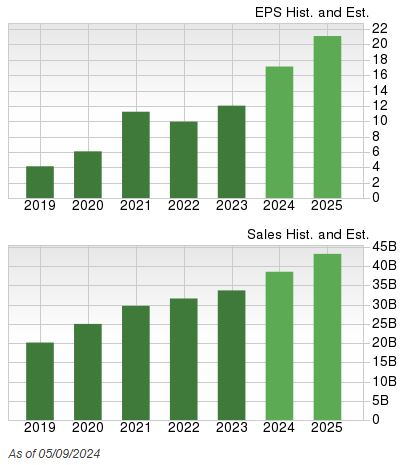

Eaton

Eaton posted EPS of $2.40 and sales of $5.9 billion, reflecting quarterly records. Further, segment margins reached 23.1%, another quarterly record and reflecting a 340-basis-point climb from the same period last year.

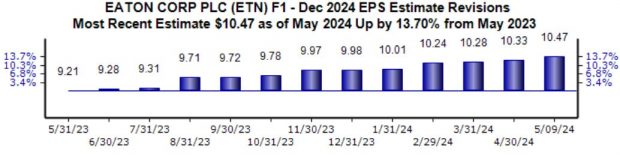

The company topped off the robust results with positive guidance, raising its outlook for organic growth, segment margins, and EPS. Analysts have taken their earnings expectations higher along with the upgraded guidance, landing the stock into a favorable Zacks Rank #2 (Buy).

The revisions trend has been particularly bullish for its current fiscal year, up nearly 14% to $10.47 per share over the last year.

Image Source: Zacks Investment Research

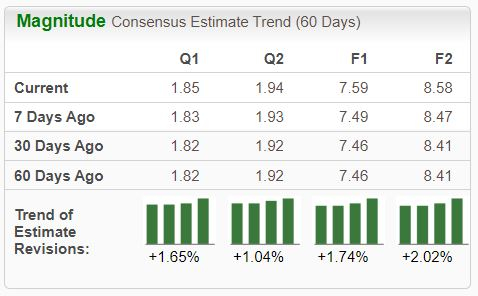

Arista Networks

Concerning headline figures, ANET posted a 14% beat relative to the Zacks Consensus EPS estimate and reported sales 1.3% ahead of expectations, with both items showing growth relative to the year-ago period.

In addition, the company’s gross margin totaled 63.7%, well improved from the 59.5% mark in the same period last year. Analysts have taken note of the company’s current favorable stance and have revised their earnings expectations accordingly, with the stock holding a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Bottom Line

Earnings season continues to grind along, with many companies already delivering their quarterly results.

Improved profitability due to margin expansion has aided the results of several companies, including Netflix, Eaton, and Arista Networks.

More By This Author:

Buyback Bonanza: 3 Companies Scooping Up SharesThree Tech Stocks To Buy For Passive Income

Bear Of The Day: Starbucks