Earnings Season: 2 AI Reports To Watch This Week

Image Source: Pexels

The 2025 Q1 earnings season continues to roll along, with various companies on the reporting docket this week.

Among the bunch are two heavily involved in the artificial intelligence frenzy: Super Micro Computer (SMCI - Free Report) and ARM Holdings (ARM - Free Report). The AI trade has cooled off notably in 2025, with many taking their gains and others recalculating their bets following tariff news/other economic developments.

But what’s the setup looking like for each heading into their respective releases? Let’s take a closer look at how expectations have evolved.

ARM Growth to Remain Robust

Arm architects, develops, and licenses high-performance, low-cost, and energy-efficient CPU products and related technology, on which many of the world's leading semiconductor companies and OEMs rely to develop their products.

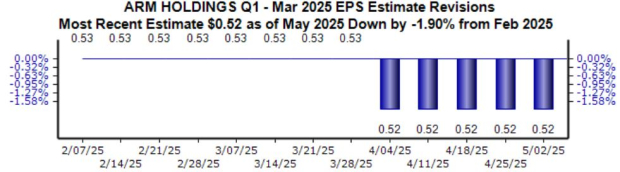

Analysts have taken their EPS expectations for the quarter to be reported modestly lower since the beginning of February, with the current $0.52 Zacks Consensus EPS estimate suggesting 44% YoY growth.

Image Source: Zacks Investment Research

Sales growth is also expected to be strong, with the $1.2 billion expected suggesting 33% growth from the same period last year. The broader AI frenzy has aided its top line growth nicely, as we can see in the chart below that illustrates its sales on a quarterly basis.

Image Source: Zacks Investment Research

SMCI Expectations Plunge

Super Micro Computer is a total IT solution Provider for AI, Cloud, Storage, and 5G/Edge services, fully explaining the buzz around the stock over recent years.

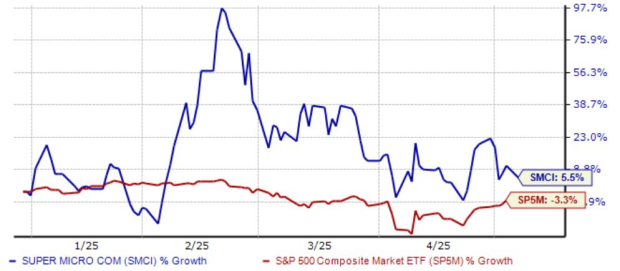

SMCI shares have delivered a market-beating performance in 2025 so far, gaining 5% compared to the S&P 500’s 3% decline. Quarterly releases have regularly been met with steep volatility over recent periods, and it’s reasonable to expect the same this time around as well.

Image Source: Zacks Investment Research

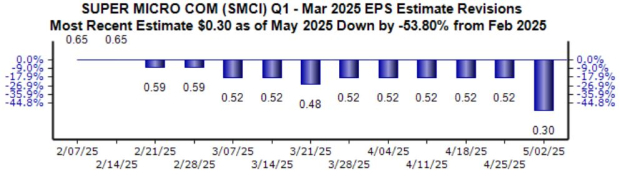

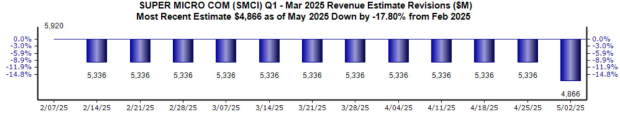

Analysts have been considerably bearish for the upcoming release, with the current $0.30 Zacks Consensus EPS estimate down more than 50% since the beginning of February. Revenue expectations have also been negative, with the current $4.9 billion expected down 18% across the same timeframe.

Image Source: Zacks Investment Research

Below is a table illustrating the top line revisions.

Image Source: Zacks Investment Research

While revisions for the period have been negative, it’s worth noting that valuation multiples have returned to earth amid the volatile price action. Shares presently trade at an 11.0X forward 12-month earnings multiple, which compares to a 14.1X five-year median and reflects a 47% discount relative to the S&P 500.

Image Source: Zacks Investment Research

Bottom Line

The 2025 Q1 earnings cycle continues to roll along, with this week’s reporting docket notably stacked. Among the bunch scheduled to report are AI favorites Super Micro Computer and ARM Holdings.

As shown above, both top and bottom line revisions paint a much more positive picture for ARM heading into the release relative to SMCI, which has seen its top and bottom line expectations move well lower.

Still, guidance will be the critical factor dictating each stock’s post-earnings movement, particularly amid the broader uncertainty we find ourselves in stemming from tariff talks and other economic developments.

More By This Author:

2 Semiconductor Reports To Watch This WeekAre Alphabet Shares A Buy Here?

3 Consumer Facing Reports To Watch This Week

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more