Earnings Preview: UNFI & COST

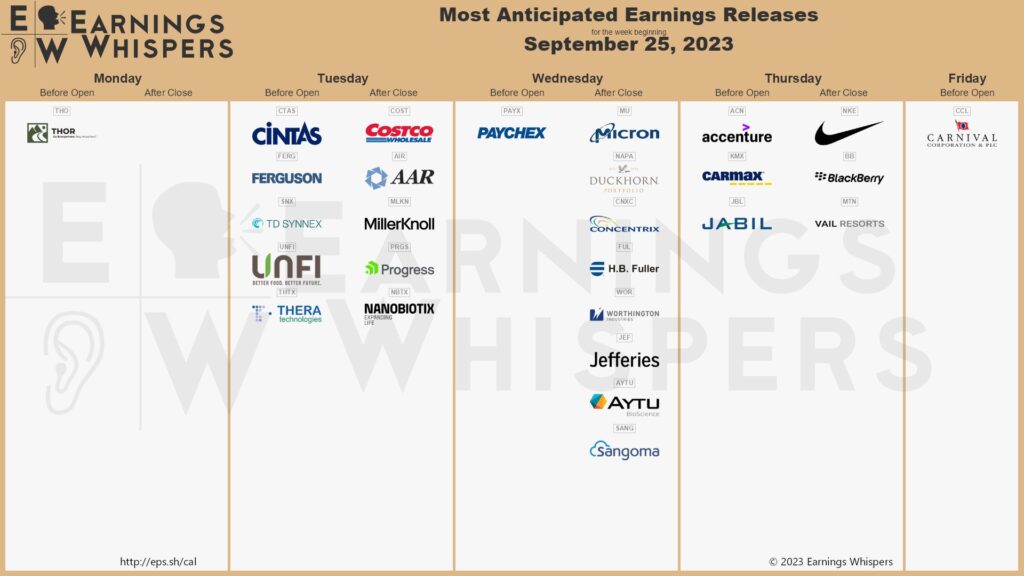

This week a number of stocks I follow report earnings: United Foods (UNFI), Costco (COST), Micron (MU), Carmax (KMX) and Nike (NKE). In this blog, I’ll preview the first two.

(Click on image to enlarge)

UNFI is not an especially well known stock but it is the nation’s leading grocery wholesaler. You might have seen their trucks on the freeway. I’ve long been interested in – and an investor in – the grocery space so UNFI has been on my radar. But I haven’t taken a position – until now.

The stock had been riding high – until two disastrous earnings reports derailed it. On September 27, 2022, UNFI gave initial FY23 EPS guidance of $4.85-$5.15. It reaffirmed that on December 7 but cut it to $3.05-$3.90 on March 8, 2023 and $1.80-$2.30 on June 7. In other words, UNFI has cut its current year EPS guidance by more than half in its last two earnings reports. Not good – and you can see what’s happened to the stock.

But UNFI is still a high quality company in the grocery space. It closed Friday at $18.85 which means the stock is trading at 9x current year EPS guidance. I think there’s value here and plan to initiate a position Monday ahead of earnings Tuesday morning.

(Click on image to enlarge)

Whereas UNFI has a market cap of around $1 billion, COST is a behemoth at $248 billion. Shares have performed nicely of late and are not far from all time highs around $600. COST shares are not cheap – as usual – but the quality of the company makes it a buy and hold IMO. August comps of +4.1% suggest that everything is going just fine and there is the possibility of a membership fee increase heading into earnings Tuesday afternoon. I see no reason not to stay long.

(Click on image to enlarge)

More By This Author:

Yields Break Out, The Olive Tree Barometer

Peak Hawkishness: All In On TLT

Can The Fed Engineer A Soft Landing? AZO Earnings