Earnings Outlook Remains Strong & Improving: A Closer Look

Image Source: Unsplash

Here are the key points:

- The overall earnings picture remains strong and steadily improving. We saw an above-average proportion of companies beat Q2 estimates, with expectations for the current and upcoming periods also increasing.

- For the 457 S&P 500 companies that have already reported Q2 results, total earnings are up +11.6% from the same period last year on +5.8% higher revenues, with 80.5% beating EPS estimates and 78.8% beating revenue estimates.

- Looking at Q2 as a whole, combining the actual results that have come out with estimates for the still-to-come companies, total S&P 500 earnings are expected to be up +12.0% from the same period last year on +6.0% higher revenues.

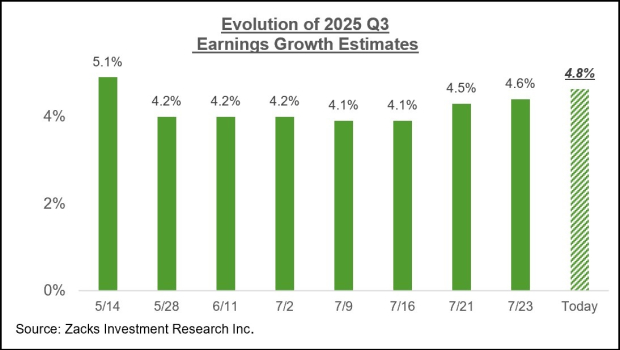

- For the current period (2025 Q3), total S&P 500 earnings are expected to increase +4.8% on +5.4% higher revenues, with estimates modestly going up since the quarter got underway.

A Favorable Estimate Revisions Trend

The revisions trend continues to remain favorable, as we have consistently been flagging in recent weeks. We see this in estimates for the current period (2025 Q3) as well as for the last quarter of the year.

For 2025 Q3, the expectation is for earnings growth of +4.8% on +5.4% revenue gains. The chart below shows how Q3 earnings growth expectations have evolved in recent weeks.

Image Source: Zacks Investment Research

Since the start of Q3 this month, estimates have modestly increased for five of the 16 Zacks sectors, including Finance, Tech, Energy, Retail, and others.

On the negative side, Q3 estimates remain under pressure for the remaining 11 Zacks sectors, with significant declines to estimates for the Medical, Basic Materials, Construction, Transportation, and other sectors.

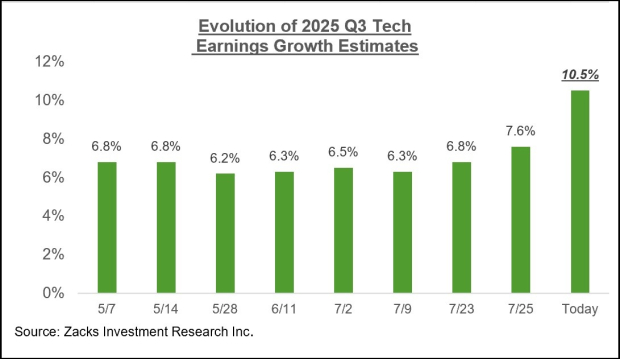

For the Tech sector, Q3 earnings are expected to be up +10.5% from the same period last year on +11.6% higher revenues. The chart below shows how the sector’s Q3 earnings growth expectations have evolved over the last couple of months.

Image Source: Zacks Investment Research

You can look at Q3 estimates for Tech players like Meta Platforms (META - Free Report), Alphabet (GOOGL - Free Report), and others.

Meta, which reported Q2 results on July 30th, is currently expected to bring in $6.69 per share in earnings in Q3. Estimates for Meta have been on a steady upward trend, with the current $6.69 EPS estimate increasing by 14.4% over the past month and 17.4% over the past two months. Alphabet, which reported Q2 results on July 23rd, is expected to earn $2.32 per share in Q3, with the estimate up +5.9% over the past month and +7.4% over the past two months.

This positive revisions trend is even more notable for the big banks and brokers like JPMorgan, Citigroup, Goldman Sachs, and others in the Finance sector.

Earnings Expectations for 2025 Q2 & Beyond

The positive results from more than 90% of S&P 500 members have helped push the Q2 earnings growth expectation higher, with earnings for the S&P 500 index now expected to increase by +12.0% from the same period last year on +6.0% higher revenues.

The chart below shows expectations for 2025 Q2 in terms of what was achieved in the preceding four periods and what is currently expected for the next three quarters.

Image Source: Zacks Investment Research

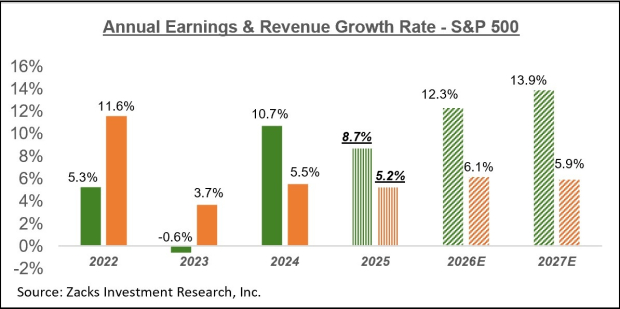

The chart below shows the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

We have been pleasantly surprised by the aforementioned favorable revisions trend, which validates the market’s rebound from the April lows. Given the positive run of Q2 results, it will make sense for this trend to remain in place over the coming weeks as we go through this reporting cycle.

More By This Author:

3 Key Takeaways From The Q2 Earnings Season

How To Make The Most Of Today's Market

Mag 7 Earnings Loom: What Can Investors Expect?