Earnings Expectations Are Starting To Plunge: Here Are The Most-Impacted Sectors

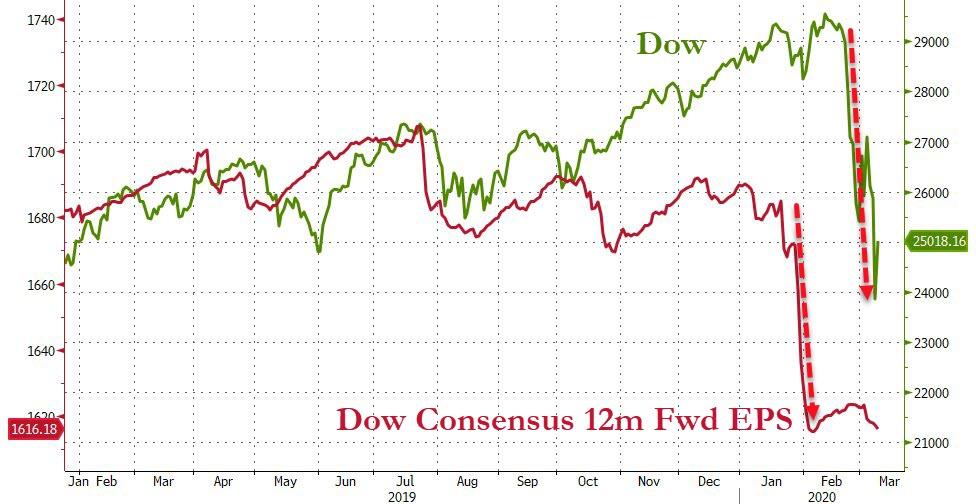

While investors are shocked, shocked I tell you, at the plunge in US stocks, they shouldn't be. Earnings expectations were already plunging long before the actual indices woke up to the new reality...

(Click on image to enlarge)

Source: Bloomberg

And of course, this has crushed the P/E of the market - providing the asset-gatherers and commission-rakers with a new talking point for why you should buy: "stocks are 'cheap' again." There's just one problem, as can be seen at the far right of this chart - although prices fell, crushing the P/E ratio; now that earnings are starting to be marked down, the P/E ratio is starting to accelerate higher once again...

(Click on image to enlarge)

Source: Bloomberg

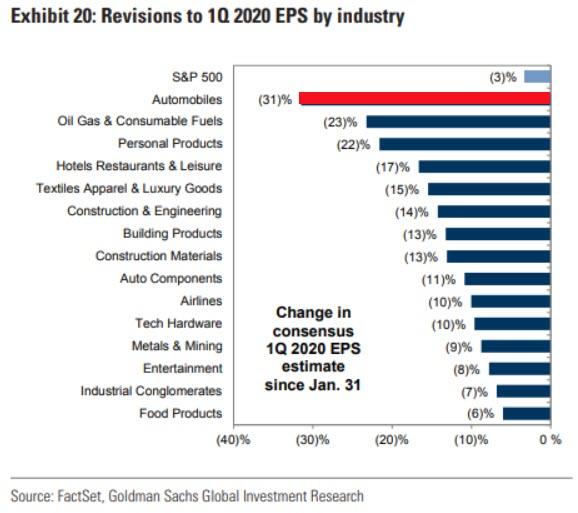

And, unsurprisingly, it is Autos and energy-related companies that are slashing earnings expectations at the fastest rate.

(Click on image to enlarge)

As Goldman notes, the market continues to believe in the v-shaped (or maybe a slight u-shaped) recovery with earnings growth expected to resume in Q4 2020...

(Click on image to enlarge)

We wouldn't hold our breath.