DVN Stock Forecast: Geopolitical Transformation In The Energy Market

Highlights

- The merge with WPX resulted in a 31 percent improvement in Devon’s cost structure.

- The current high price in the Oil & Gas market will boost DVN’s revenue even without an increase in production.

- The Piotroski F-Score and price ratios provide a positive outlook for DVN’s stocks.

Overview

Devon Energy Corporation (NYSE: DVN) is an American-based independent oil and natural gas exploration and production company, headquartered in Oklahoma City, founded in 1971. Devon operates in several of the most prolific oil and natural gas plays in the U.S., including the Delaware Basin, Eagle Ford, Anadarko Basin, Powder River Basin, and Williston Basin. Devon also sells as well as transport and storage its oil, gas and natural gas liquids (ethane, propane, butane, and natural gasoline). Devon also processes and treats hydrocarbons. Devon Energy and WPX Energy have merged in 2021 to form a leading energy company. The combined company, Devon Energy, benefits from greater scale, higher margins, and higher free cash flow.

Strong Financial Performance with Growing Cash Flow

In 4Q2021, Devon reported that its total production averaged 611,000 oil-equivalent barrels (Boe) per day, exceeding guidance by 3 percent. The merge with WPX resulted in a 31 percent improvement in Devon’s cost structure compared to 4Q2020. At the same time, the free cash flow of Devon was reported as $1,104 million in 4Q2021, which is four times as much as 1Q2021. Devon accelerated the return of cash to shareholders through an industry-first “fixed plus variable” dividend strategy. In 4Q2021, Devon declared a record high fixed-plus-variable dividend payout of $1.00 per share. This successful merger made the company achieve a better synergistic effect. The merger fully integrated and complemented the resources of the two companies, successfully increased the production scale, reduced costs as well as increased cash flow, and effectively seized a larger market share. Devon is one of the most efficient companies in the Oil & Gas industry. According to GuruFocus, DVN’s ROE of 37.19 is better than 90.93% of companies in the Oil & Gas industry. The Net Margin of 23.6% is higher than 82.15% of companies in the industry.

(Figure 1 – DVN vs Oil & Gas Industry in TTM)

In light of the Russian invasion of Ukraine the US, EU, and the UK have all announced that they will curb Russian oil and gas imports. Europe is heavily dependent on Russia for its oil and gas. In 2021, two-fifths of the gas Europeans burned came from Russia, and over a quarter of the EU’s imported crude oil comes from Russia. Today prices for oil and gas remain to be exceptionally volatile towards the upside as traders try and gauge the operational capacity of ports after Russian sanctions have forced supply-chain alterations. Russia supplies 12% of the world’s oil, including crude, light, and sweet oil, and a host of American companies can fill the void. EOG and Devon hold more permits than any other company, according to a Bloomberg analysis of federal onshore permitting data, but neither plans to grow production beyond 5%. Anyway increasing oil and gas production takes time which means the high price for the main part of this year. Devon’s market stronghold has allowed it to operate at a breakeven price of approximately $30 per barrel, which means that crude oil price will need to capitulate beyond imagination for the firm not to be profitable.

(Figure 2: Valuation Ratios for DVN and Its Peers)

Let’s look at the next comparable companies: HES, OXY, FANG, CLR, CTRA, PXD, MRO, APA. Currently, MOS’s P/E ratio of 13.97 is lower than the Average and Median values. Moreover, the current P/E ratio looks reasonable with taking into account the current prices in the commodity market and the average P/E value across comparable companies creating a good base for future stock price growth.

DVN looks intriguingly in terms of Piotroski F-Score and Altman Z-Score. Piotroski F-score is a number between 0 and 9 that is used to assess the soundness of a company’s financial position. A score of 7 may indicate that the company’s stock is undervalued and can be interpreted by investors as a good signal to buy the stock. The Altman Z-score is the result of a credit test that measures the likelihood of a publicly owned manufacturing company going bankrupt. It is also at a safe level for DVN.

Conclusion

It’s reasonable to believe DVN is a strong buy stock. Devon Energy Corporation is one of the most efficient companies in the Oil & Gas industry. Moreover, Devon has a significant number of permits to drill additional wells to increase its production. The world’s restrictions on fossil fuel imports from Russia provide an opportunity to fill the void. Although the company does not plan to increase its production by more than 5%, the current high price in the oil & gas market will boost the company’s revenue in the current year. Furthermore, a significant amount of federal drilling permits provide a reserve for expanding production in the future when the geopolitical situation will stabilize to make a decision about the necessity of production increasing.

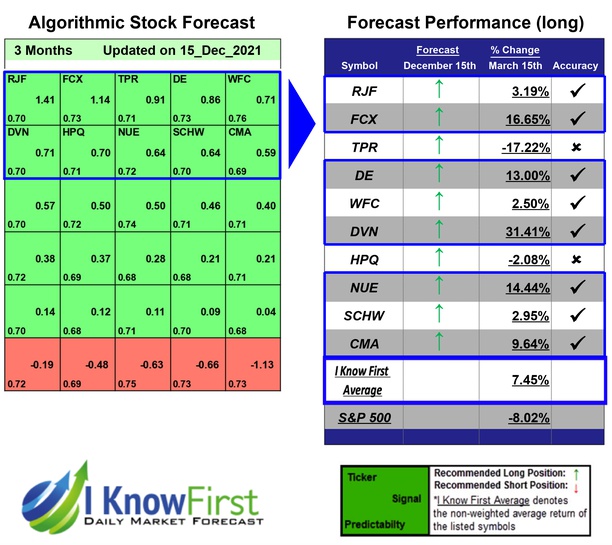

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the DVN stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with DVN Stock Forecast

I Know First has been bullish on Devon’s shares in past forecasts. In our December 15, 2021 premium article, the I Know First algorithm issued a bullish DVN stock forecast. The algorithm successfully forecasted the movement of Devon’s shares on the 1 year time horizons. Devon’s shares rose by 31.41% in line with the I Know First algorithm’s forecast.

(Click on image to enlarge)

Disclosure: This article originally appeared on Iknowfirst.com, a financial services firm that utilizes an advanced ...

more