DRI Earnings Show Inflation Is The Macro Theme

Darden Restaurants (DRI) – owner of The Olive Tree – reported earnings Thursday before the market open. Blended comps of +11.7% were quite strong – especially on top of a strong quarter a year ago. But despite more than $300 million in revenue compared to the year-ago quarter, operating income increased by only $15 million as margins were squeezed by inflation. DRI forecast total inflation of 6% for its current fiscal year. From a stock perspective, DRI is probably fairly valued at this point. They guided current fiscal year EPS to $7.40 to $8.00. At a current $115, that’s 15x forward earnings. Comps this fiscal year are expected to be a solid +4% to +6%.

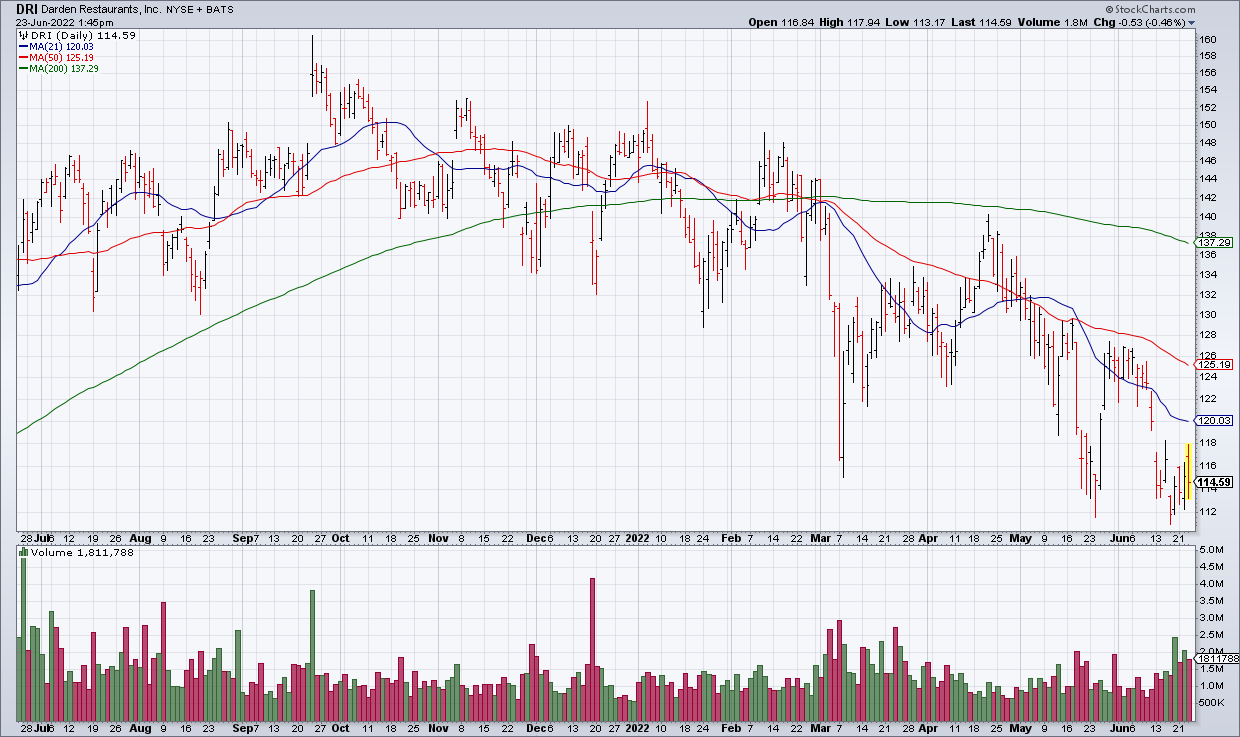

(Click on image to enlarge)

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!