DraftKings And The Growing Shift To Sports Betting

Since last October, Tennessee, Michigan, and Virginia launched their first online sports book. Meanwhile, Louisiana, Maryland, and South Dakota all legalized sports betting.

To understand the potential of stocks like DraftKings (DKNG) is to read the writing is on the wall and realize it's a matter of when and not if in the rest of the states.

Amid these legislative tailwinds, is DraftKing's potential as a growth play baked in already? Developments in the last week, plus a closer look at some technical and historical data, say not so fast.

As Ohio prepares its bill, DraftKings was making two under-the-radar moves. First, they inked a deal with Worldwide Wrestling Entertainment (WWE), becoming an official partner subject to regulatory jurisdictions.

DraftKings' immensely popular free-to-play pools product will integrate with WrestleMania, on April 10 and 11. A day later, they acquired Vegas Sports Information Network, Inc. (VSiN), a multi-platform content company that offers betting news and analysis.

Does wrestling and a niche news network really move the needle? Absolutely not. But consider DraftKings also has broadcasting partnerships with Walt Disney's (DIS) ESPN and Dish Network (DISH). It is also an official partner to the NBA, MLB, NFL, NASCAR, UFC, and PGA Tour.

They are slowly but surely nudging and positioning themselves into every sporting landscape out there where money changes hands. And regarding VSiN, DraftKings can now tap into the Vegas gambling infrastructure, a critical element in any sports betting landscape.

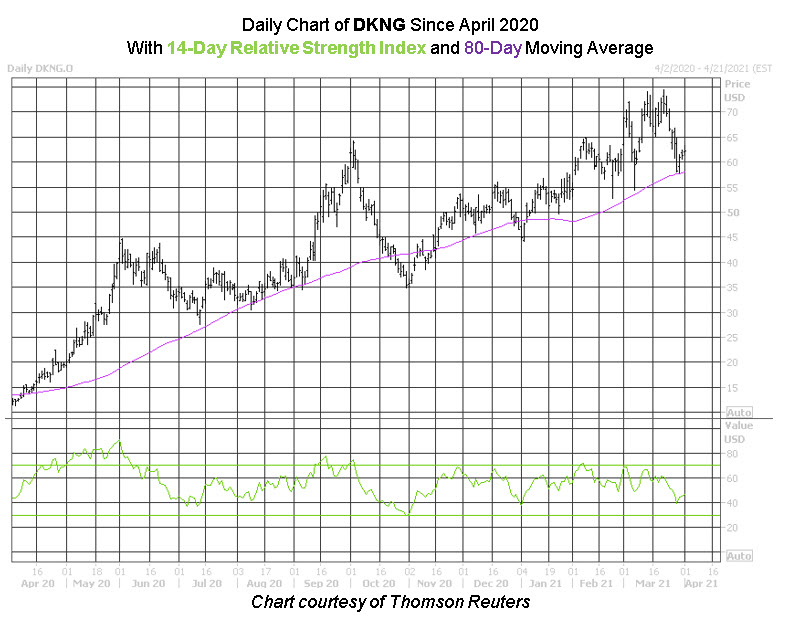

A month ago this article may not have been written, because DKNG was nabbing record highs left and right, and its 14-day Relative Strength Index (RSI) crept up into 70 and firmly in overbought territory.

But since a March 22 peak of $74.38, the stock has taken a roughly 18% haircut and offered up an attractive entry point for speculators, with its RSI last seen at a much more palatable 48.

What's more, that pullback has sent DKNG within one standard deviation of its 80-day moving average after a lengthy stretch above the trendline.

For the purpose of this study, Schaeffer's Senior Quantitative Analyst Rocky White defines that as the equity trading above the moving average for 60% of the time over the past two months and closing north of the trendline in eight of the last 10 sessions.

According to White's data, five similar signals have occurred during the past three years. DKNG was higher one month later after all five of these signals, averaging a one-month return of 13.6%. A similar move from the security's current perch would put the stock back above the $70 mark.

And there's still more pessimism to be unwound to make a run at that record high; short sellers have increased their positions by 37.5% in the two most recent reporting periods and account for a healthy 7% of DKNG's total available float.

Meanwhile, option traders' sentiment has shifted. The equity's 10-day put/call volume ratio at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) has moved up to 0.37.

While this shows call buying has remained more popular on an absolute basis, the reading ranks in the 88th annual percentile, revealing an unusual interest in long puts.

DraftKings options can be had at a premium right now too, per its Schaeffer’s Volatility Index (SVI) of 59% sits in the lowest percentile of its annual range. This means options players are pricing in relatively low volatility expectations at the moment.

Plus, the equity’s Schaeffer's Volatility Scorecard (SVS) sits up at 87 out of 100, showing that DKNG has tended to exceed option traders' volatility expectations during the past year -- a boon for option buyers.

One final note to tie things up. After inching higher to as high as $28 billion to begin March 2021, DKNG's market cap has now pulled back to that $25 billion level. This will be an area to watch in the short-term with April stock seasonality in focus.

Disclaimer: © 2021 MoneyShow.com, LLC. All Rights Reserved.

Nice! 🚀🚀🚀