Dow Up Over 200 Points As Treasury Yields Decline

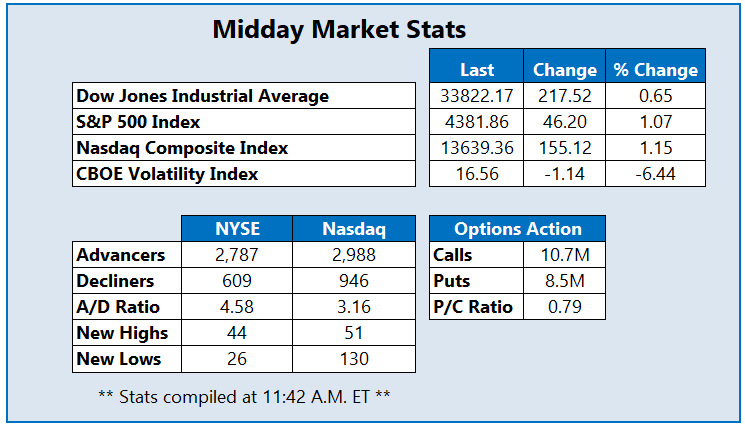

The Dow Jones Industrial Average (DJI) is up 217 points at midday, on track for its third-straight day of triple-digit gains, while the Nasdaq Composite (IXIC) and S&P 500 (SPX) sit firmly higher as well. In the bond market's first response to the Israel-Hamas conflict after observing Columbus Day, Treasury yields are moving sharply lower. At last look, the 10-year note was down over 13 basis points at 4.64%, with oil prices falling in tandem.

Options traders are targeting PepsiCo Inc (Nasdaq: PEP) today after the company announced strong third-quarter results and lifted its annual forecast. So far, 44,000 calls and 28,000 puts have been exchanged, which is already six times the average intraday options volume. The weekly 10/13 165-strike call is the most popular, with new positions opening there. At last glance, PEP was up 1.5% at $163.72, further removing itself from its Oct. 6, 52-week low of $155.83.

China-based stock Bilibili Inc (Nasdaq: BILI) is up 9.2% at $14.50 at last glance, after reports that the country is considering a new stimulus. The stock could today conquer its 40-day moving average, which rejected shares several times in August. Since the start of the year, the equity is down 38.6%.

John Wiley & Sons Inc (NYSE: WLYB) is down 15.2% at $31.44 and on the short sell restricted (SSR) list today, after news that CEO Brian Napack is stepping down. WLYB sports a 15.9% quarter-to-date deficit.

More By This Author:

Wall Street Stages Late-Day Rally After Volatile Session

Dow Rebounds, Still Below Fair Value

Stocks Finish Week Strong Despite Robust Labor Report