Dow, S&P 500 Strengthen On Upbeat Manufacturing Data

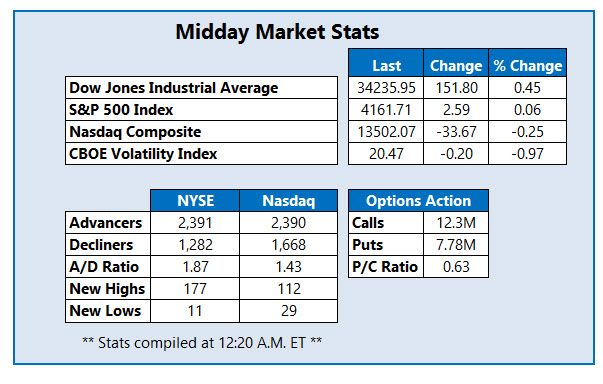

Markets are mixed midday, as Wall Street attempts to close out a mostly dismal week on an upbeat note. For one, the Dow Jones Industrial Average (DJI) is up 150 points this afternoon, while the S&P 500 Index (SPX) has also maintained most of its morning gains. The Nasdaq Composite (IXIC), meanwhile, has slipped back into the red as Big Tech continues to face some pressure, though the index is still eyeing a win for the week.

Fresh manufacturing data is responsible for much of today's upbeat sentiment after it showed activity hit a fresh record in May. In other news, bitcoin is taking yet another hit after Chinese Vice Premier Liu He advocated for tighter regulation of the cryptocurrency.

One stock seeing a surge in options activity today is Roblox Corp (NYSE: RBLX). So far, 129,000 calls and 48,000 puts have already crossed the tape, which is eight times the intraday average. The expiring May 80 call is most popular, followed by the 85 call in that same series, with new positions being opened at both. At last check, RBLX is up 9.8% at $83.79, after earlier hitting an all-time high of $84.68. Today's positive price action came after the security earned a price-target hike from CFRA to $92. The equity has had a volatile run on the charts since going public in early March with an initial public offering price (IPO) of $70, though it still sports a 27.8% quarter-to-date lead.

Social networking name Yalla Group Ltd (NYSE: YALA) is one of the best-performing stocks on the New York Stock Exchange (NYSE) today. The security was last seen up 17.9% at $18.82 after it announced a share repurchasing program worth up to $150 million. Yalla stock has been pressured lower by its 20-day day moving average since April, after it reached a Feb. 11 record of $41.35. In the last six months, though, YALA has added over 97%.

Meanwhile, one of the worst stocks on the Nasdaq today is VF Corp (NYSE: VFC). The equity is down 7% at $78.93, after posting lower-than-expected fourth-quarter earnings. The Vans and North Face parent attributed the disappointing results to higher discounts. Today's massive bear gap has the security distancing itself even more from an April 29, annual high of $90.79. Year-over-year, VFC still sports a healthy 39.5% lead, however.