Dow Plummets As Fed Update, Jobless Data Weighs

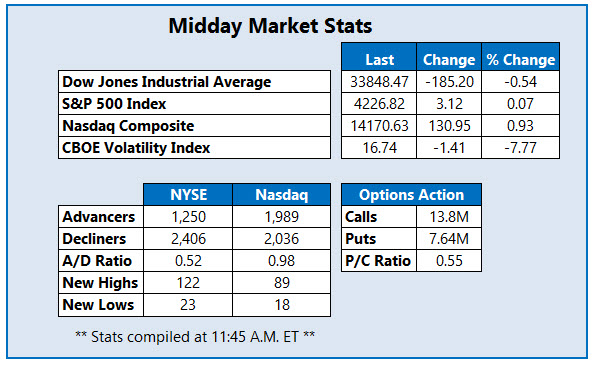

The Federal Reserve's accelerated interest rate timeline and inflation forecast is putting a damper on stocks today, with worse-than-expected weekly jobless claims only adding insult to injury. Of the major indexes, the Dow Jones Industrial Average (DJI) is being hit the hardest, down 185 points at midday as commodities and materials stocks weigh, while the S&P 500 Index (SPX) is flat. The Nasdaq Composite (IXIC), on the other hand, is firmly higher, as investors rally behind tech giants such as Tesla (TSLA).

One stock seeing an unusual amount of options activity today is Trade Desk Inc (Nasdaq: TTD), up 5.2% at $62.10 at last check. The company entered a loan and security agreement earlier this week and now has the right to increase loan facility by no more than $450 million. The stock is also on retail investors' radars, and among the top 10 trending stocks on Stocktwits. So far, 95,000 calls and 17,000 puts have been exchanged, or 14 times the intraday average. Most popular are the June 62 and 60 calls, with new positions being opened at both. The equity has been chopping lower, with the 60-day moving average rejecting several rally attempts. Year-over-year TTD is up 62.5%.

Near the top of the Nasdaq, today is Midatech Pharma PLC (Nasdaq: MTP), last seen up 42.2% at $2.90. Today's pop came after the company said data shows its technology Q-Sphera can formulate proteins into long-acting injectable products, as well as news the drug developer will shut down its Bilbao operations, cutting its monthly cash burn rate in half. Prior to this positive price action, shares had been trading mostly sideways since cooling down from a February bull gap, which boosted shares to the $3.80 level. Year-over-year, MTP sports a 102.1% lead.

Meanwhile, at the bottom of the Nasdaq is CureVac BV (Nasdaq: CVAC). Shares are down 43.3% to trade at $53.78 this afternoon, after the biotech name said its Covid-19 vaccine was only 47% effective in a late-stage trial, missing the study's main goal. The security is now trading at its lowest level since November of last year while eyeing its third-straight loss and worst percentage drop on record. In the last six months, CVAC has dropped 52.4%.