Dow, Nasdaq Dinged By Fed Fatigue As VIX Pops

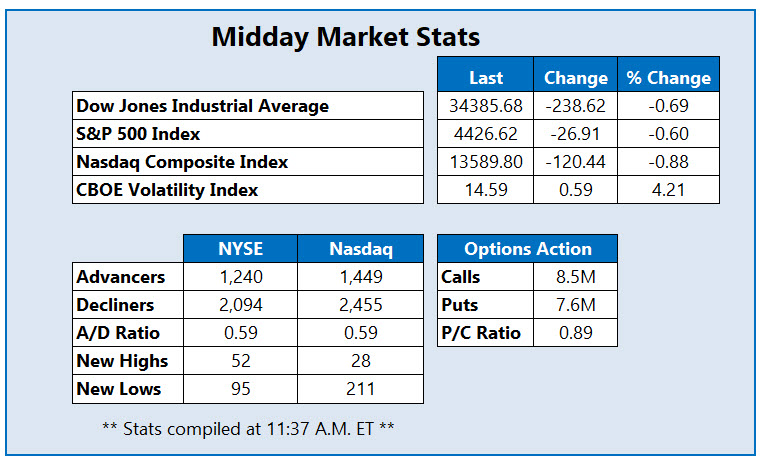

Stocks have drifted deep into the red midday, with the Dow Jones Industrial Average (DJIA) and Nasdaq Composite (IXIC) both nursing triple-digit deficits. While Wall Street is anticipating the Federal Reserve will hold its benchmark rate steady at a targeted range of 5.25% to 5.5%, investors are keen to hear comments from Fed Chair Jerome Powell about future decisions on monetary policy. Against this backdrop, the Cboe Volatility Index (VIX) is eyeing its highest close since Aug. 28.

SoFi Technologies Inc (Nasdaq: SOFI) is seeing an uptick in options activity today, with a bullish slant. At last check, over 52,000 calls have changed hands, volume that's double the average intraday amount. Leading the charge is the weekly 9/22 9-strike call, with new positions being opened there. SOFI is up 86% in 2023, with support emerging at its ascending 80-day moving average.

(Click on image to enlarge)

Enphase Energy Inc (Nasdaq: ENPH) stock is bucking the broad market selloff today, last seen 5.1% higher to trade at $123.17. The clean energy stock has taken a 53% dip in 2023, and just yesterday fell to a 19-month low of $116.86.

MGM Resorts International (NYSE: MGM) stock is near the bottom of the S&P 500 Index (SPX) today, off by 4% at $38.70. The casino stock is still reeling from the cyber attack over the weekend, with a gaming industry analyst noting the company could lose between $4.2 million and $8.4 million in daily revenue and around $1 million in cash flow every day the attack persists. While MGM is up 15.4% in 2023, it has shed 12.1% this month alone.

More By This Author:

Wall Street Stays Quiet Ahead Of Fed MeetingStocks Sluggish As Oil, Bond Yields Rise

Blue-Chip Index Secures Modest Weekly Win